IREN July 2025 Monthly Update

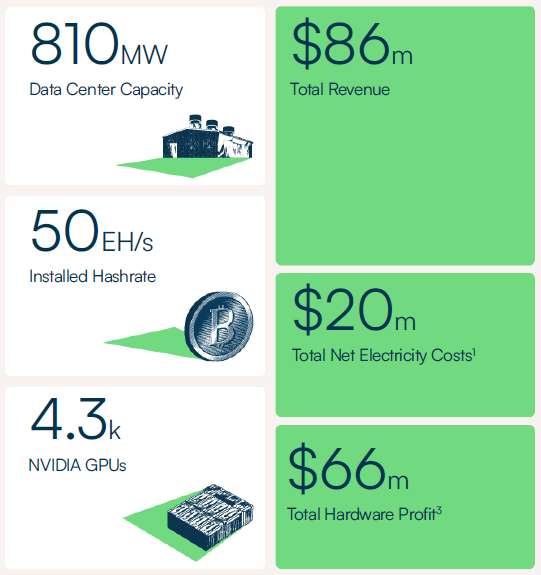

IREN (NASDAQ: IREN) reported strong performance in July 2025, achieving record monthly revenue of $86 million and hardware profits of $66 million. The company's Bitcoin mining operations reached an average hashrate of 45.4 EH/s, mining 728 BTC with a 76% hardware profit margin.

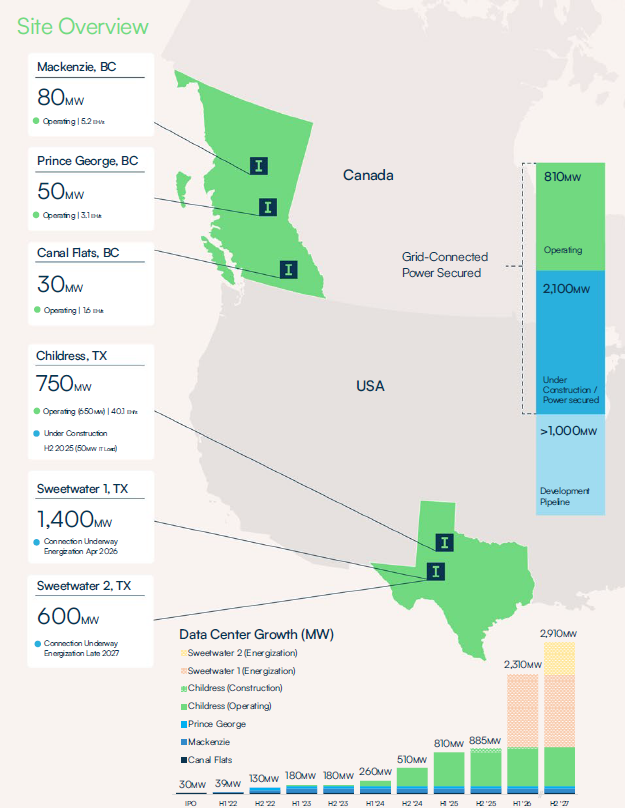

The company's AI Cloud expansion continues with 2.4k NVIDIA B200/B300 GPUs, with the initial B200 shipment already contracted. IREN's infrastructure development includes the 50MW Horizon 1 liquid-cooled AI data center on track for Q4'25 completion and progress on the 1,400MW Sweetwater 1 facility. The Mackenzie facility upgrade enhanced network redundancy with dual fiber paths.

[ "Record monthly revenue of $86 million and hardware profits of $66 million", "Bitcoin mining hardware profit margin increased to 76% with 728 BTC mined", "AI Cloud Services showing 98% hardware profit margin with $28M annualized run-rate revenue", "Successful procurement and contracting of initial 256 NVIDIA B200 GPUs", "Infrastructure expansion progressing with 50MW Horizon 1 and 1,400MW Sweetwater 1 developments", "Enhanced network redundancy with dual fiber paths at Mackenzie facility" ]IREN (NASDAQ: IREN) ha registrato una performance eccezionale a luglio 2025, raggiungendo un fatturato mensile record di 86 milioni di dollari e profitti hardware di 66 milioni di dollari. Le operazioni di mining di Bitcoin dell'azienda hanno raggiunto una hashrate media di 45,4 EH/s, con l'estrazione di 728 BTC e un margine di profitto hardware del 76%.

L'espansione del cloud AI continua con 2.4k GPU NVIDIA B200/B300, con la prima spedizione di B200 già contrattualizzata. Lo sviluppo infrastrutturale di IREN include il data center AI Horizon 1 da 50MW raffreddato a liquido, previsto per il completamento nel Q4 2025, e i progressi sull'impianto Sweetwater 1 da 1.400MW. L'aggiornamento della struttura Mackenzie ha migliorato la ridondanza della rete con percorsi in fibra ottica doppi.

IREN (NASDAQ: IREN) reportó un desempeño sólido en julio de 2025, alcanzando ingresos mensuales récord de 86 millones de dólares y ganancias por hardware de 66 millones de dólares. Las operaciones de minería de Bitcoin de la empresa alcanzaron una tasa de hash promedio de 45,4 EH/s, minando 728 BTC con un margen de ganancia de hardware del 76%.

La expansión del Cloud AI continúa con 2.4k GPUs NVIDIA B200/B300, con el primer envío de B200 ya contratado. El desarrollo de infraestructura de IREN incluye el centro de datos AI Horizon 1 de 50MW refrigerado por líquido en camino a completarse en el cuarto trimestre de 2025 y avances en la planta Sweetwater 1 de 1,400MW. La actualización de la instalación Mackenzie mejoró la redundancia de la red con caminos de fibra dual.

IREN (NASDAQ: IREN)은 2025�� 7월에 강력�� 실적�� 기록하며 월간 매출 8600�� 달러와 하드웨어 이익 6600�� 달러�� 달성했습니다. 회사�� 비트코인 채굴 운영은 평균 해시레이�� 45.4 EH/s�� 기록하며 728 BTC�� 채굴했고, 하드웨어 이익률은 76%�� 달했습니��.

회사�� AI 클라우드 확장은 2.4�� 대�� NVIDIA B200/B300 GPU와 함께 계속되고 있으��, 초기 B200 출하가 이미 계약되었습니��. IREN�� 인프�� 개발에는 2025�� 4분기 완공 예정�� 50MW 액체 냉각 AI 데이�� 센터 Horizon 1�� 1,400MW Sweetwater 1 시설 진행 상황�� 포함됩니��. Mackenzie 시설 업그레이드는 이중 광섬�� 경로�� 네트워크 중복성을 강화했습니다.

IREN (NASDAQ : IREN) a affiché de solides performances en juillet 2025, atteignant un chiffre d'affaires mensuel record de 86 millions de dollars et des bénéfices matériels de 66 millions de dollars. Les opérations de minage de Bitcoin de l'entreprise ont atteint un taux de hachage moyen de 45,4 EH/s, minant 728 BTC avec une marge bénéficiaire matérielle de 76 %.

L'expansion du cloud IA se poursuit avec 2,4k GPU NVIDIA B200/B300, la première livraison de B200 étant déjà contractée. Le développement des infrastructures d'IREN comprend le centre de données IA Horizon 1 de 50MW refroidi par liquide, dont la livraison est prévue au quatrième trimestre 2025, ainsi que les progrès du site Sweetwater 1 de 1 400MW. La mise à niveau de l'installation Mackenzie a renforcé la redondance du réseau avec des chemins en fibre optique doubles.

IREN (NASDAQ: IREN) verzeichnete im Juli 2025 eine starke Leistung mit einem Rekordumsatz von 86 Millionen US-Dollar und Hardwaregewinnen von 66 Millionen US-Dollar. Die Bitcoin-Mining-Aktivitäten des Unternehmens erreichten eine durchschnittliche Hashrate von 45,4 EH/s, wobei 728 BTC mit einer Hardware-Gewinnmarge von 76 % geschürft wurden.

Die Expansion der AI-Cloud setzt sich mit 2,4k NVIDIA B200/B300 GPUs fort, wobei die erste B200-Lieferung bereits vertraglich gesichert ist. Die Infrastrukturentwicklung von IREN umfasst das 50MW Horizon 1 flüssigkeitsgekühlte AI-Rechenzentrum, das im vierten Quartal 2025 fertiggestellt werden soll, sowie Fortschritte bei der 1.400MW Sweetwater 1-Anlage. Das Upgrade der Mackenzie-Anlage verbesserte die Netzwerkrückfallebene mit doppelten Glasfaserwegen.

- None.

- Increased net electricity costs per Bitcoin mined to $27,976 from $26,259

- Higher electricity costs at Childress (3.6c/kWh) impacting operational expenses

- Significant capital requirements for ongoing infrastructure expansion projects

Insights

IREN reports record $86M revenue with significant AI cloud expansion, showing strong dual Bitcoin/AI infrastructure strategy execution.

IREN's July performance demonstrates the company is successfully executing its dual-purpose infrastructure strategy across both Bitcoin mining and AI cloud services. The record $86M monthly revenue and $66M hardware profit highlight the effectiveness of their business model in capturing value from both sectors.

Their AI cloud business is particularly noteworthy - despite contributing only $2.3M in monthly revenue compared to Bitcoin mining's $83.6M, it achieves an impressive 98% hardware profit margin versus Bitcoin mining's 76%. This exceptional margin profile validates their strategic pivot into AI computing.

The procurement of 2,400 NVIDIA Blackwell GPUs (B200/B300) represents a significant expansion of high-value compute capacity. With the initial B200 shipment already fully contracted, IREN is demonstrating strong market demand for its AI infrastructure. The

IREN's infrastructure development shows sophisticated planning for AI-specific requirements. The completion of the Mackenzie fiber upgrade creating redundant, physically diverse fiber paths is critical for AI workloads that demand both high bandwidth and reliability. The 50MW Horizon 1 liquid-cooled data center at Childress represents purpose-built infrastructure for intensive AI computing, showing foresight in designing for the thermal challenges of GPU clusters.

IREN's ability to run both ASICs and GPUs side-by-side at Prince George showcases their adaptable infrastructure approach, allowing them to allocate resources between cryptocurrency mining and AI computing based on market conditions and profitability. This flexibility gives them a competitive advantage over single-purpose operators in either space.

IREN's July performance showcases extraordinary mining economics in the current market environment. The 45.4 EH/s operating hashrate produced 728 BTC at a net electricity cost of just

The company's Bitcoin mining revenue increased by

IREN's power strategy remains a key differentiator. Despite facing higher electricity costs at Childress (

The projected

While the Bitcoin mining business currently dominates revenue, the company's diversification into AI cloud services creates a compelling hybrid business model. This approach provides exposure to both cryptocurrency economics and the high-growth AI infrastructure market, potentially offering shareholders more balanced risk exposure than pure-play Bitcoin miners.

NEW YORK, Aug. 06, 2025 (GLOBE NEWSWIRE) -- IREN Limited (NASDAQ: ) (together with its subsidiaries, “IREN�� or “the Company��) today published its monthly update for July 2025.

July Highlights

- Record monthly revenue and hardware profit3

- AI��Cloud expanded with 2.4k NVIDIA B200/B300 GPUs

- Initial��B200 shipment completed and fully contracted

- 50MW Horizon 1 liquid-cooled AI data center on track for Q4��25

- Mackenzie fiber upgrade complete, further enhancing our ability to support continued growth of AI Cloud beyond Prince George

- 1,400MW Sweetwater 1 civil and electrical works continuing

| Key Metrics | Jul 25 | Jun 25 | |

| Bitcoin Mining | �� | �� | |

| Average operating hashrate | 45.4 EH/s | 41.1 EH/s | |

| Bitcoin mined4 | 728 BTC | 620 BTC | |

| Revenue per Bitcoin mined | $114,891 | $105,730 | |

| Net electricity cost per Bitcoin mined2 | ( | ( | |

| Revenue | |||

| Net electricity costs1 | ( | ( | |

| Hardware profit3 | |||

| Hardware profit margin5 | |||

| �� | �� | �� | |

| AI Cloud Services | �� | �� | |

| Revenue | |||

| Net electricity costs1 | ( | ( | |

| Hardware profit3 | |||

| Hardware profit margin5 | |||

| �� | �� | �� | |

Management Commentary

“We delivered another month of record revenue of

“We are observing accelerating interest in our newly procured Blackwell GPUs, with the initial delivery of 256 B200 GPUs already contracted. Our ability to run ASICs and GPUs side-by-side at Prince George underscores the adaptability of our infrastructure and our ability to capture the market opportunity ahead.��

Technical Commentary

AI Cloud Services

- Diverse��customer mix �� contract terms ranging from on-demand to 3 years, including through white-labelled compute with leading US AI cloud providers (Hopper GPUs generating annualized run-rate revenue of

$28m )7 - Blackwell��GPUs procured �� initial delivery of 256 B200s already contracted with a customer, with remaining ~1.1k B200s & ~1.1k B300s scheduled for delivery at Prince George over the coming months

AI Data Centers

- Mackenzie��dual fiber –��following the installation of an additional fiber path at the Mackenzie 80MW data center, all operating sites now feature dual, physically diverse fiber paths, strengthening network redundancy across our portfolio and further enhancing our ability to support continued growth of AI Cloud beyond Prince George

- Customer��workstreams progressing �� continued engagement across a range of structures such as powered shells, build-to-suit and turnkey colocation across site portfolio, including Childress and Sweetwater

- Procurement���� continuing to secure long-lead equipment to enable rapid expansion of liquid cooled capacity at Childress beyond the initial 50MW Horizon 1 deployment including chillers, dry coolers, CDUs and diesel generators

Bitcoin Mining

- Record��monthly revenues �� driven by higher Bitcoin prices and increase in average operating hashrate, with record number of Bitcoin mined during the month despite seasonal curtailment, including for 4CP

- Maintaining��strong and resilient margins �� underpinned by best-in-class efficiency (15 J/TH), with higher electricity costs (3.6c/kWh Childress net electricity cost in July) offset by higher Bitcoin prices1

- Significant��cashflow potential �� 50 EH/s generates

$830m illustrative annualized hardware profit6

Events

- RAISE Summit | IREN & Poolside Panel

Replay available

- Canaccord Annual Growth Conference

Boston, August 12-13, 2025

- SALT Wyoming Blockchain Symposium

Jackson Hole, August 18-21, 2025

- YOTTA, Digital Infrastructure Conference

Las Vegas, September 10, 2025

Denis Skrinnikoff (IREN CTO) and Eiso Kant (Poolside Co-Founder & CTO) presenting at RAISE Summit (July 2025)

Project Update

Childress, Horizon 1 (July 2025)

Sweetwater 1 (July 2025)

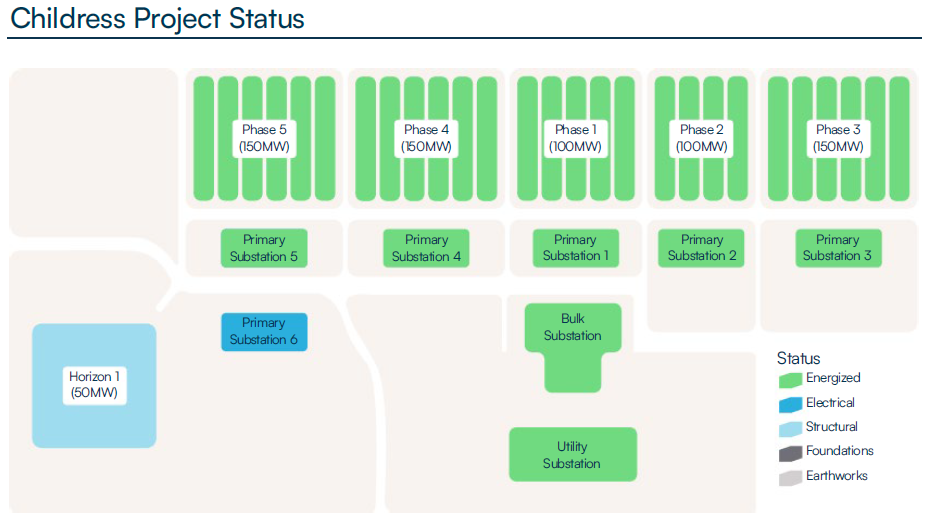

Childress (750MW)

- 650MW of operational data centers

- Horizon 1 (up to 50MW IT load) on track for Q4 2025 delivery, with the erection of building structures underway and commencement of liquid cooling plant fabrication

- Planning and site works ongoing for Horizon 2 and beyond

Sweetwater 1 (1.4GW)

- Substation foundation work commenced

- Energization scheduled for April 2026

Sweetwater 2 (600MW)

- Design work complete for a direct fiber loop connecting Sweetwater 1 & 2

- Procurement of long lead high voltage equipment

- Targeting energization late 2027

Childress Project Status

Site Overview

Assumptions and Notes

- Total net electricity costs are presented on a net basis and calculated as GAAP electricity charges, demand response program revenue and demand response fees. Figures are based on current internal estimates and exclude Renewable Energy Certificate (“REC��) purchases.

- Net electricity costs per Bitcoin mined is calculated as Net electricity costs for Bitcoin mining divided by Bitcoin mined.

- Hardware profit is calculated as revenue less net electricity costs. Hardware profit is a non-GAAP financial measure and is provided in addition to, and not as a substitute for, measures of financial performance prepared in accordance with GAAP. Refer to the Forward-Looking Statements disclaimer.

- Bitcoin and Bitcoin mined in this investor update are presented in accordance with our revenue recognition policy which is determined on a Bitcoin received basis (post deduction of mining pool fees).

- Hardware profit margin for Bitcoin Mining and AI Cloud Services is calculated as revenue less net electricity costs, divided by revenue (for each respective revenue stream) and excludes all other costs.

- Illustrative Annualized Hardware Profit = illustrative annualized mining revenue less assumed net electricity costs. Source: CoinWarz Bitcoin Mining Calculator. Illustrative calculations and inputs assume hardware operates at

100% uptime, 3.5c/kWh net electricity costs, 3.125 BTC block reward, 0.1 BTC transaction fees,0.16% pool fees, 765MW power consumption,$115 k Bitcoin price, 50 EH/s operating hashrate and 914 EH/s network hashrate. Illustrative Annualized Hardware Profit is for illustrative purposes only and should not be considered projections of IREN’s operating performance. Inputs are based on assumptions, including historical information, which are likely to be different in the future and users should input their own assumptions. There is no assurance that any illustrative outputs will be achieved within the timeframes presented or at all, or that mining hardware will operate at100% uptime. The above should be read strictly in conjunction with the forward-looking statements disclaimer in this press release. - AI Cloud Services annualized run-rate revenue for utilized Hopper GPUs as of August 5, 2025.

Reconciliation of Non-GAAP metrics

| �� | Units | Jul 25 | Jun 25 |

| Electricity charges | $’m | (21.6) | (17.5) |

| Add/(deduct) the following: | �� | �� | �� |

| Demand response program revenue | $’m | 1.3 | 1.2 |

| Demand response program fees | $’m | (0.1) | (0.1) |

| Total net electricity costs1 | $'m | (20.4) | (16.3) |

| Net electricity costs �� Bitcoin mining | $’m | (20.4) | (16.3) |

| Total Bitcoin mined | # | 728 | 620 |

| Net electricity costs per Bitcoin mined2 | $ | (27,976) | (26,259) |

| �� | �� | �� | �� |

| Bitcoin mining revenue | $’m | 83.6 | 65.5 |

| Add/(deduct) the following: | �� | �� | �� |

| Net electricity costs �� Bitcoin mining1 | $’m | (20.4) | (16.3) |

| Bitcoin mining Hardware Profit3 | $'m | 63.3 | 49.2 |

| Bitcoin mining Hardware Profit Margin5 | % | 76% | 75% |

| �� | �� | �� | �� |

| AI Cloud Services revenue | $’m | 2.3 | 2.2 |

| Add/(deduct) the following: | �� | �� | �� |

| Net electricity costs �� AI Cloud Services1 | $’m | (0.04) | (0.03) |

| Al Cloud Services Hardware Profit3 | $'m | 2.3 | 2.1 |

| Al Cloud Services Hardware Profit Margin5 | % | 98% | 98% |

| �� | �� | �� | �� |

| Total Hardware Profit3 | $'m | 65.6 | 51.4 |

| �� | �� | �� | �� |

Contacts

| Media Megan Boles Aircover Communications +1 562 537 7131 [email protected] Jon Snowball Sodali & Co +61 477 946 068 +61 423 136 761 | Investors Mike Power IREN [email protected] |

| �� | �� |

To keep updated on IREN’s news releases and SEC filings, please subscribe to email alerts at��.

Forward-Looking Statements

This press release includes “forward-looking statements�� within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or IREN’s future financial or operating performance. For example, forward-looking statements include but are not limited to the Company’s business strategy, expected operational and financial results, and expected increase in power capacity and hashrate. In some cases, you can identify forward-looking statements by terminology such as “anticipate,�� “believe,�� “may,�� “can,�� “should,�� “could,�� “might,�� “plan,�� “possible,�� “project,�� “strive,�� “budget,�� “forecast,�� “expect,�� “intend,�� “target��, “will,�� “estimate,�� “predict,�� “potential,�� “continue,�� “scheduled�� or the negatives of these terms or variations of them or similar terminology, but the absence of these words does not mean that statement is not forward-looking. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward-looking statements. In addition, any statements or information that refer to expectations, beliefs, plans, projections, objectives, performance or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking.

These forward-looking statements are based on management’s current expectations and beliefs. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause IREN’s actual results, performance or achievements to be materially different from any future results performance or achievements expressed or implied by the forward looking statements, including, but not limited to: Bitcoin price and foreign currency exchange rate fluctuations; IREN’s ability to obtain additional capital on commercially reasonable terms and in a timely manner to meet its capital needs and facilitate its expansion plans; the terms of any future financing or any refinancing, restructuring or modification to the terms of any future financing, which could require IREN to comply with onerous covenants or restrictions, and its ability to service its debt obligations, any of which could restrict its business operations and adversely impact its financial condition, cash flows and results of operations; IREN’s ability to successfully execute on its growth strategies and operating plans, including its ability to continue to develop its existing data center sites, design and deploy direct-to-chip liquid cooling systems, and diversify and expand into the market for high performance computing (“HPC��) solutions (including the market for cloud services (“AI Cloud Services��) and potential colocation services; IREN’s limited experience with respect to new markets it has entered or may seek to enter, including the market for HPC solutions (including AI Cloud Services and potential colocation services); expectations with respect to the ongoing profitability, viability, operability, security, popularity and public perceptions of the Bitcoin network; expectations with respect to the profitability, viability, operability, security, popularity and public perceptions of any current and future HPC solutions (including AI Cloud Services and potential colocation services) that IREN offers; IREN’s ability to secure and retain customers on commercially reasonable terms or at all, particularly as it relates to its strategy to expand into markets for HPC solutions (including AI Cloud Services and potential colocation services); IREN’s ability to manage counterparty risk (including credit risk) associated with any current or future customers, including customers of its HPC solutions (including AI Cloud Services and potential colocation services) and other counterparties; the risk that any current or future customers, including customers of its HPC solutions (including AI Cloud Services and potential colocation services), or other counterparties may terminate, default on or underperform their contractual obligations; Bitcoin global hashrate fluctuations; IREN’s ability to secure renewable energy, renewable energy certificates, power capacity, facilities and sites on commercially reasonable terms or at all; delays associated with, or failure to obtain or complete, permitting approvals, grid connections and other development activities customary for greenfield or brownfield infrastructure projects; IREN’s reliance on power and utilities providers, third party mining pools, exchanges, banks, insurance providers and its ability to maintain relationships with such parties; expectations regarding availability and pricing of electricity; IREN’s participation and ability to successfully participate in demand response products and services and other load management programs run, operated or offered by electricity network operators, regulators or electricity market operators; the availability, reliability and/or cost of electricity supply, hardware and electrical and data center infrastructure, including with respect to any electricity outages and any laws and regulations that may restrict the electricity supply available to IREN; any variance between the actual operating performance of IREN’s miner hardware achieved compared to the nameplate performance including hashrate; IREN’s ability to curtail its electricity consumption and/or monetize electricity depending on market conditions, including changes in Bitcoin mining economics and prevailing electricity prices; actions undertaken by electricity network and market operators, regulators, governments or communities in the regions in which IREN operates; the availability, suitability, reliability and cost of internet connections at IREN’s facilities; IREN’s ability to secure additional hardware, including hardware for Bitcoin mining and any current or future HPC solutions (including AI Cloud Services and potential colocation services) it offers, on commercially reasonable terms or at all, and any delays or reductions in the supply of such hardware or increases in the cost of procuring such hardware; expectations with respect to the useful life and obsolescence of hardware (including hardware for Bitcoin mining and any current or future HPC solutions (including AI Cloud Services and potential colocation services) IREN offers); delays, increases in costs or reductions in the supply of equipment used in IREN’s operations including as a result of tariffs and duties, and certain equipment being in high demand due to global supply chain constraints; changing political and geopolitical conditions, including changing international trade policies and the implementation of wide-ranging, reciprocal and retaliatory tariffs and trade restrictions; IREN’s ability to operate in an evolving regulatory environment; IREN’s ability to successfully operate and maintain its property and infrastructure; reliability and performance of IREN’s infrastructure compared to expectations; malicious attacks on IREN’s property, infrastructure or IT systems; IREN’s ability to maintain in good standing the operating and other permits and licenses required for its operations and business; IREN’s ability to obtain, maintain, protect and enforce its intellectual property rights and confidential information; any intellectual property infringement and product liability claims; whether the secular trends IREN expects to drive growth in its business materialize to the degree it expects them to, or at all; any pending or future acquisitions, dispositions, joint ventures or other strategic transactions; the occurrence of any environmental, health and safety incidents at IREN’s sites, and any material costs relating to environmental, health and safety requirements or liabilities; damage to IREN’s property and infrastructure and the risk that any insurance IREN maintains may not fully cover all potential exposures; ongoing proceedings relating to the default by two of the Company’s wholly-owned special purpose vehicles under limited recourse equipment financing facilities; ongoing securities litigation relating in part to the default, and any future litigation, claims and/or regulatory investigations, and the costs, expenses, use of resources, diversion of management time and efforts, liability and damages that may result therefrom; IREN's failure to comply with any laws including the anti-corruption laws of the United States and various international jurisdictions; any failure of IREN's compliance and risk management methods; any laws, regulations and ethical standards that may relate to IREN’s business, including those that relate to Bitcoin and the Bitcoin mining industry and those that relate to any other services it offers, including laws and regulations related to data privacy, cybersecurity and the storage, use or processing of information and consumer laws; IREN’s ability to attract, motivate and retain senior management and qualified employees; increased risks to IREN’s global operations including, but not limited to, political instability, acts of terrorism, theft and vandalism, cyberattacks and other cybersecurity incidents and unexpected regulatory and economic sanctions changes, among other things; climate change, severe weather conditions and natural and man-made disasters that may materially adversely affect IREN’s business, financial condition and results of operations; public health crises, including an outbreak of an infectious disease and any governmental or industry measures taken in response; IREN’s ability to remain competitive in dynamic and rapidly evolving industries; damage to IREN’s brand and reputation; our ability to remediate our existing material weakness and to establish and maintain an effective system of internal controls; expectations relating to environmental, social or governance issues or reporting; the costs of being a public company; the increased regulatory and compliance costs of IREN ceasing to be a foreign private issuer and an emerging growth company, as a result of which we are now required, among other things, to file periodic reports and registration statements on U.S. domestic issuer forms with the SEC, prepare our financial statements in accordance with U.S. GAAP rather than IFRS, and to modify certain of our policies to comply with corporate governance practices required of a U.S. domestic issuer; that we do not currently pay any cash dividends on our ordinary shares, and may not in the foreseeable future and, accordingly, your ability to achieve return on your investment in our ordinary shares will depend on appreciation, if any, in the price of our ordinary shares; and other important factors discussed under the caption “Risk Factors�� in IREN’s annual report on Form 20-F filed with the SEC on August 28, 2024 as such factors may be updated from time to time in its other filings with the SEC, accessible on the SEC’s website at www.sec.gov and the Investor Relations section of IREN’s website at https://investors.iren.com.

These and other important factors could cause actual results to differ materially from those indicated by the forward-looking statements made in this investor update. Any forward-looking statement that IREN makes in this investor update speaks only as of the date of such statement. Except as required by law, IREN disclaims any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements, whether as a result of new information, future events or otherwise.

Preliminary Financial Information

The financial information presented in this investor update is not subject to the same closing procedures as our unaudited quarterly financial results and our audited annual financial results, and has not been reviewed or audited by our independent registered public accounting firm. The preliminary financial information included in this investor update does not represent a comprehensive statement of our financial results or financial position and should not be viewed as a substitute for unaudited financial statements prepared in accordance with International Financial Reporting Standards. Accordingly, you should not place undue reliance on the preliminary financial information included in this investor update.

Non-GAAP Financial Measures��

This investor update includes non-GAAP financial measures, including net electricity costs, net electricity costs per Bitcoin mined, hardware profit, hardware profit margin, illustrative annualized hardware profit and AI Cloud Services annualized run-rate revenue. We provide these measures in addition to, and not as a substitute for, measures of financial performance prepared in accordance with GAAP. There are a number of limitations related to the use of non-GAAP financial measures. For example, other companies, including companies in our industry, may calculate these measures differently. The Company believes that these measures are important and supplement discussions and analysis of its results of operations and enhances an understanding of its operating performance.��

Net electricity costs are calculated as GAAP electricity charges, demand response program revenue and demand response fees. Figures are based on current internal estimates and excludes the cost of RECs. Net electricity costs per Bitcoin mined is calculated as Net electricity costs for Bitcoin mining divided by Bitcoin mined. Hardware Profit is calculated as revenue less net electricity costs (excludes all other site, overhead and REC costs). Hardware Profit Margin is calculated as revenue less net electricity costs divided by revenue (excludes all other site, overhead and REC costs). Illustrative Annualized Hardware Profit is calculated as illustrative annualized mining revenue less assumed net electricity costs (excludes all other site, overhead and REC costs). AI Cloud Services annualized run-rate revenue reflects contracted revenue for utilized GPUs.

Photos accompanying this announcement are available at