Mako Mining Announces Q2 2025 Production Results Generating Record Gold Revenue of US$38.1 million and an Increase in Cash of US$18.2 million

Mako Mining (OTCQX:MAKOF) reported strong Q2 2025 production results, achieving record gold revenue of $38.1 million. The company's San Albino gold mine in Nicaragua produced 10,104 oz of gold sold at $3,323 per ounce, while the Moss Mine contributed 1,372 oz from residual leaching.

Key operational metrics at San Albino include 54,354 tonnes mined at 6.24 g/t Au grade, 52,705 tonnes milled with 80.3% gold recovery, and mill throughput of 595 tonnes per day at 97% availability. The company's cash position increased significantly to $28.6 million, up $18.2 million from the previous quarter.

Additionally, Mako is advancing its Eagle Mountain project in Guyana, with environmental and engineering studies underway, and plans to restart mining operations at the Moss Mine in early Q3 2025.

Mako Mining (OTCQX:MAKOF) ha riportato risultati di produzione solidi nel secondo trimestre 2025, raggiungendo un ricavo record dall'oro di 38,1 milioni di dollari. La miniera d'oro San Albino in Nicaragua ha prodotto 10.104 once d'oro vendute a 3.323 dollari per oncia, mentre la miniera Moss ha contribuito con 1.372 once provenienti da lisciviazione residua.

I principali dati operativi di San Albino includono 54.354 tonnellate estratte con una qualità di 6,24 g/t Au, 52.705 tonnellate lavorate con un recupero dell'oro dell'80,3% e una capacità di lavorazione di 595 tonnellate al giorno con una disponibilità del 97%. La posizione di cassa della società è aumentata significativamente a 28,6 milioni di dollari, in crescita di 18,2 milioni rispetto al trimestre precedente.

Inoltre, Mako sta portando avanti il progetto Eagle Mountain in Guyana, con studi ambientali e ingegneristici in corso, e prevede di riavviare le operazioni minerarie presso la miniera Moss all'inizio del terzo trimestre 2025.

Mako Mining (OTCQX:MAKOF) reportó sólidos resultados de producción en el segundo trimestre de 2025, alcanzando un ingreso récord por oro de 38,1 millones de dólares. La mina de oro San Albino en Nicaragua produjo 10.104 onzas de oro vendidas a 3.323 dólares por onza, mientras que la mina Moss aportó 1.372 onzas provenientes de lixiviación residual.

Las métricas operativas clave en San Albino incluyen 54.354 toneladas extraídas con una ley de 6,24 g/t Au, 52.705 toneladas procesadas con una recuperación de oro del 80,3% y una capacidad de procesamiento de 595 toneladas diarias con un 97% de disponibilidad. La posición de efectivo de la compañía aumentó significativamente a 28,6 millones de dólares, un incremento de 18,2 millones respecto al trimestre anterior.

Además, Mako está avanzando en su proyecto Eagle Mountain en Guyana, con estudios ambientales e ingenieriles en curso, y planea reiniciar las operaciones mineras en la mina Moss a principios del tercer trimestre de 2025.

Mako Mining (OTCQX:MAKOF)�� 2025�� 2분기 생산 실적에서 강력�� 성과�� 보고하며 사상 최대 �� 매출 3,810�� 달러�� 달성했습니다. 니카라과�� 위치�� San Albino 금광은 10,104 온스�� ���� 생산하여 온스�� 3,323달러�� 판매했으��, Moss 광산은 잔류 침출에서 1,372 온스�� 기여했습니다.

San Albino�� 주요 운영 지표는 54,354�� 채굴�� �� 함량 6.24 g/t, 52,705�� 제련�� �� 회수�� 80.3%, 그리�� 97% 가동률�� 일일 595�� 처리량을 기록했습니다. 회사�� 현금 보유액은 �� 분기 대�� 1,820�� 달러 증가�� 2,860�� 달러�� 크게 늘어났습니다.

또한, Mako�� 가이아나의 Eagle Mountain 프로젝트�� 진행 중이�� 환경 �� 엔지니어�� 연구가 진행 중이��, 2025�� 3분기 초에 Moss 광산�� 채굴 작업 재개�� 계획하고 있습니다.

Mako Mining (OTCQX:MAKOF) a annoncé de solides résultats de production pour le deuxième trimestre 2025, atteignant un chiffre d'affaires record en or de 38,1 millions de dollars. La mine d'or San Albino au Nicaragua a produit 10 104 onces d'or vendues à 3 323 dollars l'once, tandis que la mine Moss a contribué avec 1 372 onces issues de la lixiviation résiduelle.

Les indicateurs opérationnels clés à San Albino incluent 54 354 tonnes extraites avec une teneur en or de 6,24 g/t, 52 705 tonnes broyées avec un taux de récupération de l'or de 80,3 %, et un débit d'usine de 595 tonnes par jour avec une disponibilité de 97 %. La trésorerie de l'entreprise a augmenté de manière significative pour atteindre 28,6 millions de dollars, soit une hausse de 18,2 millions par rapport au trimestre précédent.

De plus, Mako fait avancer son projet Eagle Mountain en Guyane, avec des études environnementales et d'ingénierie en cours, et prévoit de relancer les opérations minières à la mine Moss au début du troisième trimestre 2025.

Mako Mining (OTCQX:MAKOF) meldete starke Produktionsergebnisse für das zweite Quartal 2025 und erzielte einen rekordverdächtigen Goldumsatz von 38,1 Millionen US-Dollar. Die Goldmine San Albino in Nicaragua produzierte 10.104 Unzen Gold, verkauft zu 3.323 US-Dollar pro Unze, während die Moss-Mine 1.372 Unzen aus Restlaugung beisteuerte.

Wichtige Betriebskennzahlen in San Albino umfassen 54.354 Tonnen abgebaut mit einem Goldgehalt von 6,24 g/t, 52.705 Tonnen verarbeitet mit einer Goldrückgewinnung von 80,3 % und einer Anlagenkapazität von 595 Tonnen pro Tag bei 97 % Verfügbarkeit. Die Barposition des Unternehmens stieg deutlich auf 28,6 Millionen US-Dollar, ein Anstieg um 18,2 Millionen gegenüber dem Vorquartal.

Zusätzlich treibt Mako sein Eagle Mountain-Projekt in Guyana voran, mit laufenden Umwelt- und Ingenieurstudien, und plant, den Abbau in der Moss-Mine Anfang des dritten Quartals 2025 wieder aufzunehmen.

- Record quarterly revenue of $38.1 million from gold sales

- Strong realized gold price of $3,323 per ounce

- Cash position increased by $18.2 million to $28.6 million

- Mill throughput 19% above nameplate capacity at 595 tpd

- High mill availability of 97%

- Substantial stockpile of 127,897 tonnes at 2.52 g/t Au

- High strip ratio of 38.3:1 at San Albino

- Gold recovery rate of 80.3% shows room for improvement

VANCOUVER, BRITISH COLUMBIA / / July 14, 2025 / Mako Mining Corp. (TSX-V:MKO)(OTCQX:MAKOF) ("Mako" or the "Company") is pleased to provide second quarter 2025 ("Q2 2025") production results for the Company's San Albino gold mine ("San Albino") in northern Nicaragua, the Moss Mine in Arizona and an update on the Eagle Mountain gold project in Guyana. Certain amounts shown in this news release may not total to exact amounts due to rounding differences. All amounts expressed in U.S. dollars unless otherwise noted.

Q2 2025 San Albino Operational Highlights

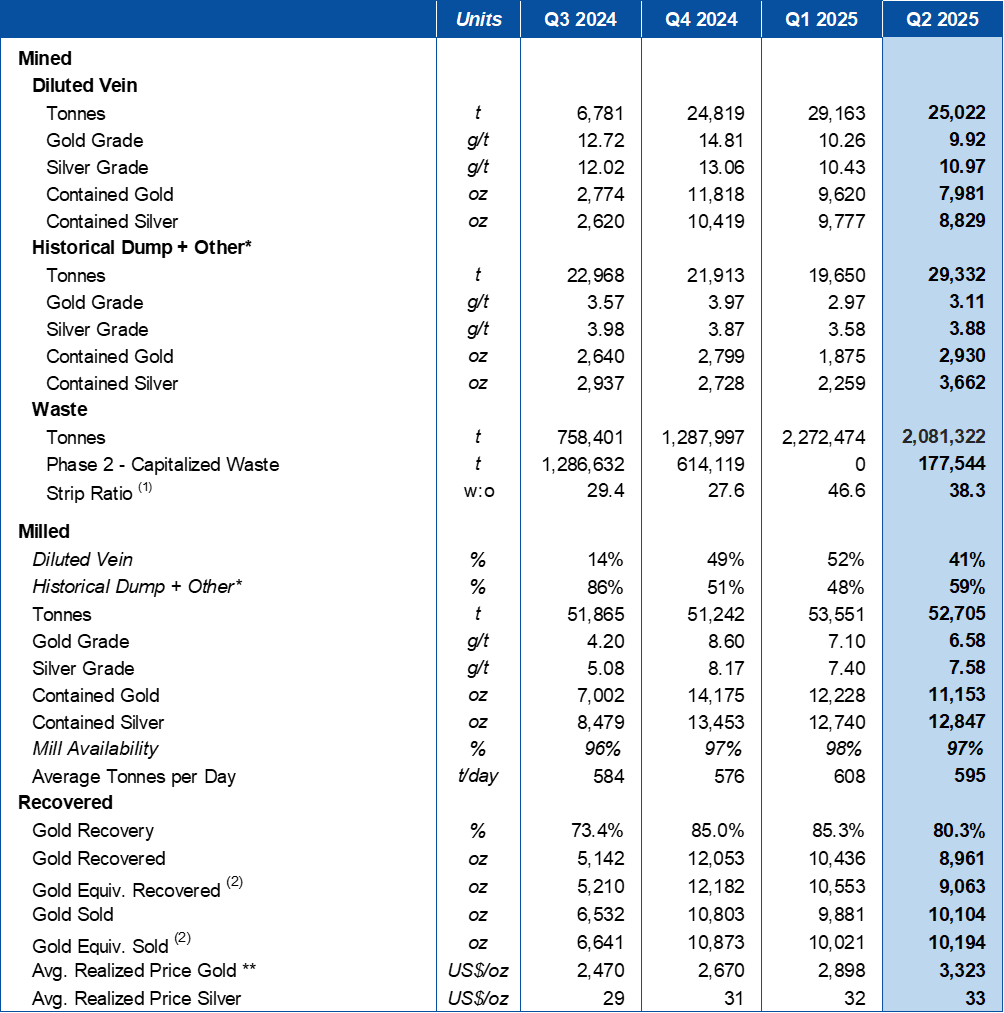

54,354 tonnes mined, containing 10,911 ounces ("oz") of gold ("Au") at an average grade of 6.24 grams per tonne ("g/t") Au and 12,491 oz of silver ("Ag") at 7.15 g/t Ag

25,022 tonnes mined from diluted vein material containing 7,981 oz Au at 9.92 g/t Au and 8,829 oz Ag at 10.97 g/t Ag

29,332 tonnes mined from historical dump and other mineralized material above cutoff grade ("historical dump + other") containing 2,930 oz Au at 3.11 g/t Au and 3,662 oz Ag at 3.88 g/t Ag

38.3:1 strip ratio (1)

52,705 tonnes milled containing 11,153 oz Au and 12,847 oz Ag grading 6.58 g/t Au and 7.58 g/t Ag

41% and59% from diluted vein and historical dump and other, respectively595tonnes per day ("tpd") milled at

97% availabilityMill recovery of

80.3% for gold

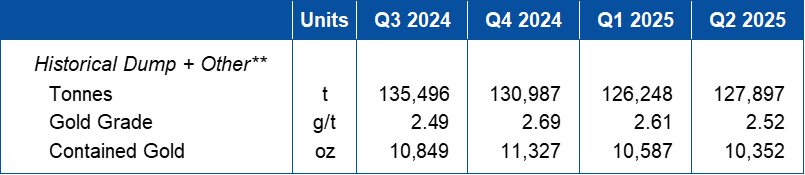

At quarter end, the stockpile was estimated at 127,897 tonnes at an average grade of 2.52 g/t Au for contained Au of 10,352 oz

Q2 2025 Mako Financial Highlights

Mako total gold sales of 11,476 oz Au for total revenue of

$38.1 million in Q2 2025San Albino Mine sales of 10,104 oz Au at

$3,323 per ounceMoss Mine sales of 1,372 oz Au from residual leaching activities at

$3,321 per ounce

Delivered final 13,500 oz silver payment to Sailfish Silver Loan for a total of

$0.4 million in Q2 2025$1.5 million release of collateral at Moss Mine from Trisura Guarantee Insurance CompanyCash Balance of

$28.6 million as of June 30th, 2025

Akiba Leisman, Chief Executive Officer of Mako states that "in Q2 2025 we generated US

Table 1 - Operating Results for San Albino

* Includes historical dump, hanging wall, footwall, historical muck and all other non-vein mineralized material above cutoff grade.

**For the purpose of calculating revenue, payments to Sailfish are deducted from the Average AG���˹ٷ�ized Price Gold.

(1) Strip Ratio calculation does not include waste material that is capitalized

(2) Equivalent Gold ounces are calculated by: Silver recovered. or Silver sold (oz) / Avg. AG���˹ٷ�ized Price Gold ($/oz) / Avg. AG���˹ٷ�ized Price Silver ($/oz)

Table 2 - San Albino Quarter-End Stockpile Statistics

** Includes historical dump, hanging wall, footwall, historical muck and all other non-vein mineralized material above cutoff grade.

Mining at San Albino

In Q2 2025, the mine produced an average of 597 tonnes per day of diluted vein, historical dump and other material. The average strip ratio (which excludes capitalized waste material) was 38.3:1. The Diluted vein material was sourced from six different veins: Las Conchitas South (Bayacun-Limon-Mango

Milling at San Albino

During Q2 2025, the plant throughput rate averaged 595 tpd,

Moss Mine

In Q2 2025, residual leaching continued at the Moss Mine, with gold sales of 1,372 oz. The Company engaged a new mining contractor on June 10th with the mine receiving an initial delivery of mining equipment with the full fleet expected to arrive by early August. There are currently over 80,000 tonnes of material already blasted that are waiting to be excavated, hauled and crushed through the fully refurbished 10,000 tonnes per day plant. The Company expects to restart mining operations in early Q3 2025, with steady state production expected by the end of the year.

Eagle Mountain Gold Project

The H1 2025 work program included engineering and environmental activities to confirm mine design parameters and to generate the baseline environmental data and other studies required to complete an Environmental Impact Assessment ("EIA") for submission to the Guyana Environmental Protection Agency ("EPA"). The Company anticipates submission of the draft EIS to the EPA in H2 2025.

Phase 2 geotechnical activities, which commenced in Q1 2025, comprised drilling and testing of the saprolite and underlying fresh rock to facilitate infrastructure siting studies and site hydrogeological drilling and hydrology testing to generate data for both pit optimization and water resource management studies. H1 2025 activities also included environmental geochemical testing of water, soils, and rock and metallurgical tests to produce representative tailings samples for environmental modelling.

In March, the Company advanced permitting efforts for the Eagle Mountain Project with the submission of comprehensive Environmental Application and Project Summary documents to the Guyana EPA, marking a critical step in the regulatory approval process. Subsequently, in May, Mako hosted EPA officials at the Eagle Mountain site.

On behalf of the Board,

Akiba Leisman

Chief Executive Officer

Qualified Person

John Rust, a metallurgical engineer and qualified person (as defined under NI 43-101) has read and approved the technical information contained in this press release. Mr. Rust is a senior metallurgist and a consultant to the Company.

About Mako

Mako Mining Corp. is a publicly listed gold mining, development and exploration company. The Company operates the high-grade San Albino gold mine in Nueva Segovia, Nicaragua, which ranks as one of the highest-grade open pit gold mines globally and offers district-scale exploration potential. Mako also owns the Moss Mine in Arizona, an open pit gold mine in northwestern Arizona. Mako also holds a

For further information: Mako Mining Corp., Akiba Leisman, Chief Executive Officer, Telephone: 917-558-5289, E-mail: [email protected] or visit our website at and SEDAR .

Forward-Looking Information: Statements contained herein, other than historical fact, may be considered "forward-looking information" within the meaning of applicable securities laws. The forward-looking information contained herein is based on the Company's plans and expectations and assumptions as of the date such statements forward looking statements include that: expectations stated regarding Q2 and Q3 2025 production at San Albino, expected timing for the submission of the EIS to the Guyana EPA. Such forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking information, including, without limitation; that production results in Q2 and Q3 2025 will not meet expectations; that the EIS will not be submitted on the timeline expected; uncertainty related to mining exploration properties; political risks and uncertainties involving the Company's mineral properties; the inherent uncertainty of cost estimates and the potential for unexpected costs and expense; commodity price fluctuations and other risks and uncertainties as disclosed in the Company's public disclosure filings on SEDAR+ at www.sedarplus.ca. Such information contained herein represents management's best judgment as of the date hereof, based on information currently available and is included for the purposes of providing investors with the Company's expectations regarding the Company's Q2 2025 production and operating results at San Albino gold project, financial highlights for Q2 2025 and current corporate updates, and may not be appropriate for other purposes. Mako does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Mako Mining Corp.

View the original on ACCESS Newswire