Mako Mining Reports Second Quarter 2025 Financial Results, Including Record Adjusted EBITDA of US$21.3 million, a Record Increase In Cash of US$18.2 million and EPS of US$0.11/share from 11,476 oz Gold Sold at US$3,323/oz

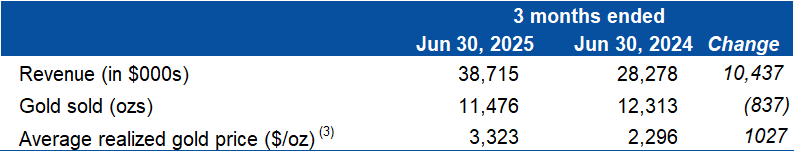

Mako Mining (OTCQX:MAKOF) reported exceptional Q2 2025 financial results, achieving record performance metrics. The company generated $38.7 million in revenue from gold sales, a significant increase from $28.3 million in Q2 2024. Key highlights include record Adjusted EBITDA of $21.3 million, an $18.2 million increase in cash, and earnings per share of $0.11.

The company sold 11,476 ounces of gold at an average price of $3,323 per ounce, with Cash Costs of $1,509 and AISC of $1,668 per ounce sold. Mako demonstrated strong operational efficiency with a Twelve Trailing Months ROE of 33.9% and ROA of 23.5%. The company expects similar production rates for San Albino in H2 2025, with Q4 projected to be a record quarter as mining resumes at Moss Mine.

Mako Mining (OTCQX:MAKOF) ha pubblicato risultati finanziari eccezionali per il secondo trimestre 2025, registrando dati record. La società ha generato 38,7 milioni di dollari di ricavi dalla vendita di oro, in forte aumento rispetto ai 28,3 milioni del Q2 2024. I punti chiave includono un Adjusted EBITDA record di 21,3 milioni di dollari, un incremento di cassa di 18,2 milioni e utili per azione pari a 0,11 dollari.

La società ha venduto 11.476 once d'oro a un prezzo medio di 3.323 dollari per oncia, con Cash Costs di 1.509 dollari e AISC di 1.668 dollari per oncia venduta. Mako ha mostrato elevata efficienza operativa con un ROE su dodici mesi consecutivi del 33,9% e ROA del 23,5%. La società prevede ritmi produttivi simili per San Albino nella seconda metà del 2025, con il quarto trimestre destinato a essere record grazie alla ripresa delle attività alla Moss Mine.

Mako Mining (OTCQX:MAKOF) informó resultados financieros excepcionales en el segundo trimestre de 2025, alcanzando métricas de desempeño récord. La compañía generó 38,7 millones de dólares en ingresos por ventas de oro, un aumento significativo respecto a los 28,3 millones del Q2 2024. Los puntos clave incluyen un Adjusted EBITDA récord de 21,3 millones de dólares, un incremento de efectivo de 18,2 millones y ganancias por acción de 0,11 dólares.

La compañía vendió 11.476 onzas de oro a un precio promedio de 3.323 dólares por onza, con Costos en Efectivo de 1.509 dólares y AISC de 1.668 dólares por onza vendida. Mako demostró una fuerte eficiencia operativa con un ROE de doce meses móviles del 33,9% y ROA del 23,5%. La empresa espera ritmos de producción similares para San Albino en la segunda mitad de 2025, con el cuarto trimestre proyectado como récord al reanudarse la minería en Moss Mine.

Mako Mining (OTCQX:MAKOF)�� 2025�� 2분기�� 뛰어�� 실적�� 보고하며 기록적인 성과�� 달성했습니다. 회사�� �� 판매�� 3,870�� 달러�� 매출�� 올려 2024�� 2분기�� 2,830�� 달러에서 크게 증가했습니다. 주요 내용으로�� 조정 EBITDA(Adjusted EBITDA) 사상 최대�� 2,130�� 달러, 현금 1,820�� 달러 증가, 주당순이�� 0.11달러가 포함됩니��.

회사�� 평균 가�� 온스�� 3,323달러�� 11,476온스�� ���� 판매했으��, 현금 비용(Cash Costs)은 온스�� 1,509달러, AISC�� 온스�� 1,668달러였습니��. Mako�� 과거 12개월 기준 자기자본이익��(ROE) 33.9%, 총자산이익률(ROA) 23.5%�� 높은 운영 효율성을 입증했습니다. 회사�� 2025�� 하반�� San Albino�� 생산 수준�� 비슷�� 것으�� 예상하며, Moss Mine�� 채굴 재개�� 4분기�� 사상 최대 분기가 �� 것으�� 전망합니��.

Mako Mining (OTCQX:MAKOF) a publié des résultats financiers exceptionnels pour le deuxième trimestre 2025, atteignant des indicateurs de performance record. La société a généré 38,7 millions de dollars de revenus provenant des ventes d'or, en nette hausse par rapport à 28,3 millions au T2 2024. Les points clés incluent un EBITDA ajusté record de 21,3 millions de dollars, une augmentation de trésorerie de 18,2 millions et un bénéfice par action de 0,11 dollar.

La société a vendu 11 476 onces d'or à un prix moyen de 3 323 dollars par once, avec des coûts cash de 1 509 dollars et un AISC de 1 668 dollars par once vendue. Mako a démontré une forte efficacité opérationnelle avec un ROE sur douze mois glissants de 33,9% et un ROA de 23,5%. L'entreprise prévoit des niveaux de production similaires pour San Albino au second semestre 2025, le quatrième trimestre devant être record avec la reprise de l'exploitation de la Moss Mine.

Mako Mining (OTCQX:MAKOF) meldete herausragende Finanzergebnisse für das zweite Quartal 2025 und erreichte Rekordkennzahlen. Das Unternehmen erzielte 38,7 Mio. USD Umsatz aus Goldverkäufen, ein deutlicher Anstieg gegenüber 28,3 Mio. USD im Q2 2024. Zu den Highlights zählen ein rekordverdächtiges bereinigtes EBITDA von 21,3 Mio. USD, ein Barmittelanstieg von 18,2 Mio. USD und ein Ergebnis je Aktie von 0,11 USD.

Das Unternehmen verkaufte 11.476 Feinunzen Gold zu einem Durchschnittspreis von 3.323 USD pro Unze, mit Cash Costs von 1.509 USD und AISC von 1.668 USD pro verkaufter Unze. Mako zeigte hohe operative Effizienz mit einer ROE über zwölf aufeinanderfolgende Monate von 33,9% und ROA von 23,5%. Für H2 2025 erwartet das Unternehmen ähnliche Produktionsraten bei San Albino, wobei das vierte Quartal als Rekordquartal prognostiziert wird, da der Abbau in der Moss Mine wieder aufgenommen wird.

- Record Adjusted EBITDA of $21.3 million in Q2 2025

- Revenue increased to $38.7 million, up from $28.3 million in Q2 2024

- Strong profitability with $8.8 million Net Income and $0.11 EPS

- Impressive TTM Return on Equity of 33.9% and Return on Assets of 23.5%

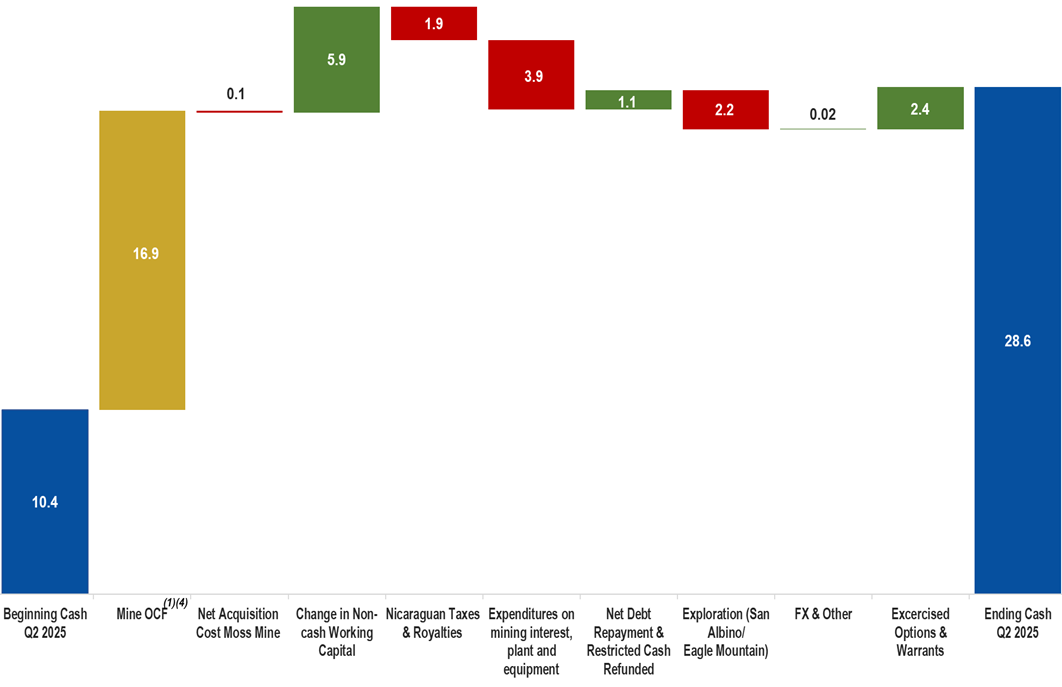

- Record $18.2 million increase in cash position

- Q4 2025 expected to be a record quarter for the company

- Mining at Moss Mine was delayed due to equipment delays from contractor

- Second half of 2025 performance heavily weighted towards Q4, indicating potential volatility

- Acquired Elevation Gold Mining Corporation's debt with expected recoveries significantly below face value

VANCOUVER, BRITISH COLUMBIA / / August 22, 2025 / Mako Mining Corp. (TSX-V:MKO)(OTCQX:MAKOF) ("Mako" or the "Company") is pleased to provide financial results for the three and six months ended June 30, 2025 ("Q2 2025"). All dollar amounts referred to herein are expressed in United States dollars unless otherwise stated.

The Company's financial results for Q2 2025 reflect record gold sales from its San Albino and Moss Mine of

Q2 2025 Mako Mining Highlights

Financial

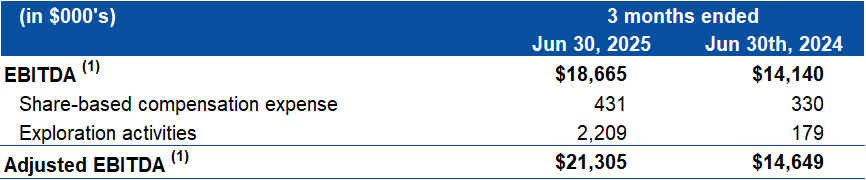

$38.7 million in Revenue$16.9 million in Mine Operating Cash Flow ("MineOCF") (1) (4)$21.3 million in Adjusted EBITDA (1)$18.2 million increase in cash$8.8 million Net Income$1,509 Cash Costs ($/oz sold) (1) (2)$1,668 All-In Sustaining Costs ("AISC") ($/oz sold) (1) (2)Twelve Trailing Months ("TTM") Return on Equity ("ROE") (1) of

33.9% and Return on Assets ("ROA") of23.5% (1)Delivered final installment of 13,500 oz of silver in Q2 2025 to the Sailfish Silver Loan

Growth

$2.2 million in exploration and evaluation expenses ($0.4 million San Albino and Las Conchitas,$0.5 million exploration in El Jicaro Concession in Nicaragua and, approximately,$1.1 million at Eagle Mountain, Guyana)

Subsequent to June 30th, 2025

The Company made interest payments of

$0.3 million on the Revised Wexford Loan.On July 2, 2025, the Company acquired for

$1.8 million the secured indebtedness of Elevation Gold Mining Corporation from Maverix Metals Inc. under Elevation's ongoing CCAA proceedings As principal secured creditor, Mako is now entitled to distributions under the CCAA process, though expected recoveries will be significantly below the debt's face value.

Akiba Leisman, Chief Executive Officer, states that "Q2 was another strong quarter for Mako, with record Adjusted EBITDA of US

Table 1 - Revenue Mako Mining Corp.

Table 2 - Operating San Albino and Financial Data Mako Mining Corp.

Table 3 - EBITDA Reconciliation

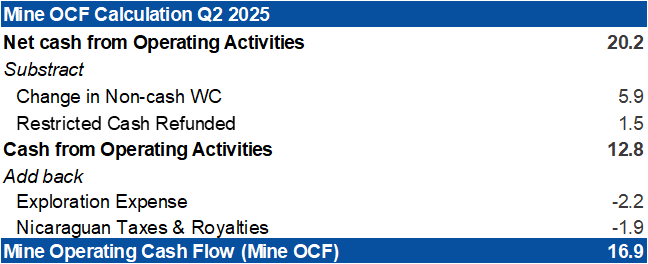

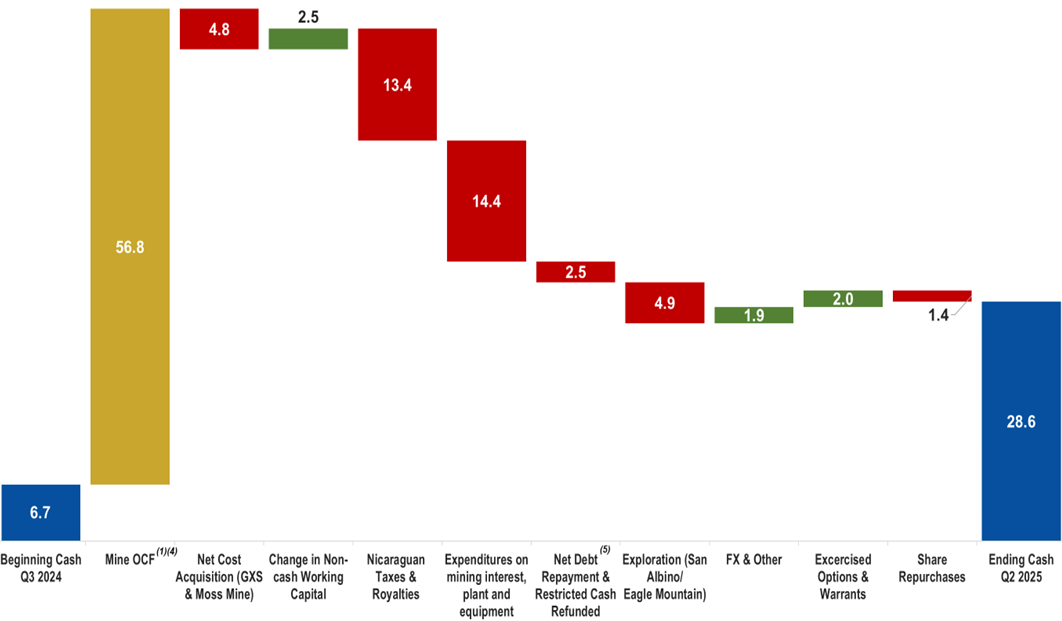

Chart 1

Q2 2025 - Mine OCF Calculation and Cash Reconciliation (in $ million)

Chart 2

Twelve Trailing Months (TTM) - Mine OCF Calculation and Cash Reconciliation (in $ million)

End Notes

Refers to a Non-GAAP financial measure within the meaning of National Instrument 52-112 - Non-GAAP and Other Financial Measures Disclosure ("NI 52-112"). Refer to information under the heading "Non-GAAP Measures" as well as the reconciliations later in this press release.

Refers to a Non-GAAP ratio within the meaning of NI-52-112. Refer to information under the heading "Non-GAAP Measures" later in this press release.

AG���˹ٷ�ized price before deductions from Sailfish gold streaming agreement.

Refer to "Chart 1 & 2 - Mine OCF Calculation and Cash Reconciliation (in $ millions)" for a reconciliation of the beginning and ending cash position of the Company, including OCF.

Includes Repayment Silver Loan, Wexford Loan, Wexford Bridge Loan related to Goldsource Acquisition, other lease payments and a release of US

$1.5 million from Trisura Guarantee insurance Company held as collateral for various environmental bonds held at the Moss Mine

For complete details, please refer to condensed interim consolidated financial statements and the associated management discussion and analysis for the three and six months ended June 30, 2025, available on SEDAR+ () or on the Company's website ().

Non-GAAP Measures

The Company has included certain non-GAAP financial measures and non-GAAP ratios in this press release such as EBITDA, Adjusted EBITDA, Mine Operating Cash Flow cash cost per ounce sold, total cash cost per ounce sold, AISC per ounce sold. These non-GAAP measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. In the gold mining industry, these are commonly used performance measures and ratios, but do not have any standardized meaning prescribed under IFRS and therefore may not be comparable to other issuers. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company's underlying performance of its core operations and its ability to generate cash flow.

"EBITDA" represents earnings before interest (including non-cash accretion of financial obligation and lease obligations), income taxes and depreciation, depletion and amortization.

"Adjusted EBITDA" represents EBITDA, adjusted to exclude exploration activities, share-based compensation and change in provision for reclamation and rehabilitation.

"Cash costs per ounce sold" is calculated by deducting revenues from silver sales and dividing the sum of mining, milling and mine site administration cost.

"AISC per ounce sold" includes total cash costs (as defined above) and adds the sum of G&A, sustaining capital and certain exploration and evaluation ("E&E") costs, sustaining lease payments, provision for environmental fees, if applicable, and rehabilitation costs paid, all divided by the number of ounces sold. As this measure seeks to reflect the full cost of gold production from current operations, capital and E&E costs related to expansion or growth projects are not included in the calculation of AISC per ounce. Additionally, certain other cash expenditures, including income and other tax payments, financing costs and debt repayments, are not included in AISC per ounce.

"Mine OCF" represents operating cash flow, excluding Nicaraguan taxes and royalties, changes in non-cash working capital and exploration expense

"ROE" is calculated by dividing the twelve trailing months Net Income by the average shareholder's equity. The average shareholder's equity is calculated by adding the total equity at the end of the period to the total equity at the beginning of the period and dividing by two.

"ROA" is calculated by dividing the twelve trailing months Net Income by the average total assets. The average total assets is calculated by adding the total assets at the end of the period to the total assets at the beginning of the period and dividing by two.

On behalf of the Board,

Akiba Leisman

Chief Executive Officer

About Mako

Mako Mining Corp. is a publicly listed gold mining, development and exploration company. The Company operates the high-grade San Albino gold mine in Nueva Segovia, Nicaragua, which ranks as one of the highest-grade open pit gold mines globally and offers district-scale exploration potential. In addition, Mako also owns the Moss Mine in Arizona, an open pit gold mine in northwestern Arizona. Mako also holds a

For further information on Mako Mining Corp., contact Akiba Leisman, Chief Executive Officer, Telephone: 917-558-5289, E-mail: [email protected] or visit our website at and the Company's profile on the SEDAR+ website at .

Forward-Looking Information: Some of the statements contained herein may be considered "forward-looking information" within the meaning of applicable securities laws. Forward-looking information can be identified by words such as, without limitation, "estimate", "project", "believe", "anticipate", "intend", "expect", "plan", "predict", "may" or "should" or variations thereon or comparable terminology. The forward-looking information contained herein reflects the Company's current beliefs and expectations, based on management's reasonable assumptions, and includes, without limitation, management's expectation that the Moss mine will be a substantial cash flowing mine when full scale mining operations begin in September 2025 and the expectation that 2025 will show the results from the work performed by the Company in 2024. Such forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking information, including, without limitation, changes in the Company's exploration and development plans and growth parameters and its ability to fund its growth to reach its expected new record production numbers; unanticipated costs; the October 24, 2022 measures having impacts on business operations not currently expected, or new sanctions being imposed by the U.S. Treasury Department or other government entity in Nicaragua in the future; and other risks and uncertainties as disclosed in the Company's public disclosure filings on SEDAR+ at www.sedarplus.ca. Such information contained herein represents management's best judgment as of the date hereof, based on information currently available and is included for the purposes of providing investors with information regarding the Company's Q2 2025 and full year 2024 financial results and may not be appropriate for other purposes. Mako does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Mako Mining Corp.

View the original on ACCESS Newswire