Wix Launches Financial Services Suite to Power Business Growth

Wix (NASDAQ: WIX) has unveiled a comprehensive financial services suite featuring two new solutions: Wix Checking and Wix Capital. Wix Checking, powered by Unit's embedded finance technology, provides users with a free integrated business checking account within the Wix platform, offering instant access to earnings and real-time cash flow monitoring.

The suite also includes Wix Capital, a Merchant Cash Advance (MCA) service designed to help businesses address funding needs through a more accessible alternative to traditional banking. The service exchanges future sales percentage for immediate capital access.

These financial tools are currently available to select U.S.-based Wix Payments users, with plans for broader rollout.

Wix (NASDAQ: WIX) ha presentato una suite completa di servizi finanziari che include due nuove soluzioni: Wix Checking e Wix Capital. Wix Checking, basato sulla tecnologia di finanza integrata di Unit, offre agli utenti un conto corrente aziendale gratuito integrato nella piattaforma Wix, con accesso immediato ai guadagni e monitoraggio in tempo reale del flusso di cassa.

La suite comprende anche Wix Capital, un servizio di Anticipo Contante per Commercianti (MCA) pensato per aiutare le imprese a soddisfare le esigenze di finanziamento tramite un'alternativa più accessibile rispetto alle banche tradizionali. Il servizio prevede lo scambio di una percentuale delle vendite future per ottenere capitale immediato.

Questi strumenti finanziari sono attualmente disponibili per un gruppo selezionato di utenti Wix Payments negli Stati Uniti, con piani per un'implementazione più ampia.

Wix (NASDAQ: WIX) ha lanzado una completa suite de servicios financieros que incluye dos nuevas soluciones: Wix Checking y Wix Capital. Wix Checking, impulsado por la tecnología de finanzas integradas de Unit, ofrece a los usuarios una cuenta corriente empresarial gratuita integrada en la plataforma Wix, con acceso instantáneo a ganancias y monitoreo en tiempo real del flujo de efectivo.

La suite también incluye Wix Capital, un servicio de Anticipo de Efectivo para Comerciantes (MCA) diseñado para ayudar a las empresas a cubrir sus necesidades de financiamiento mediante una alternativa más accesible que la banca tradicional. El servicio intercambia un porcentaje de las ventas futuras por acceso inmediato a capital.

Estas herramientas financieras están disponibles actualmente para un grupo selecto de usuarios de Wix Payments en Estados Unidos, con planes para una expansión más amplia.

Wix (NASDAQ: WIX)�� �� 가지 새로�� 솔루션인 Wix Checking�� Wix Capital�� 포함�� 종합 금융 서비�� 제품군을 공개했습니다. Unit�� 임베디드 금융 기술�� 기반으로 하는 Wix Checking은 사용자가 Wix 플랫�� 내에�� 무료�� 통합�� 비즈니스 체크 계좌�� 이용�� �� 있게 하며, 수입 즉시 접근�� 실시�� 현금 흐름 모니터링�� 제공합니��.

�� 제품군에�� 또한 미래 매출�� 일정 비율�� 즉시 자본으로 교환하는 상인 현금 선지�� 서비스인 Wix Capital�� 포함되어 있어, 전통적인 은행보�� �� 접근하기 쉬운 대안을 제공합니��.

�� 금융 도구들은 현재 미국 �� 일부 Wix Payments 사용자에�� 제공되고 있으��, 향후 �� 넓은 범위�� 확대�� 계획입니��.

Wix (NASDAQ : WIX) a dévoilé une suite complète de services financiers comprenant deux nouvelles solutions : Wix Checking et Wix Capital. Wix Checking, propulsé par la technologie de finance intégrée de Unit, offre aux utilisateurs un compte courant professionnel intégré et gratuit sur la plateforme Wix, avec un accès instantané aux revenus et un suivi en temps réel des flux de trésorerie.

La suite inclut également Wix Capital, un service d'Avance de Fonds pour Commerçants (MCA) conçu pour aider les entreprises à répondre à leurs besoins de financement via une alternative plus accessible que les banques traditionnelles. Ce service échange un pourcentage des ventes futures contre un accès immédiat au capital.

Ces outils financiers sont actuellement disponibles pour un nombre limité d'utilisateurs de Wix Payments basés aux États-Unis, avec des plans d'extension plus larges.

Wix (NASDAQ: WIX) hat eine umfassende Suite von Finanzdienstleistungen vorgestellt, die zwei neue Lösungen umfasst: Wix Checking und Wix Capital. Wix Checking, angetrieben von Units Embedded-Finance-Technologie, bietet Nutzern ein kostenloses integriertes Geschäftskonto innerhalb der Wix-Plattform mit sofortigem Zugriff auf Einnahmen und Echtzeit-Überwachung des Cashflows.

Die Suite beinhaltet auch Wix Capital, einen Merchant Cash Advance (MCA)-Service, der Unternehmen dabei unterstützt, Finanzierungsbedürfnisse über eine zugänglichere Alternative zu traditionellen Banken zu decken. Der Service tauscht einen Prozentsatz zukünftiger Umsätze gegen sofortigen Kapitalzugang ein.

Diese Finanzinstrumente sind derzeit für ausgewählte Wix Payments-Nutzer in den USA verfügbar, mit Plänen für eine breitere Einführung.

- Integration of banking services directly into Wix platform at no additional cost

- Instant access to earnings after sales completion

- Simplified financial operations with automated reconciliation

- Alternative funding option through Merchant Cash Advance service

- Limited availability - only select U.S.-based Wix Payments users eligible initially

- Merchant Cash Advance requires giving up percentage of future sales

Insights

Wix's expansion into embedded finance with checking accounts and merchant financing strengthens its platform ecosystem and creates new revenue opportunities.

Wix's launch of integrated financial services marks a strategic expansion beyond its core website building capabilities into the high-growth embedded finance market. The new offerings��Wix Checking (powered by Unit) and Wix Capital (a Merchant Cash Advance service)—address critical small business pain points while creating powerful platform lock-in effects.

The checking account service eliminates the traditional multi-day settlement delays for merchants by providing instant access to sales proceeds. This real-time liquidity feature solves a significant cash flow challenge for small businesses that typically must wait 2-3 days to access their funds through traditional payment processors. By integrating directly with Wix Payments, the platform creates a closed-loop financial ecosystem that reduces friction and improves user retention.

The Merchant Cash Advance offering positions Wix to capture value from the $15+ billion annual MCA market while addressing the well-documented challenges small businesses face in securing traditional financing. The revenue-based repayment structure aligns Wix's interests with merchant success and provides an alternative capital source without dilution or fixed payment obligations.

This move follows the broader trend of vertical SaaS platforms expanding horizontally into financial services—similar to what we've seen from Shopify, Toast, and Square. For Wix, these financial products create three strategic advantages: 1) new revenue streams beyond subscription fees, 2) increased platform stickiness through deeper financial integration, and 3) enhanced data visibility into merchant cash flows that can inform future product development.

The new financial suite includes Wix Checking and Wix Capital, two new solutions designed to help Wix merchants access their funds immediately, take control of cash flow, and support business growth online and offline

NEW YORK �� Ltd. (NASDAQ: WIX), the leading SaaS website builder platform globally1, today announced the launch of Wix Checking2 and Wix Capital, a powerful new financial services suite aimed to help users manage cash flow and fund growth. Eligible businesses can efficiently streamline their finances, enabling them to concentrate on growth and innovation.

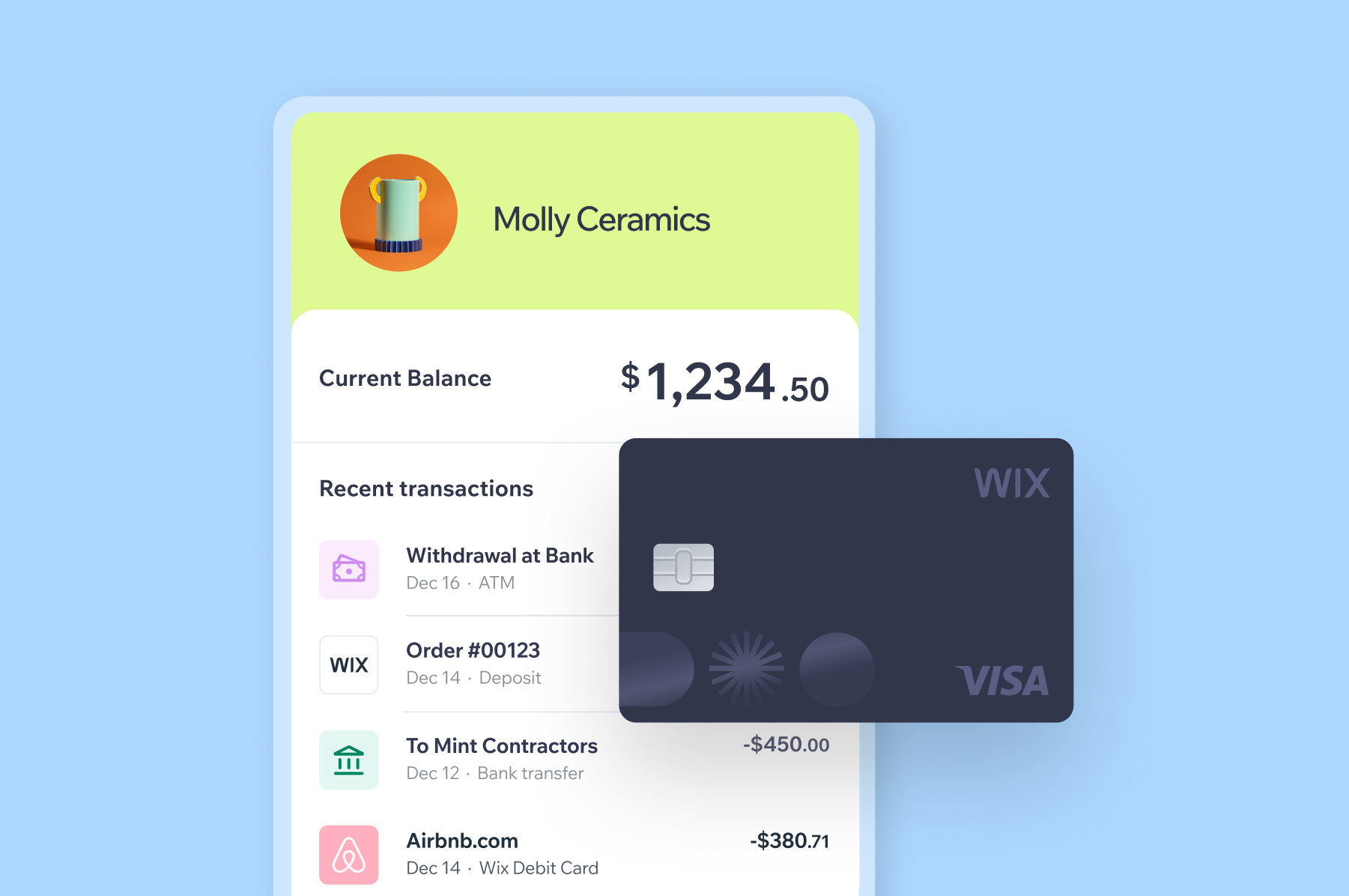

Wix Checking, powered by Unit's embedded finance solution, gives users a fully integrated business checking account directly within the Wix platform at no extra cost. It is designed to simplify financial operations by offering a clear, real-time view of cash flow and business performance. Users can instantly access their earnings the moment a sale is completed, track incoming revenue and outgoing expenses side by side, and make faster, more informed decisions. By syncing automatically with Wix Payments, Wix Checking removes the need for external banking tools and manual reconciliations, saving time and reducing errors. To use their funds, merchants can either make purchases with the Wix Visa® business debit card or transfer money to an external bank account for added flexibility. The result is a seamless, all-in-one financial experience that gives business owners greater control, speed, and simplicity in managing their money.

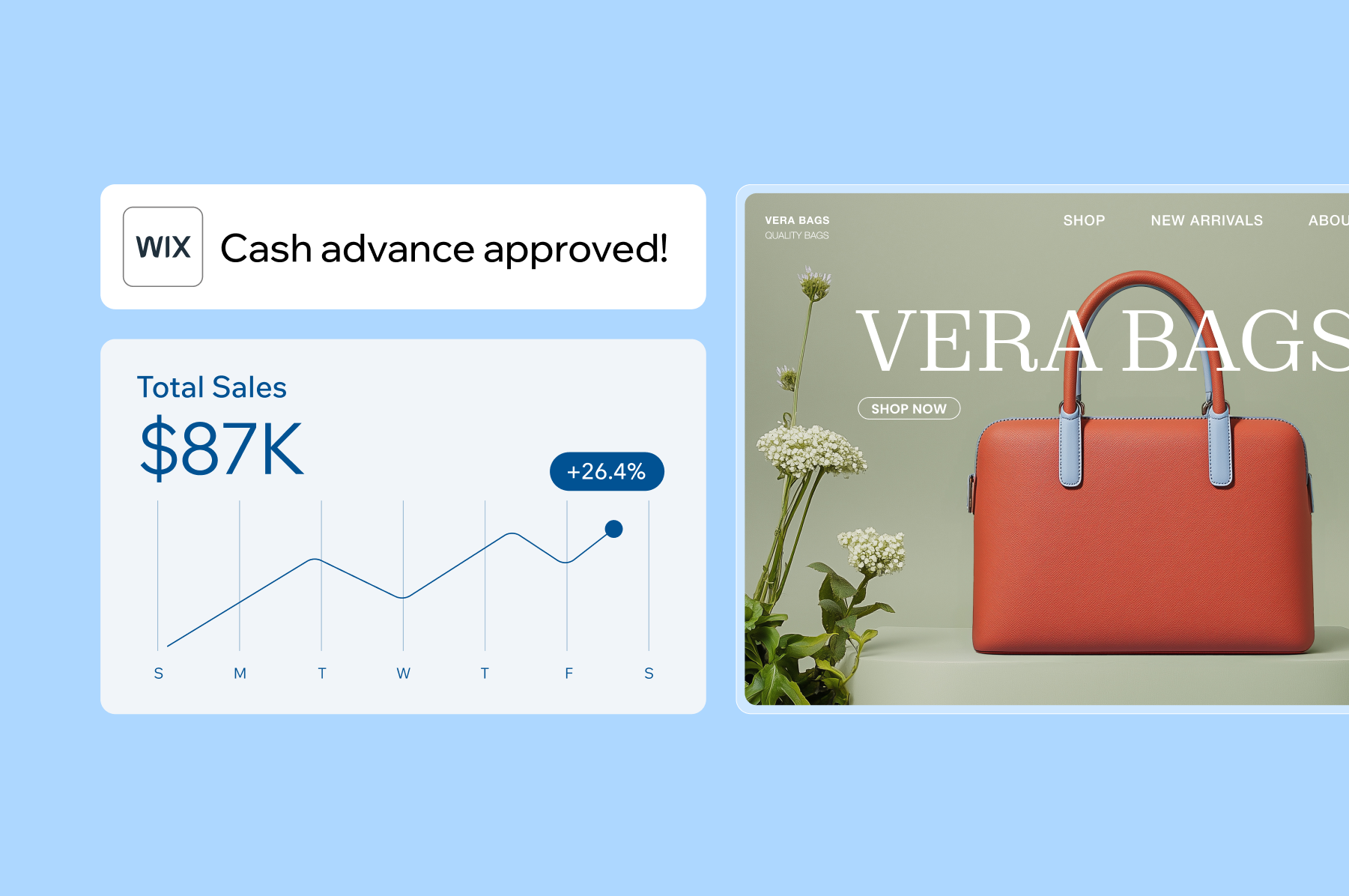

In addition to Wix Checking, Wix has introduced Wix Capital, a Merchant Cash Advance (MCA) service designed to help businesses address cash flow gaps and unlock growth. Many small businesses face challenges when trying to secure funding through traditional banks, often encountering long approval processes or strict requirements. Wix Capital offers a faster, more accessible alternative by allowing users to request a cash advance in exchange for a fixed fee and a percentage of future sales. This provides access to funds that can be used for essential business needs such as inventory, payroll, or operational expenses. Removing barriers to capital and making funding available at the moment it’s needed most is key to helping businesses grow. Built directly into the Wix platform, Wix Capital gives users a simple and flexible way to invest in their business without leaving the tools they already use to run it.

“With Wix Checking and Wix Capital, we’re giving users a complete financial solution built into the platform they already use,�� said Amit Sagiv and Volodymyr Tsukur, Co-Heads of Wix Payments. “It’s fast, simple, and designed to help small businesses access their money and fuel growth �� all in one place. This is part of our broader commitment to supporting the full journey of business ownership, from managing day-to-day operations to making smarter financial decisions.��

Wix Checking and Wix Capital are available to a select group of U.S.-based users using Wix Payments, with plans to roll out to more users on a gradual basis3.��

About Wix.com Ltd.

is the leading SaaS website builder platform1 to create, manage and grow a digital presence. Founded in 2006, Wix is a comprehensive platform providing users - self-creators, agencies, enterprises, and more - with industry-leading performance, security, AI capabilities and a reliable infrastructure. Offering a wide range of commerce and business solutions, advanced SEO and marketing tools, the platform enables users to take full ownership of their brand, their data and their relationships with their customers. With a focus on continuous innovation and delivery of new features and products, users can seamlessly build a powerful and high-end digital presence for themselves or their clients.��

For more about Wix, please visit our

Media Relations Contact: ����

1 Based on number of active live sites as reported by competitors' figures, independent third-party data and internal data as of Q1 2025.

2 Wix is not a bank. Banking products and services are provided by Lincoln Savings Bank, Member FDIC. The Wix Debit Card is issued by Lincoln Savings Bank pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa debit cards are accepted. Wix is not FDIC insured. FDIC insurance only covers the failure of a covered bank.

3��Certain criteria and qualifications may apply.��

Attachments