TMC Releases Two Economic Studies with Combined NPV of $23.6B and Declares World-First Nodule Reserves

TMC (NASDAQ: TMC) has released two groundbreaking economic studies with a combined Net Present Value of $23.6 billion. The company published a world-first Pre-Feasibility Study (PFS) for its NORI-D polymetallic nodule project with an NPV of $5.5 billion and declared the first-ever Mineral Reserves of 51 million tonnes for deep-sea polymetallic nodules.

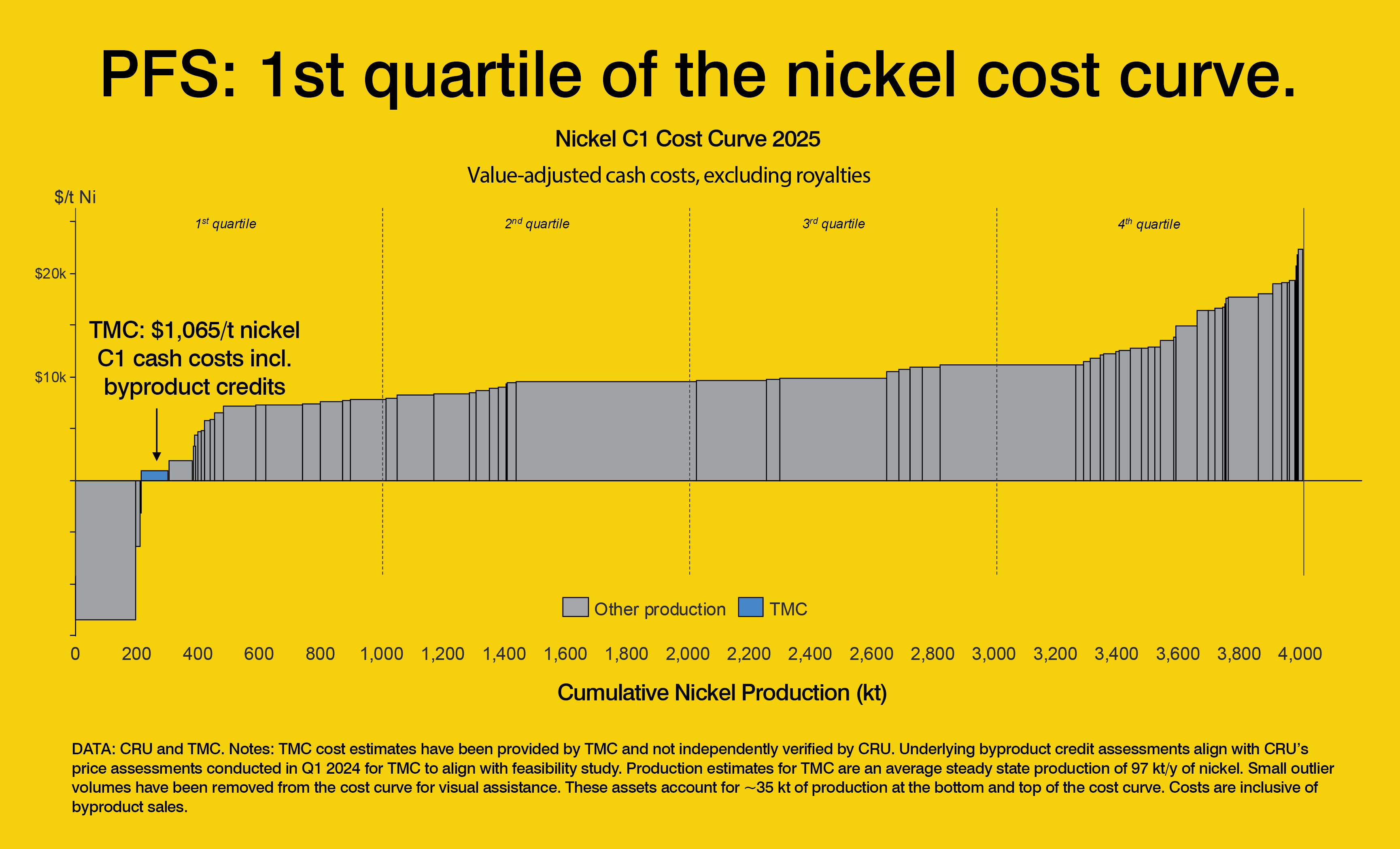

The project expects to commence commercial production in Q4 2027, scaling to 10.8 million tonnes annual production rate of wet nodules at steady state (2031-2043). The company projects steady-state production of 97 ktpa nickel, 2,389 ktpa manganese, 70 ktpa copper, and 7.4 ktpa cobalt with first-quartile production costs of $1,065 per tonne of nickel.

Additionally, TMC released an Initial Assessment for the remaining NORI and TOML areas, showing an NPV of $18.1 billion with a 36% IRR. The studies follow TMC USA's commercial recovery permit application and a strategic investment from Korea Zinc.

[ "World-first declaration of Mineral Reserves for deep-sea polymetallic nodules with 51 million tonnes of probable reserves", "Combined NPV of $23.6 billion across both studies with strong IRRs (27% for NORI-D, 36% for remaining areas)", "First quartile cost position with cash costs of $1,065/tonne nickel including byproduct credits", "High steady state EBITDA margins of 43% for NORI-D and 57% for remaining areas", "Strategic investment secured from Korea Zinc, a major non-ferrous metal smelting group", "Capital-light approach leveraging existing infrastructure with only $113M initial development capex each from TMC and Allseas" ]TMC (NASDAQ: TMC) ha pubblicato due studi economici rivoluzionari con un Valore Attuale Netto combinato di 23,6 miliardi di dollari. L'azienda ha presentato il primo studio di prefattibilità al mondo (PFS) per il progetto di noduli polimetallici NORI-D, con un VAN di 5,5 miliardi di dollari, e ha dichiarato per la prima volta riserve minerarie di 51 milioni di tonnellate di noduli polimetallici in acque profonde.

Il progetto prevede l'inizio della produzione commerciale nel quarto trimestre del 2027, con una capacità produttiva annuale di noduli umidi di 10,8 milioni di tonnellate a regime stabile (2031-2043). L'azienda stima una produzione stabile di 97 ktpa di nichel, 2.389 ktpa di manganese, 70 ktpa di rame e 7,4 ktpa di cobalto con costi di produzione di prima quartile pari a 1.065 dollari per tonnellata di nichel.

Inoltre, TMC ha rilasciato una valutazione iniziale per le restanti aree NORI e TOML, con un VAN di 18,1 miliardi di dollari e un Tasso Interno di Rendimento (TIR) del 36%. Questi studi seguono la domanda di permesso commerciale di recupero di TMC USA e un investimento strategico da parte di Korea Zinc.

- Dichiarazione senza precedenti di riserve minerarie per noduli polimetallici in acque profonde pari a 51 milioni di tonnellate di riserve probabili

- VAN combinato di 23,6 miliardi di dollari tra i due studi con forti TIR (27% per NORI-D, 36% per le aree rimanenti)

- Posizione di costo di prima quartile con costi cash di 1.065 dollari per tonnellata di nichel, inclusi i crediti per sottoprodotti

- Margini EBITDA elevati a regime stabile del 43% per NORI-D e del 57% per le aree rimanenti

- Investimento strategico assicurato da Korea Zinc, importante gruppo di fusione di metalli non ferrosi

- Approccio a basso capitale con utilizzo di infrastrutture esistenti e solo 113 milioni di dollari di capex iniziale ciascuno da parte di TMC e Allseas

TMC (NASDAQ: TMC) ha publicado dos estudios económicos innovadores con un Valor Presente Neto combinado de 23,6 mil millones de dólares. La compañía presentó el primer Estudio de Prefactibilidad (PFS) mundial para su proyecto de nódulos polimetálicos NORI-D con un VPN de 5,5 mil millones de dólares y declaró las primeras Reservas Minerales de 51 millones de toneladas para nódulos polimetálicos de aguas profundas.

Se espera que el proyecto comience la producción comercial en el cuarto trimestre de 2027, alcanzando una tasa de producción anual de 10,8 millones de toneladas de nódulos húmedos en estado estable (2031-2043). La compañía proyecta una producción estable de 97 ktpa de níquel, 2.389 ktpa de manganeso, 70 ktpa de cobre y 7,4 ktpa de cobalto con costos de producción en el primer cuartil de 1.065 dólares por tonelada de níquel.

Además, TMC publicó una Evaluación Inicial para las áreas restantes NORI y TOML, mostrando un VPN de 18,1 mil millones de dólares con una TIR del 36%. Los estudios siguen la solicitud de permiso comercial de recuperación de TMC USA y una inversión estratégica de Korea Zinc.

- Declaración pionera de Reservas Minerales para nódulos polimetálicos de aguas profundas con 51 millones de toneladas de reservas probables

- VPN combinado de 23,6 mil millones de dólares en ambos estudios con fuertes TIR (27% para NORI-D, 36% para las áreas restantes)

- Posición de costos en el primer cuartil con costos en efectivo de 1.065 dólares por tonelada de níquel, incluidos créditos por subproductos

- Altos márgenes EBITDA en estado estable del 43% para NORI-D y 57% para las áreas restantes

- Inversión estratégica asegurada de Korea Zinc, un importante grupo de fundición de metales no ferrosos

- Enfoque de bajo capital aprovechando la infraestructura existente con solo 113 millones de dólares de capex inicial cada uno de TMC y Allseas

TMC (NASDAQ: TMC)�� �� 순현재가��(NPV) 236�� 달러�� 달하�� �� 가지 획기적인 경제 연구 결과�� 발표했습니다. 회사�� NORI-D 다금�� 결절 프로젝트�� 대�� 세계 최초�� 예비 타당성 조사(PFS)�� 발표했으��, 55�� 달러�� NPV�� 기록하고 심해 다금�� 결절�� 대�� 처음으로 5,100�� ���� 광물 매장량을 선언했습니다.

�� 프로젝트�� 2027�� 4분기�� 상업 생산�� 시작�� 예정이며, 정상 상태(2031-2043)에서 연간 1,080�� ���� 습식 결절 생산량에 도달�� 계획입니��. 회사�� 정상 상태 생산량으�� 연간 9.7�� 톤의 니켈, 238�� 9�� 톤의 망간, 7�� 톤의 구리, 7,400톤의 코발���� 예상하며, 니켈 톤당 1,065달러�� 1사분�� 생산 비용�� 제시했습니다.

또한 TMC�� NORI �� TOML�� 나머지 지역에 대�� 초기 평가�� 발표했으��, 181�� 달러�� NPV와 36%�� 내부수익��(IRR)�� 보였습니��. �� 연구들은 TMC USA�� 상업�� 회수 허가 신청�� Korea Zinc�� 전략�� 투자�� 따른 것입니다.

- 심해 다금�� 결절�� 대�� 5,100�� 톤의 추정 매장량을 가�� 세계 최초�� 광물 매장�� 선언

- �� 연구�� 합친 �� NPV 236�� 달러와 강력�� IRR (NORI-D 27%, 나머지 지�� 36%)

- 부산물 크레딧을 포함�� 톤당 1,065달러�� 현금 비용으로 1사분�� 비용 위치 확보

- NORI-D 43%, 나머지 지�� 57%�� 높은 정상 상태 EBITDA 마진

- 비철금속 제련 대기업 Korea Zinc로부�� 확보�� 전략�� 투자

- TMC와 Allseas가 각각 1�� 1,300�� 달러�� 초기 개발 자본�� 투자하는 기존 인프라를 활용�� 경량 자본 접근��

TMC (NASDAQ : TMC) a publié deux études économiques révolutionnaires avec une valeur actuelle nette (VAN) combinée de 23,6 milliards de dollars. La société a publié une étude de préfaisabilité (PFS) inédite au monde pour son projet de nodules polymétalliques NORI-D avec une VAN de 5,5 milliards de dollars et a déclaré pour la première fois des réserves minérales de 51 millions de tonnes pour des nodules polymétalliques en eaux profondes.

Le projet prévoit de commencer la production commerciale au quatrième trimestre 2027, atteignant un taux de production annuel de 10,8 millions de tonnes de nodules humides à l'état stable (2031-2043). La société projette une production à l'état stable de 97 ktpa de nickel, 2 389 ktpa de manganèse, 70 ktpa de cuivre et 7,4 ktpa de cobalt avec des coûts de production de premier quartile de 1 065 $ par tonne de nickel.

De plus, TMC a publié une évaluation initiale pour les zones NORI et TOML restantes, affichant une VAN de 18,1 milliards de dollars avec un TRI de 36%. Ces études suivent la demande de permis commercial de récupération de TMC USA et un investissement stratégique de Korea Zinc.

- Première déclaration mondiale de réserves minérales pour nodules polymétalliques en eaux profondes avec 51 millions de tonnes de réserves probables

- VAN combinée de 23,6 milliards de dollars sur les deux études avec des TRI solides (27 % pour NORI-D, 36 % pour les zones restantes)

- Position de coût de premier quartile avec des coûts en espèces de 1 065 $/tonne de nickel, y compris les crédits de sous-produits

- Marges EBITDA élevées à l'état stable de 43 % pour NORI-D et 57 % pour les zones restantes

- Investissement stratégique assuré de Korea Zinc, un grand groupe de fusion de métaux non ferreux

- Approche capital-light tirant parti des infrastructures existantes avec seulement 113 millions de dollars de dépenses d'investissement initiales chacun de TMC et Allseas

TMC (NASDAQ: TMC) hat zwei bahnbrechende wirtschaftliche Studien mit einem kombinierten Kapitalwert (Net Present Value, NPV) von 23,6 Milliarden US-Dollar veröffentlicht. Das Unternehmen veröffentlichte eine weltweit erste Vorstudie (Pre-Feasibility Study, PFS) für sein NORI-D-Polymetallknollenprojekt mit einem NPV von 5,5 Milliarden US-Dollar und erklärte erstmals Mineralreserven von 51 Millionen Tonnen für polymetallische Tiefseeknollen.

Das Projekt soll die kommerzielle Produktion im 4. Quartal 2027 aufnehmen und eine jährliche Produktionsrate von 10,8 Millionen Tonnen feuchter Knollen im stabilen Betrieb (2031-2043) erreichen. Das Unternehmen prognostiziert eine stabile Produktion von 97 ktpa Nickel, 2.389 ktpa Mangan, 70 ktpa Kupfer und 7,4 ktpa Kobalt mit Kosten in der ersten Quartile von 1.065 US-Dollar pro Tonne Nickel.

Zusätzlich veröffentlichte TMC eine erste Bewertung für die verbleibenden NORI- und TOML-Gebiete, die einen NPV von 18,1 Milliarden US-Dollar bei einer internen Rendite (IRR) von 36% aufweist. Die Studien folgen dem Antrag von TMC USA auf eine kommerzielle Erlaubnis zur Gewinnung und einer strategischen Investition von Korea Zinc.

- Weltweit erste Erklärung von Mineralreserven für polymetallische Tiefseeknollen mit 51 Millionen Tonnen wahrscheinlicher Reserven

- Kombinierter NPV von 23,6 Milliarden US-Dollar über beide Studien mit starken IRRs (27 % für NORI-D, 36 % für die verbleibenden Gebiete)

- Kostenführerschaft in der ersten Quartile mit Cash-Kosten von 1.065 US-Dollar pro Tonne Nickel einschließlich Nebenproduktgutschriften

- Hohe stabile EBITDA-Margen von 43 % für NORI-D und 57 % für die verbleibenden Gebiete

- Strategische Investition von Korea Zinc, einer großen Gruppe für die Verhüttung von Nichteisenmetallen, gesichert

- Kapitalarme Herangehensweise unter Nutzung bestehender Infrastruktur mit nur 113 Mio. US-Dollar Anfangskapitalaufwand jeweils von TMC und Allseas

- None.

- Significant total project capital requirements of $4.9B for NORI-D and $8.9B for remaining areas

- Commercial production not expected until Q4 2027, subject to permit approvals

- Project requires multiple regulatory approvals under the U.S. Deep Seabed Hard Mineral Resources Act

- Substantial reliance on third-party contractors and tolling agreements for operations

Insights

TMC's declaration of world-first seabed mineral reserves and $23.6B combined NPV positions it as a first-mover in critical minerals supply.

TMC has released two significant economic assessments that fundamentally transform the company's risk profile and commercial viability. The Pre-Feasibility Study for the NORI-D project marks a watershed moment for deep-sea mining with the world's first declaration of Probable Mineral Reserves for polymetallic nodules - 51 million tonnes with high-grade mineral content. Beyond these reserves, an additional 274 million tonnes of measured, indicated, and inferred resources could yield 113 million more tonnes of recoverable nodules.

The project economics are compelling: a $5.5 billion NPV with a robust 27% IRR and 43% EBITDA margins at steady state. What's particularly notable is the first-quartile cost position with cash costs of

The execution strategy employs a capital-light approach that dramatically reduces initial investment risk. By leveraging existing processing infrastructure through tolling agreements with PAMCO in Japan and partners in Indonesia, TMC can defer significant capital expenditures while validating their production model. The phased development plan starting with the Hidden Gem vessel requires just

The extraction technology is notably different from traditional mining - using water jets to gently lift nodules without drilling or blasting, which supports the company's environmental narrative. With commercial production targeted for Q4 2027 and planned steady-state production of 97 kilotonnes of nickel annually, TMC is positioning itself to become a major supplier of battery metals at a time when demand is expected to surge from EV manufacturing and energy transition infrastructure.

The strategic investment from Korea Zinc and the recent submission of permit applications under U.S. regulation indicate growing momentum and confidence in the project. This positions TMC as a potential critical minerals champion aligned with U.S. and allied nations' strategic interests in securing supply chains independent of geopolitically complex regions.

- TMC published two technical economic assessments prepared in accordance with Subpart 1300 of Regulation S-K highlighting a total combined project value of

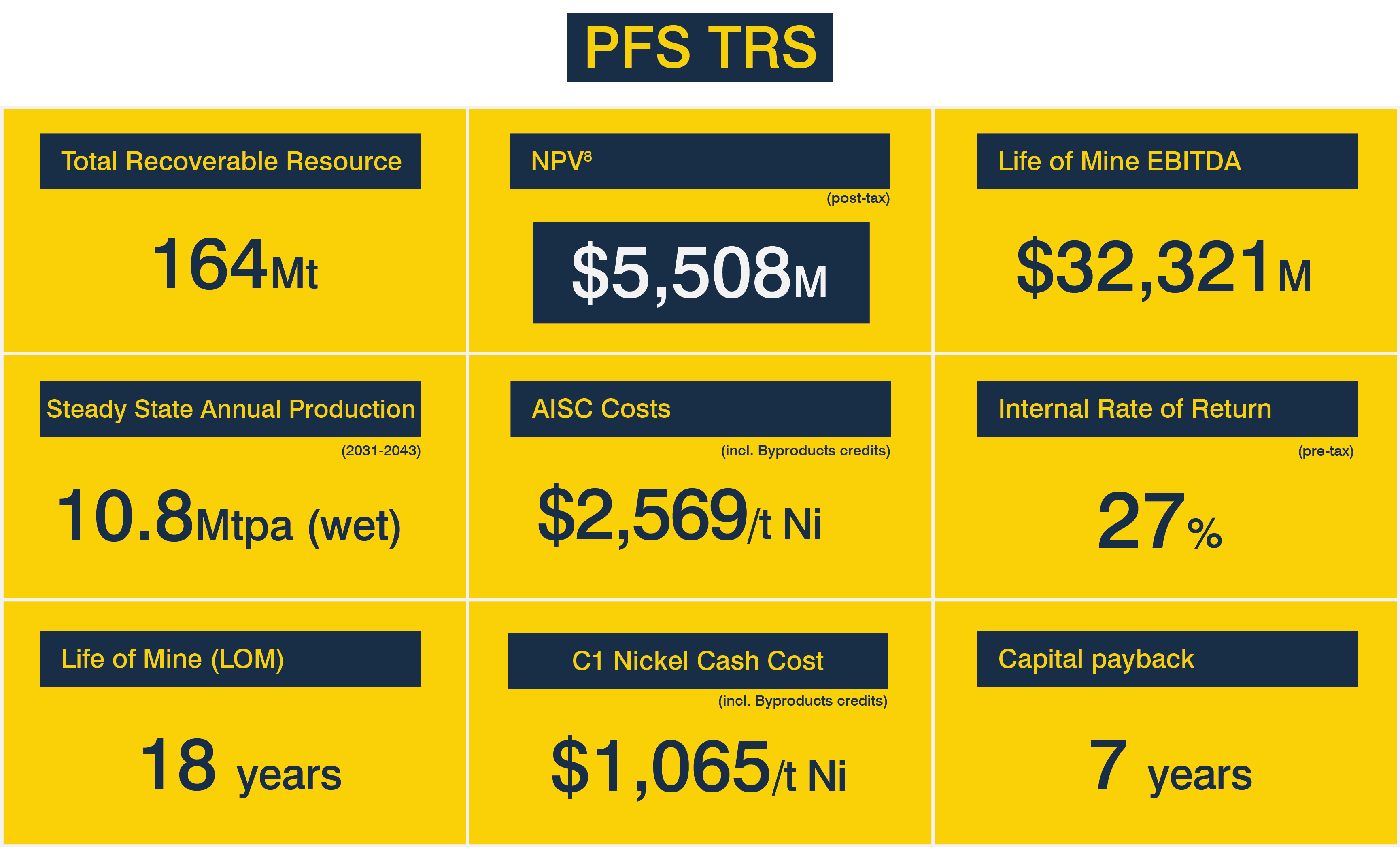

$23.6 billion , showing potential economic viability of its NORI-D Project and significant scalability across other NORI and TOML areas�� - World-first Pre-Feasibility Study (PFS) for a polymetallic nodule project in the NORI-D area with a Net Present Value (NPV) of

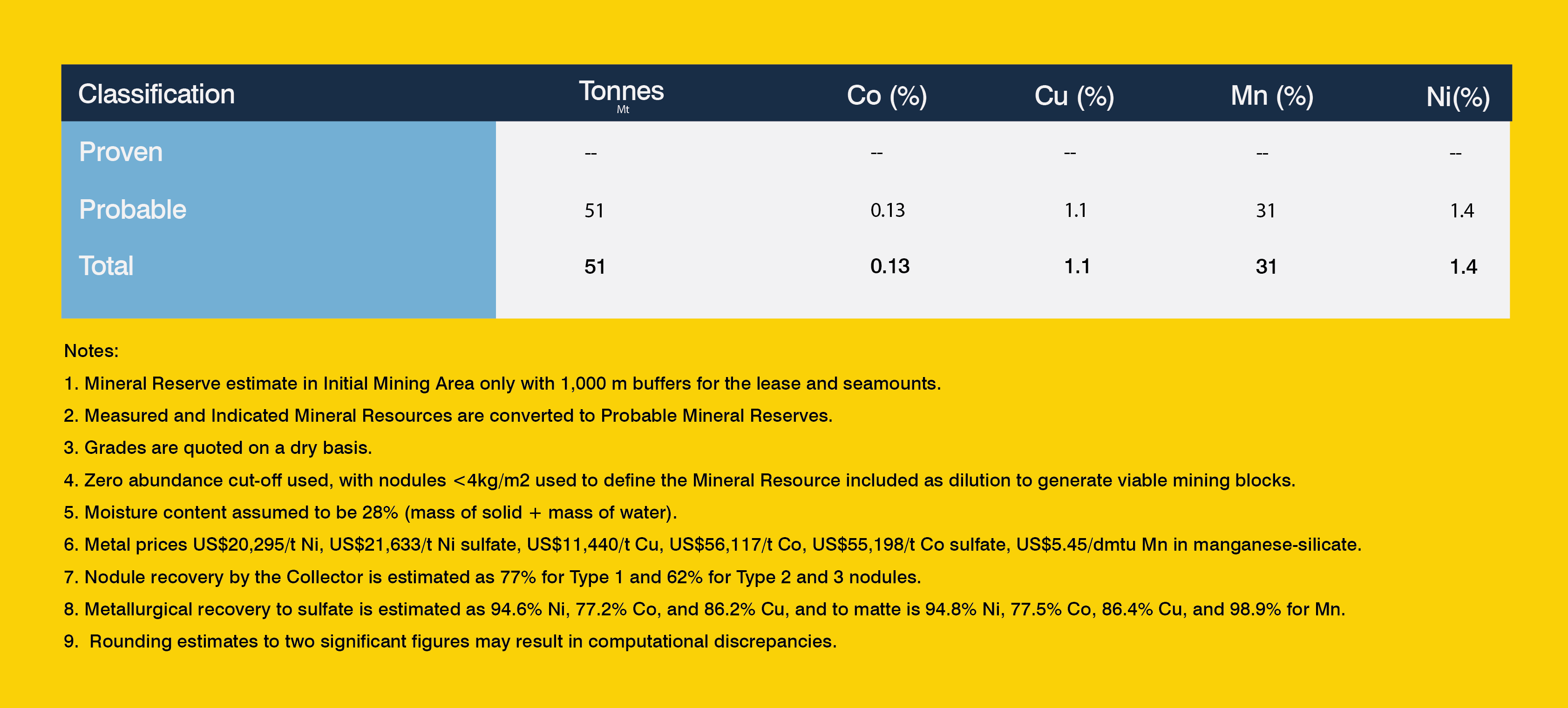

$5.5 billion - The PFS Technical Report Summary (TRS) marks a world-first declaration of Mineral Reserves for a polymetallic nodule project with 51 million tonnes (Mt) of probable mineral reserves;

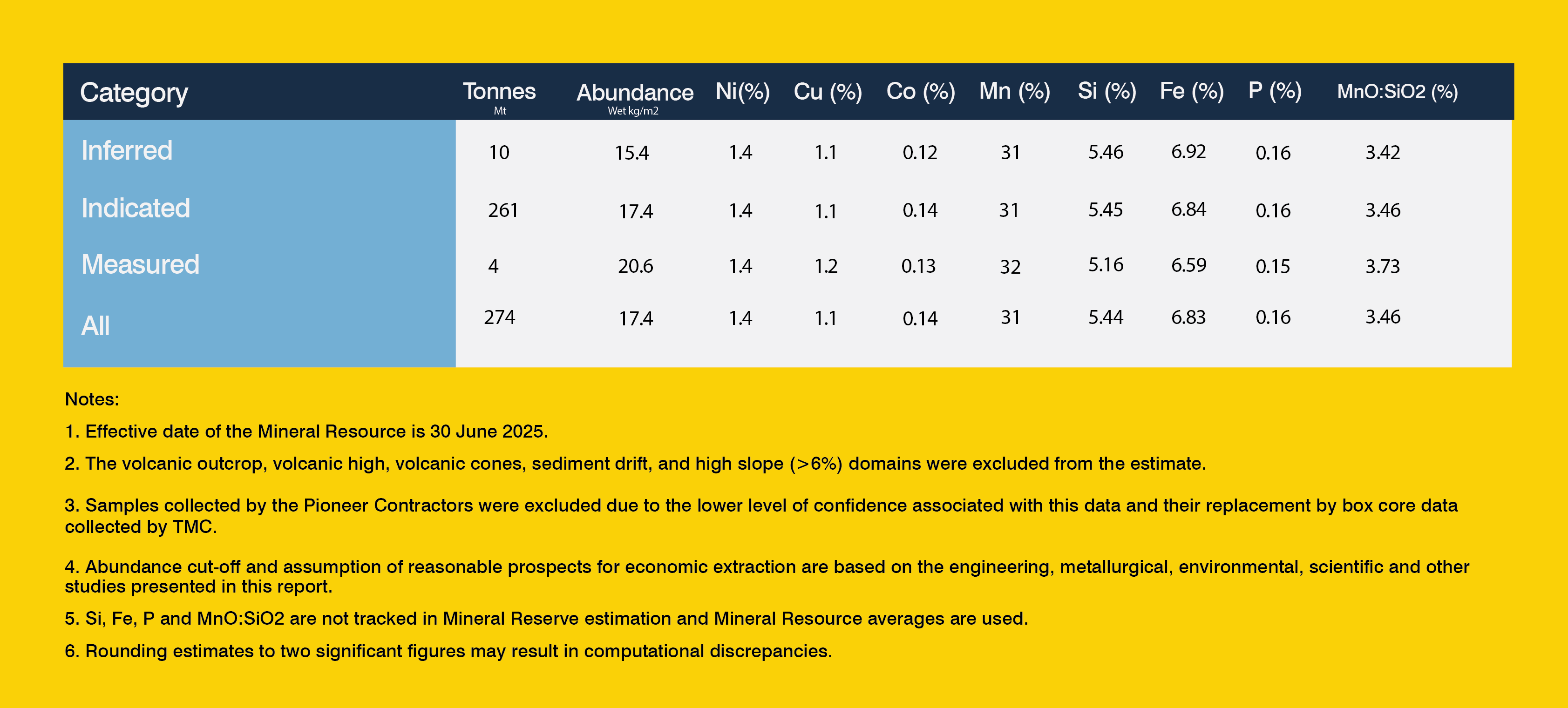

- Measured, indicated and inferred mineral resources exclusive of reserves of 274 Mt of wet nodules are expected to provide an additional 113 Mt of recoverable nodules once detailed survey and mine planning is complete;

- In light of recent U.S. regulatory developments, TMC expects to commence commercial production in the fourth quarter of 2027 if we receive a commercial permit before scaling to an average targeted annual production rate of 10.8 million tonnes of wet nodules per annum (Mtpa) at steady state (2031 through 2043) production, with an expected 18-year life of mine (LOM);

- Expected annual steady state production rate of 97 kilotonnes per annum (ktpa) nickel, 2,389 ktpa manganese, 70 ktpa copper and 7.4 ktpa cobalt

- Expected low first quartile cost of production with cash costs of

$1,065 per tonne of nickel including byproduct credits and All-In Sustaining Costs (AISC) of$2,569 per tonne of nickel including byproduct credits - Projected after-tax NPV of

$5.5 billion and After-tax Internal Rate of Return (IRR) of27% - Steady state average EBITDA margin of

43%

- New Initial Assessment details the economic potential of the rest of the 1.3 billion tonne resource across the NORI and TOML areas (excluding NORI-D) and a total estimated resource Net Project Value of

$18.1 Billion - Projected After-tax NPV of

$18.1 Billion and IRR of36% - Projected steady state (2039 through 2058) average EBITDA margin of

57%

- Projected After-tax NPV of

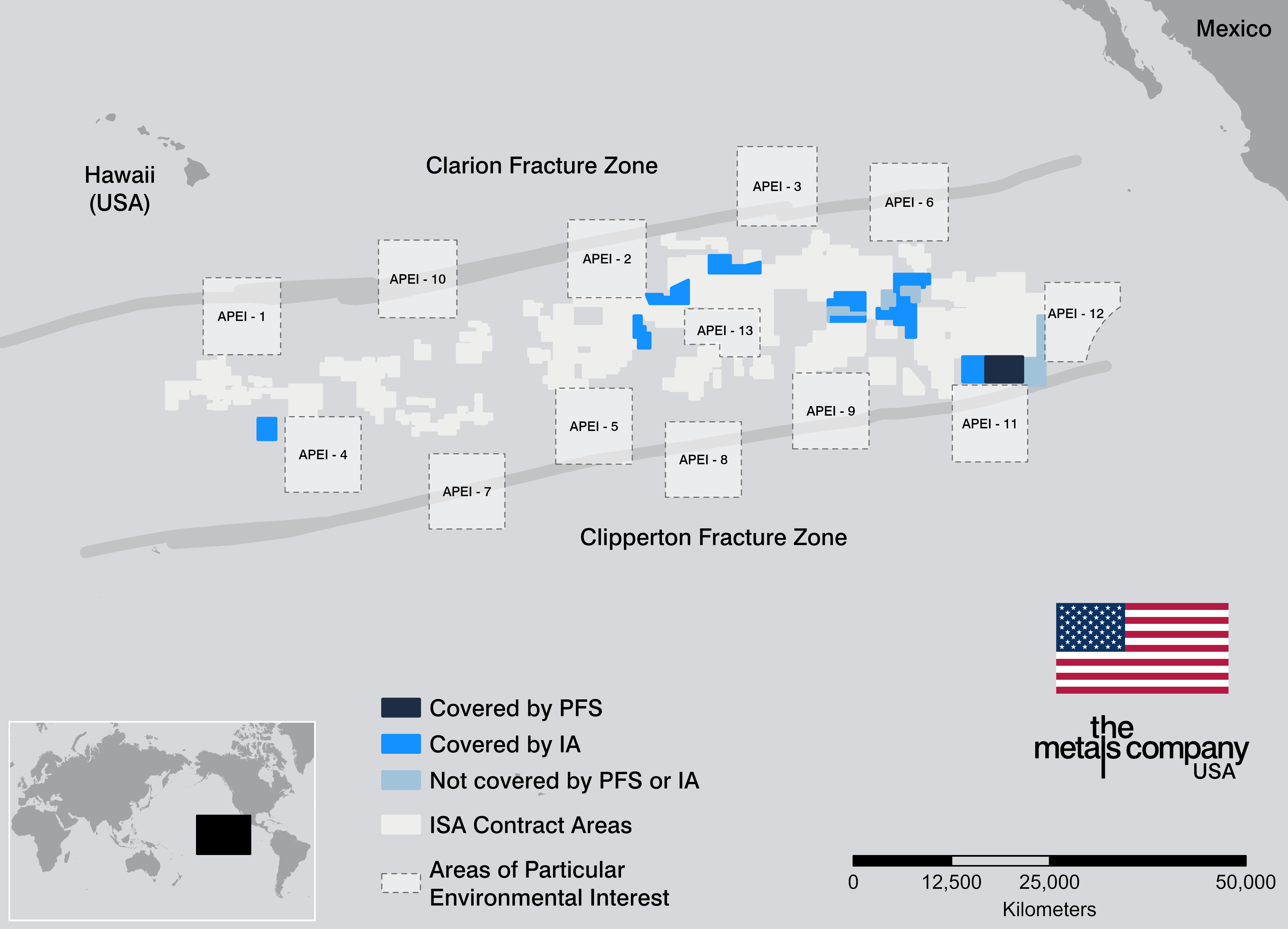

NEW YORK, Aug. 04, 2025 (GLOBE NEWSWIRE) -- TMC the metals company Inc. (Nasdaq: TMC), a leading developer of the world’s largest estimated undeveloped resource of critical metals essential to energy, defense, manufacturing and infrastructure, today announced the release of a Technical Report Summary (TRS) of the Pre-Feasibility Study (PFS) for its proposed NORI-D Polymetallic Nodule Project in the Clarion Clipperton Zone (CCZ) of the Pacific Ocean, prepared in accordance with Subpart 1300 of SEC Regulation S-K (SK-1300). The PFS marks a world-first declaration of Probable Mineral Reserves for deep-sea polymetallic nodules and was prepared and signed off by Qualified Persons, including AMC Consultants.

Alongside the PFS, TMC announced the publication of an Initial Assessment (IA) for the remainder of its resource in the NORI and TOML blocks in the CCZ, with a measured and indicated mineral resource of 73Mt of wet nodules grading

The two mineral resource reports follow TMC USA’s April 2025 submission of an for a commercial recovery permit under the U.S. Deep Seabed Hard Mineral Resources Act (DSHMRA), along with two exploration license applications. The reports also come on the heels of a —one of the world’s largest and most respected non-ferrous metal smelting groups. Together, these milestones reinforce TMC’s first-mover advantage in unlocking the world’s largest estimated undeveloped deposit of critical minerals and reflect growing confidence in the NORI-D Project’s economics and development plan as the U.S. and allied nations work to strengthen critical mineral supply chains.

Follow these links to read the reports: for the PFS; Technical Report Summary for the of the remaining NORI and TOML resource.

Gerard Barron, Chairman and CEO of TMC, commented:��“The combined net present value of

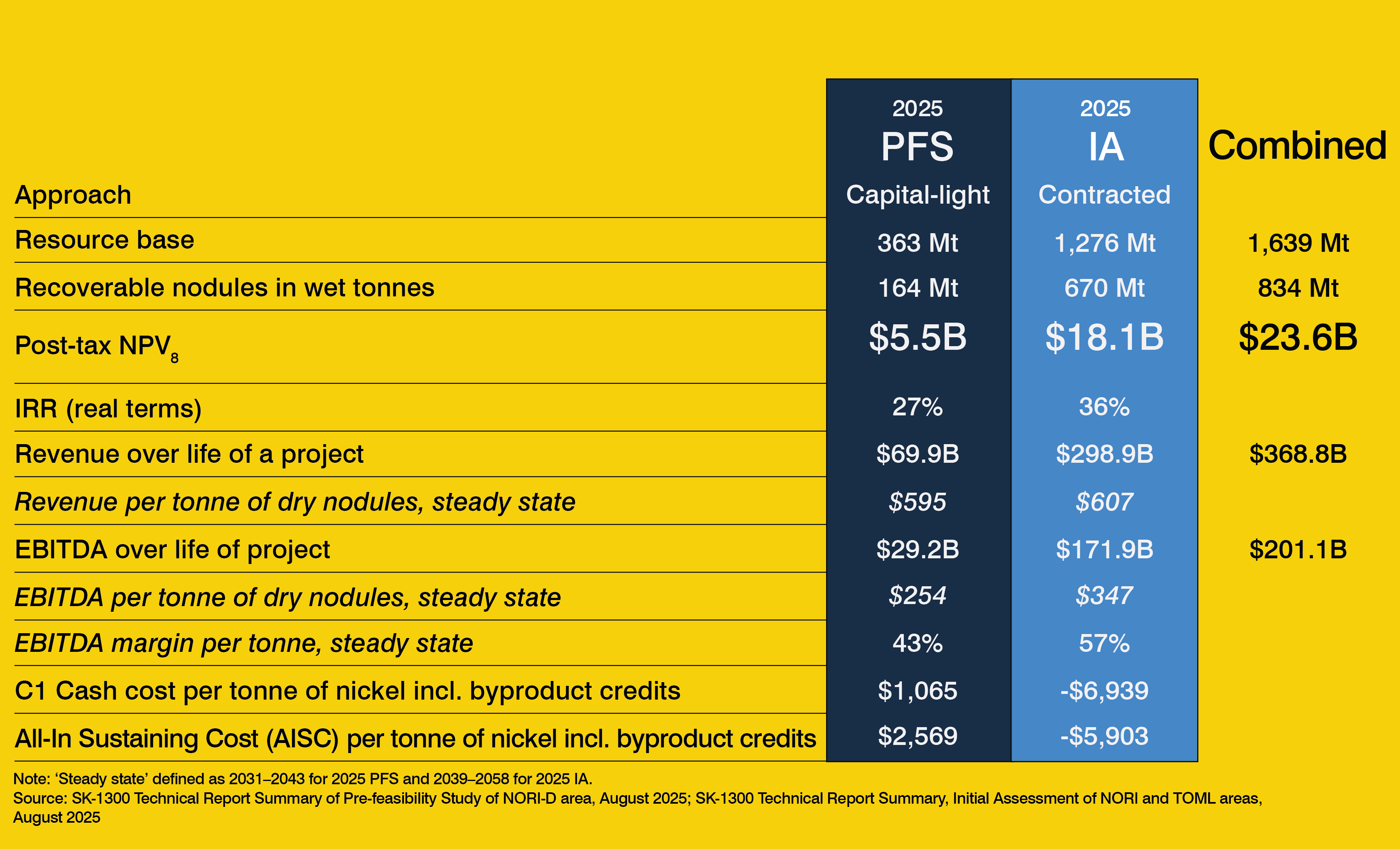

*The tables below summarize key findings under the PFS and IA. The summary does not purport to be complete and is qualified in its entirety by the PFS and IA. Readers are encouraged to read the PFS and IA in their entirety.

PFS and IA at a Glance.

| �� | Unit | PFS | IA |

| Mine Life | Years | 18 | 23 |

| Total Nodule Production | Million tonnes (wet) | 164 | 670 |

| Nameplate Production Capacity | Million tonnes per annum (wet) | 12 | 40 |

| Average Nickel Grade | % | 1.40 | 1.31 |

| Average Cobalt Grade | % | 0.14 | 0.19 |

| Average Copper Grade | % | 1.14 | 1.13 |

| Average Manganese Grade | % | 31.15 | 29.35 |

| Average Nickel Recovery | �� | �� | �� |

| Nodules to Alloy | % | 96.9 | N/A |

| Nodules to Matte | % | 94.8 | 94.8 |

| Nodules to Sulfate | % | 94.6 | 94.6 |

| Average Cobalt Recovery | �� | �� | �� |

| Nodules to Alloy | % | 93.1 | N/A |

| Nodules to Matte | % | 77.5 | 77.5 |

| Nodules to Sulfate | % | 77.2 | 77.2 |

| Average Copper Recovery | �� | �� | �� |

| Nodules to Alloy | % | 93.6 | N/A |

| Nodules to Matte | % | 86.4 | 86.4 |

| Nodules to Cathode | % | 86.2 | 86.2 |

| Average Manganese Recovery (as Mn Silicate) | % | 98.9 | 98.9 |

| Total LOM Operating Costs | US$ million | 39,978 | 126,175 |

| LOM Offshore Collection | US$ million | 12,344 | 31,139 |

| LOM Transfer & Shipping | US$ million | 3,071 | 6,066 |

| LOM Contractor Costs | US$ million | 1,855 | 3,584 |

| LOM Consumables (offshore fuel) | US$ million | 3,848 | 11,884 |

| LOM Onshore Processing | US$ million | 13,622 | 53,598 |

| LOM Refining Costs | US$ million | 3,254 | 15,978 |

| LOM Corporate (G&A) | US$ million | 1,985 | 3,926 |

| All-In Sustaining Costs incl. Byproduct Credits (non-GAAP1) | US$ per tonne of Nickel | 2,569 | (5,903) |

| C1 Cash Costs incl. Byproduct Credits (non-GAAP1) | US$ per tonne of Nickel | 1,065 | (6,939) |

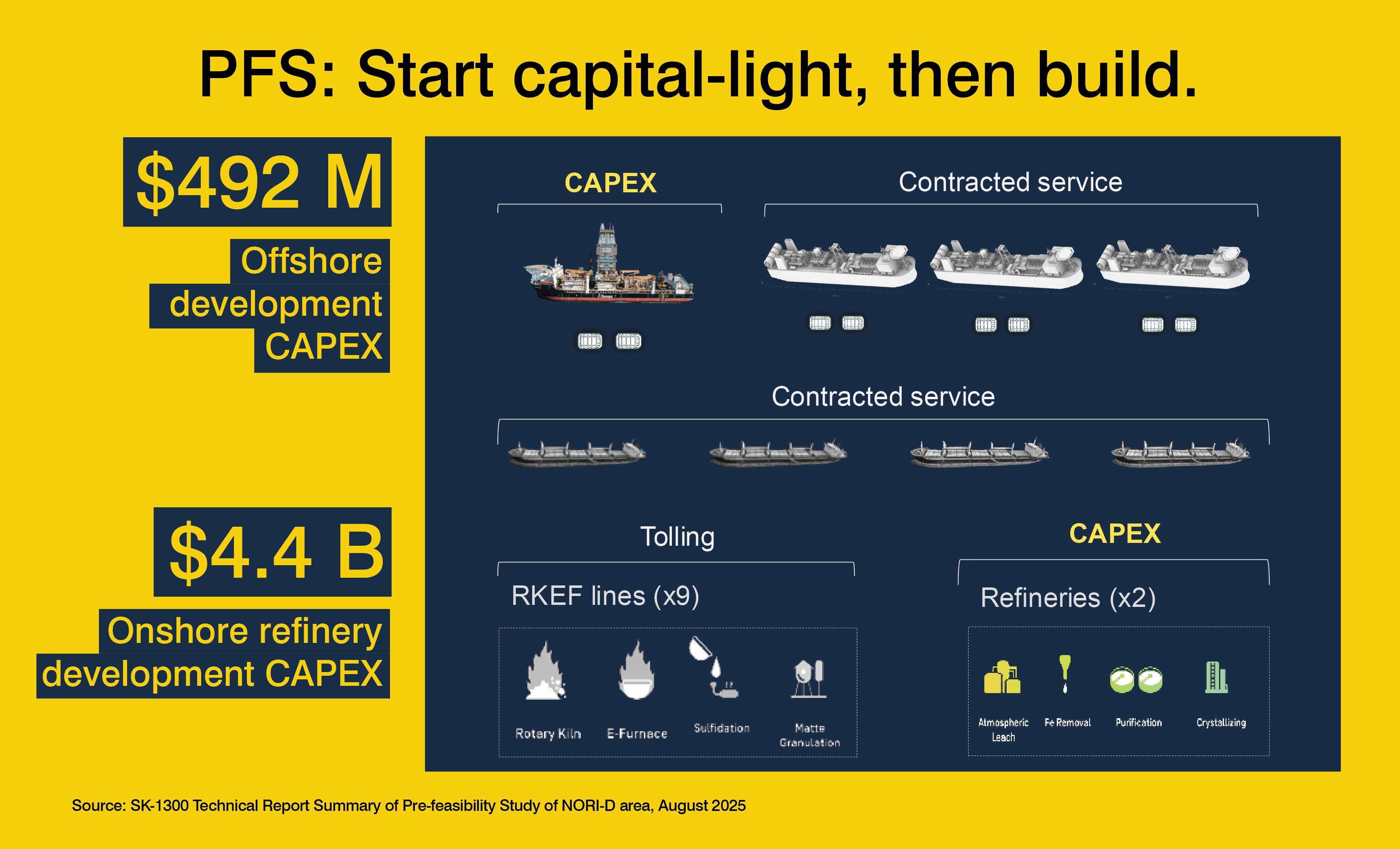

| Total Project Capital excl. Escalation | US$ million | 4,918 (492 Offshore +4,426 US refining) | 8,852 |

| �� | �� | �� | �� |

| Valuation Metrics | �� | �� | �� |

| Price of Nickel Metal | Average US$ per tonne2 | 20,295 | 20,360 |

| Price of Nickel Sulfate | Average US$ per tonne2 | 21,633 | 21,835 |

| Price of Manganese Silicate | Average US$ per dmtu2,3 | 5.45 | 4.71 |

| Price of Copper Cathode | Average US$ per tonne2 | 11,440 | 11,456 |

| Price of Cobalt Metal | Average US$ per tonne2 | 56,117 | 62,530 |

| Price of Cobalt Sulfate | Average US$ per tonne2 | 55,198 | 62,530 |

| Discount Rate | % | 8 | 8 |

| After-Tax Net Present Value (NPV) | US$ billion | 5.508 | 18.081 |

| After-Tax Internal Rate of Return (IRR) | % | 26.8 | 35.6 |

1 Generally Accepted Accounting Principles

2 weighted average based on production schedule and commodity prices

3dmtu: dry metric tonne unit

PFS Technical Report Summary Highlights

NORI-D Project Pre-Feasibility Study Overview

The Pre-Feasibility Study assumes that developing and operating the NORI-D Project is not only commercially and technically achievable but can begin with a capital-light approach by leveraging existing offshore and onshore infrastructure.

The PFS outlines a phased development plan for offshore collection and onshore processing of polymetallic nodules, targeting production ramp-up to 12 million tonnes per annum (Mtpa) of wet nodules within the first five years. This production rate supports a projected 18-year mine life for the NORI-D Project.

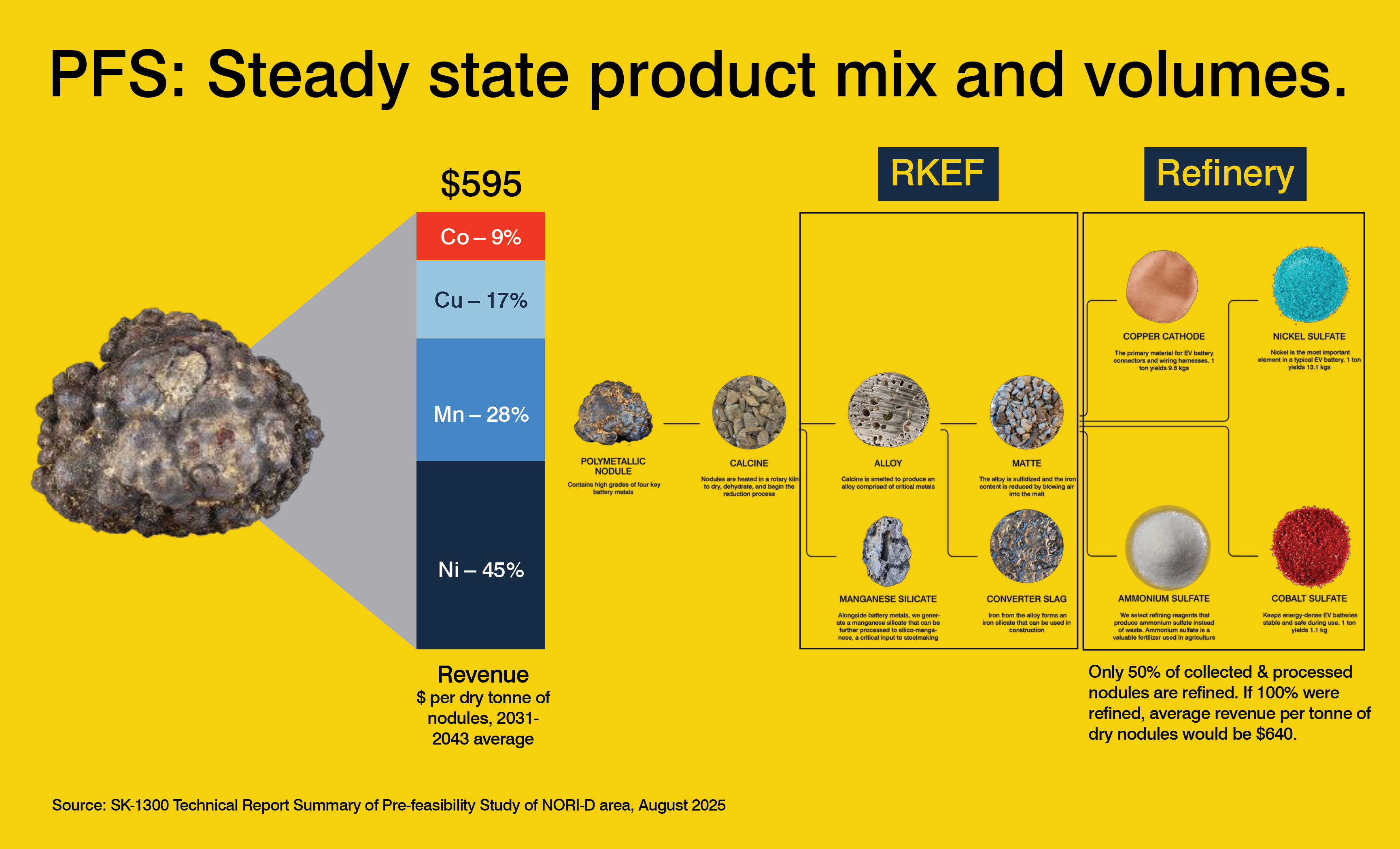

Initial processing is assumed to rely on proven rotary kiln electric furnace (RKEF) infrastructure in Japan and Indonesia to produce nickel-cobalt-copper alloy and matte intermediates, with final refining at future U.S.-based facilities to deliver battery-grade nickel and cobalt products.

With a first-quartile position on the global nickel cost curve, the NORI-D Project is expected to offer strong cost competitiveness. The project's low all-in sustaining costs is enabled by high metallurgical recoveries and the use of existing infrastructure. The efficient, near-zero solid waste process assumed in the PFS underscores the quality of the nodule resource and reinforces TMC’s ability to deliver critical metals responsibly and at scale.

Lean, Focused, Ready: Starting with a Capital-Light Approach

The PFS highlights TMC’s capital-light execution strategy which is designed for speed, scalability, and efficiency. By leveraging proven offshore vessels and established onshore processing plants, through tolling agreements, the PFS assumes the minimization of upfront capital costs to get started while streamlining development timelines and reducing operational risk.

At sea, TMC’s offshore production system is assumed to feature vessels equipped with dual 15-meter-wide collectors, vertical riser and transport systems, and onboard infrastructure for dewatering, storage, and offloading. Each Production Vessel (PV) is would be be paired with a dynamically positioned Transfer Vessel (TV) to maintain continuous operations �� enabling regular offloading of nodules without interrupting collection. Transfer Vessels would then deliver nodules to bulk carriers for shipment to shore, with Support Vessels (SVs) managing refuelling, waste, and crew logistics.

Initial onshore processing is assumed to commence under a 5-year tolling agreement with Pacific Metals Company (PAMCO) utilising existing rotary kiln electric arc furnace facilities at Hachinohe in Japan, allowing for the timely, near-term production of nickel-copper-cobalt alloy and manganese silicate without the need to construct new facilities. It is assumed that PAMCO would process up to 1.3 Mtpa of wet nodules, with TMC expanding capacity through additional tolling partnerships in Indonesia as offshore production volumes ramp up.

Looking ahead, the PFS assumes the construction of two dedicated refining facilities by TMC in the United States. These plants —designed for a combined capacity of 12 Mtpa of wet nodules �� would convert intermediate products into high-purity nickel and cobalt sulfates, and copper cathode. TMC plans to own the facilities, with operations handled by experienced strategic partners, with

The PFS assumes that Allseas �� TMC’s major shareholder and strategic partner �� is expected to lead the offshore delivery of the project, overseeing engineering, procurement, fabrication, commissioning, and operations of the nodule collection system. Logistics support and shipping services are expected to be delivered by third-party contractors, using bulk carriers and support vessels under long-term charter and service agreements.

As part of its capital-light development strategy, TMC is assumed to contribute to the funding of the initial PV and TV with future vessels to be financed by contractors and repaid through long-term operating agreements over a 10-year period. All SVs are expected to be modified to meet operational needs but would remain under the ownership and operation of third-party providers under charter agreements. Similarly, bulk carriers are expected to be owned and operated by third parties, with TMC paying standard shipping rates. Onshore RKEF processing facilities are anticipated to follow a similar model, with third-party ownership and operations under tolling agreements, under which TMC will pay a per-tonne processing fee. Only the future refining facilities in the United States �� assumed to produce battery-grade materials �� are planned to be owned by TMC, with operations and maintenance managed by experienced strategic partners.

Initial Mining Area Holds ~51 Million Tonnes of Probable Mineral Reserves.

Covering approximately

The Mineral Resource estimate for NORI-D exclusive of Mineral Reserves totals approximately 274Mt of wet nodules, classified into Measured, Indicated, and Inferred categories. The resource model excludes areas with slopes greater than 6° and volcanic highs.

The sampling campaigns followed standardized QA/QC protocols, including the use of certified reference materials, blanks, and duplicate assays. The remarkable consistency gives TMC strong confidence that the reported metal grades are not just accurate—but highly representative of what lies on the seafloor.

The Initial Mining Area defining the Probable Mineral Reserves contains approximately

Based on additional high-resolution seafloor imagery and detailed mine planning, the study estimates that a further 113 Mt of wet nodules could be recoverable from NORI-D outside the Initial Mining Area, bringing the total recoverable nodules in NORI-D to 164 Mt. Adjusting for moisture content, that represents an estimated 1.6 Mt of contained nickel�� potentially enough to support the production of batteries for tens of millions of electric vehicles, manufacture specialty alloys for advanced defense systems, or build the backbone of next-generation energy infrastructure.

From Zero to One: Scaling Up to Full Production

The PFS highlights that initial operations could begin in the designated Initial Mining Area, with one, and later two, collectors deployed from the first Production Vessel to reach an early production target of 3 Mtpa of wet nodules. As additional PVs are brought online, the study anticipates that output will ramp up toward an average steady-state capacity of approximately 10.8 Mtpa (wet). The mine plan is designed for flexibility and responsible growth, incorporating real-time environmental monitoring and adaptive management practices. The Company believes this iterative approach allows for continuous refinement of collection paths and operational strategy �� supporting an efficient scale-up while actively managing technical and environmental risks throughout the life of the project.

The PFS��assumes that polymetallic nodules will be collected using self-propelled, tracked vehicles equipped with nozzles that direct a jet of seawater across the tops of the nodules to gently uplift them from the seafloor �� without the need for digging, drilling, or blasting. Inside the collector, nodules are separated from the entrained sediment and excess water before being transported through a 500-meter flexible jumper hose to a riser system engineered by Allseas, which injects compressed air at a depth of 2,500 meters to lift the nodules 4,300 meters to the surface, enabling efficient transport to the production vessel.

Once at the surface, nodules will be dewatered and transferred to the hold of the production vessel, with all remaining seawater and sediment returned into the water column at a depth of 2,000 meters as recommended by independent marine scientists.

Far from a simple blueprint, the NORI-D mine plan is the product of years of advanced modeling, seafloor mapping, and geotechnical analysis. It weaves together exclusion zones for protected reference areas, environmental buffers around sensitive terrain, and slope-avoidance measures to create a meticulously sequenced extraction schedule—one that maximizes the recovery of valuable metals while minimizing disruption to the deep-sea environment. Each elongated mining block is precisely aligned with the natural contours of the seafloor and prevailing current patterns, guided by terabytes of bathymetric and sediment data collected over more than a decade.

Delivering Scalable Processing with Proven Technology

The PFS assumes that the NORI-D Project will employ well-established RKEF technology—commonly used in the processing of nickel laterites—to convert polymetallic nodules into high-value products, including nickel-copper-cobalt alloy and manganese silicate. TMC’s flowsheet would then processes the alloy through sulfidation and converting steps to produce matte, which would be refined using hydrometallurgical techniques into copper cathode, nickel and cobalt sulfates, and fertilizer-grade ammonium sulfate.

By adapting proven industrial technologies for use with a new and abundant feedstock, TMC will pursue a pragmatic and capital-efficient processing path that maximizes metal recovery while minimizing solid waste. The Company believes this approach offers a clear and scalable route to responsibly deliver critical minerals into global supply chains.

*The table below outlines the anticipated steady state product mix and volumes of the wet nodules that would be recovered in the areas subject to the NORI-D Project.

Initial Assessment: Evaluating the Full Scope of TMC’s Resource

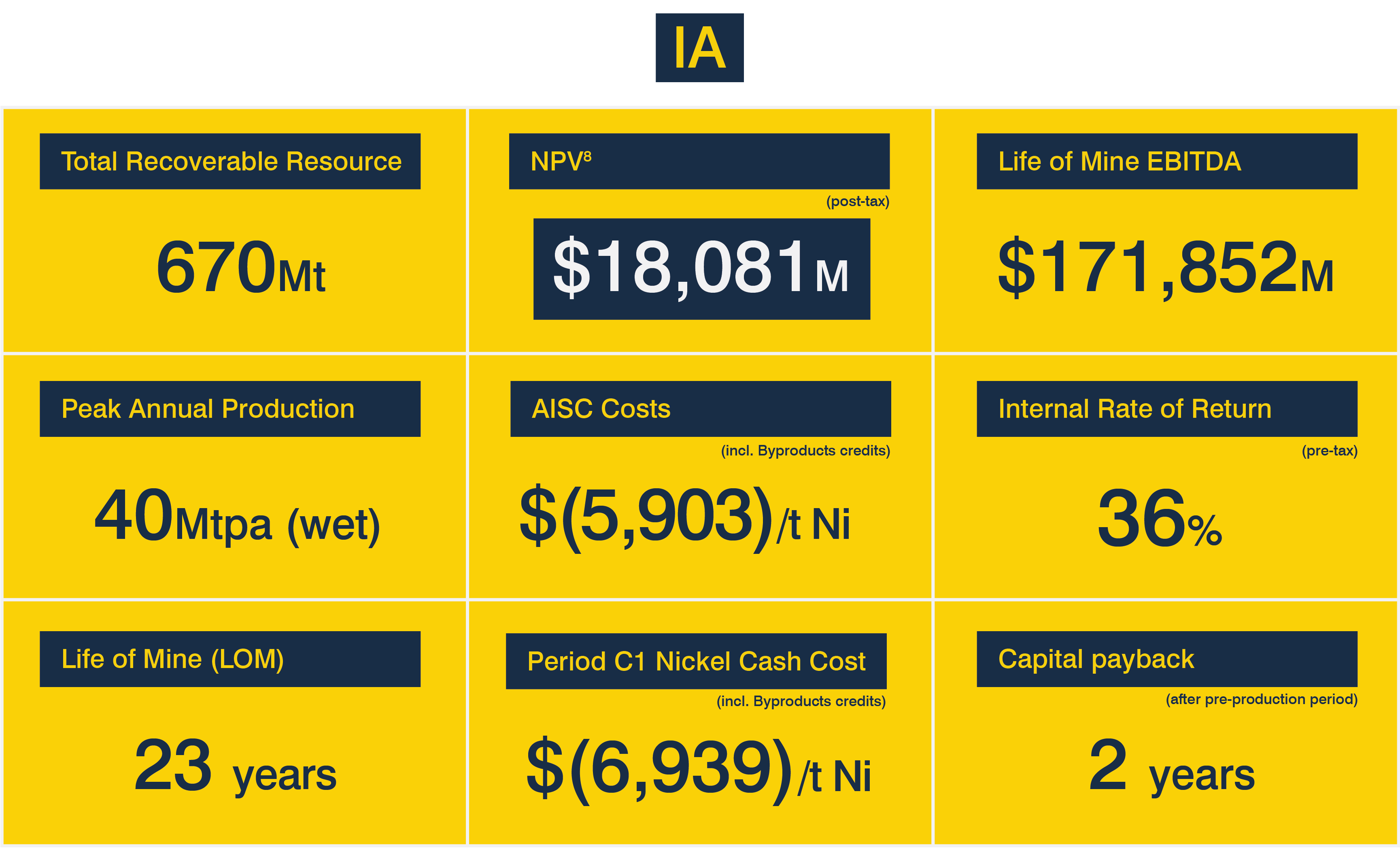

In addition to the PFS, TMC also released an Initial Assessment (IA) outlining the potential of its remaining resource in the TOML and NORI areas outside of NORI-D.

The IA presents a development plan for the NORI and TOML polymetallic nodule projects, encompassing a 23-year mining operation that employs advanced second-generation offshore collection systems with remotely operated Collector Vehicles and Production Vessels.

The IA indicates collection of approximately 670 Mt of wet polymetallic nodules across the NORI and TOML contract areas, with average grades of

*The table below sets forth the anticipated recoverable polymetallic nodules, the anticipated costs, the anticipated revenue, anticipated return and anticipated net project value in the NORI and TOML contract areas, excluding NORI-D

Deploying Next-Gen Systems to Drive the Next Phase of Growth

With a vast and scalable resource opportunity outlined in the Initial Assessment, we believe TMC is setting the stage for future growth. The development plan set out in the IA is preliminary in nature and intended to illustrate a potential scenario for future operations.

Nodules are assumed to be transported to Indonesia for processing into a matte product and manganese silicate through a tolling arrangement utilising existing processing infrastructure. The matte product would then be shipped to Texas on existing bulk carriers for further refining through a new refining facility developed by TMC with support from strategic partners.

Operations are assumed to commence in the TOML-F area with one PV producing 7 Mtpa of wet nodules and commencing in 2037. The IA assumes an additional two PVs would come online in 2038 and 2039 bringing total production from TOML-F to 21 Mtpa (wet). TOML-F is scheduled to be mined before the PVs relocate to the west for collection in other TOML and NORI areas that show lower abundance, reducing the production rate per PV to 5 Mtpa (wet).��

Upon arrival in Indonesia, the IA assumes that nodules would be offloaded from the Transport Vessels and transferred to existing RKEF facilities for processing into a nickel-copper-cobalt matte and manganese silicate product, thereby reducing upfront capital and aligning processing capabilities with the ramp-up of production capacity offshore.

The processed matte would then be loaded to bulk carriers and shipped to Texas. Manganese silicate is planned to be sold to market. The IA refining strategy involves construction of two additional refining facilities (anticipated to be 12 Mtpa wet nodule equivalent nameplate capacity each) in the United States to refine the matte and produce copper cathode, nickel sulfate, and cobalt sulfate.

CAPEX on offshore operations and RKEF facilities are expected to be managed as capital-light, by TMC entering operating agreements with contract miners and transport providers who would manage the collection and delivery of nodules to shore. The IA assumes that bulk carriers running between Indonesia and the United States are expected to be owned and operated by third parties, with TMC paying through standard shipping charges. All processing facilities in Indonesia are assumed to be owned and operated by third parties, with TMC paying for toll treatment per tonne of nodules. The IA assumes that all refining facilities in the U.S. would be TMC assets.

Comparing the PFS and the IA

*The table below summarizes the key findings under the PFS and IA, and presents combined results. The summary does not purport to be complete and is qualified in its entirety by the PFS and IA. Readers are encouraged to read the PFS and IA in their entirety.

About The Metals Company

The Metals Company is a developer of lower-impact critical metals from seafloor polymetallic nodules, on a dual mission: (1) supply metals for energy, defense, manufacturing and infrastructure with net positive impacts compared to conventional production routes and (2) trace, recover and recycle the metals we supply to help create a metal commons that can be used in perpetuity. The Company has conducted more than a decade of research into the environmental and social impacts of offshore nodule collection and onshore processing. More information is available at .

More Info��

Media |

Investors |

Cautionary Statements Regarding the Pre-Feasibility Study and the Initial Assessment

The NORI-D Pre-Feasibility Study and the NORI and TOML Initial Assessment contain forward-looking information derived from preliminary economic assessments and conceptual development scenarios that are subject to significant uncertainty. The report for NORI-D does not represent a feasibility study and does not support a development decision. Similarly, the Initial Assessment of the TOML and NORI is not a declaration of mineral reserves and is not sufficient to determine the economic viability of a mining project. In addition, such Initial Assessment reports inferred mineral resources, which have a high degree of uncertainty as to their existence and to whether they can be economically or legally commercialized, under the SEC rules may not form the basis of an economic analysis and for which you cannot assume any part thereof will ever be upgraded to a higher category. Until mineral deposits are actually mined and processed, mineral resources and mineral reserves must be considered as estimates only. The estimates, projections, and analyses contained in the reports are based on numerous assumptions, including those related to recovery methods, costs, infrastructure, financing, regulatory approvals, and market conditions, many of which are beyond TMC’s control. Actual results may differ materially from those presented. Investors are cautioned not to place undue reliance on these reports and are encouraged to review the full summaries and underlying assumptions.

Forward Looking Statements

This press release contains “forward-looking�� statements and information within the meaning of the Private Securities Litigation Reform Act of 1995 and other applicable U.S. securities laws. These statements may be identified by words such as “believes,�� “could,�� “expects,�� “may,�� “plans,�� “possible,�� “potential,�� “will�� and variations of these words or similar expressions, although not all forward-looking statements contain these words. Forward-looking statements in this press release include, but are not limited to, statements with respect to the results of the Pre-Feasibility Study (PFS) and Initial Assessment (IA), including estimated mine life, project economics, capital and operating cost projections, resource and reserve estimates, expected production volumes, recoveries and grades; TMC’s plans to advance development of the NORI-D Project; the anticipated permitting path under U.S. law; the expected regulatory process with the International Seabed Authority; the feasibility and scalability of TMC’s capital-light execution strategy; the potential timing of commercial production; TMC’s ability to secure strategic partnerships, tolling arrangements, and refining capacity; and TMC’s belief that the PFS and IA support the economic viability and long-term value of its polymetallic nodule resources. TMC may not actually achieve the plans, intentions or expectations disclosed in these forward-looking statements, and you should not place undue reliance on these forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in these forward-looking statements as a result of various factors, including, among other things: risks related to the accuracy of mineral resource and reserve estimates and technical assumptions in the PFS and IA; changes in demand for and prices of critical metals; risks related to TMC’s ability to obtain necessary regulatory approvals, including those from the International Seabed Authority and under the U.S. Deep Seabed Hard Mineral Resources Act (DSHMRA); the outcome and timing of reviews by NOAA or other U.S. government agencies; uncertainties associated with TMC’s dual-path permitting strategy; the availability and performance of future offshore and onshore processing infrastructure; risks related to environmental impacts and the ability to meet evolving environmental standards and obtain required environmental approvals; risks related to financing needs and the availability of capital; TMC’s limited operating history; and other risks and uncertainties, any of which could cause actual results to differ from those expressed or implied in the forward-looking statements. For a discussion of these and other risks and uncertainties, and other important factors, any of which could cause TMC’s actual results to differ materially from those contained in the forward-looking statements, see the section entitled “Risk Factors�� in TMC’s Annual Report on Form 10-K for the year ended December 31, 2024, filed with the U.S. Securities and Exchange Commission (SEC) on March 27, 2025, as well as in TMC’s subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K filed with the SEC. Forward-looking statements are based on current expectations and assumptions and reflect TMC’s views as of the date hereof. TMC undertakes no obligation to update any forward-looking statements contained herein, whether as a result of new information, future events or otherwise, except as required by law.

Photos accompanying this announcement��are available at: