NRSInsightsâ� July 2025 Retail Same-Store Sales Report

NRSInsights, a subsidiary of IDT Corporation (NYSE: IDT), reported strong retail performance metrics for July 2025. The company's network, comprising 37,200 active POS terminals across approximately 32,100 independent retailers, recorded a 5.8% increase in same-store sales year-over-year, marking the highest growth rate in over a year.

Key performance indicators showed positive trends with units sold up 3.2% year-over-year and baskets increasing 1.5%. The average prices for top 500 items rose 2.9% compared to July 2024. The network processed $2.1 billion in sales (+18% YoY) across 145 million transactions during July 2025.

Notable growth was observed in beverages, prepared cocktails, modern oral nicotine, and performance nutrition categories, while some snack categories experienced pressure.

NRSInsights, una controllata di IDT Corporation (NYSE: IDT), ha riportato solide performance nel settore retail per luglio 2025. La rete dell'azienda, composta da 37.200 terminali POS attivi distribuiti in circa 32.100 rivenditori indipendenti, ha registrato un aumento del 5,8% nelle vendite a parità di negozio rispetto all'anno precedente, segnando il tasso di crescita più alto degli ultimi dodici mesi.

I principali indicatori di performance hanno mostrato tendenze positive con un incremento del 3,2% nelle unità vendute e un aumento dell'1,5% nel numero di acquisti per cliente rispetto a luglio 2024. I prezzi medi dei 500 articoli più venduti sono cresciuti del 2,9%. La rete ha processato 2,1 miliardi di dollari in vendite (+18% su base annua) attraverso 145 milioni di transazioni nel mese di luglio 2025.

à stata rilevata una crescita significativa nelle categorie di bevande, cocktail preparati, nicotina orale moderna e nutrizione per la performance, mentre alcune categorie di snack hanno subito delle difficoltà .

NRSInsights, una subsidiaria de IDT Corporation (NYSE: IDT), informó sólidos indicadores de desempeño minorista para julio de 2025. La red de la compañÃa, compuesta por 37,200 terminales POS activos en aproximadamente 32,100 minoristas independientes, registró un aumento del 5.8% en ventas comparables año tras año, marcando la tasa de crecimiento más alta en más de un año.

Los indicadores clave mostraron tendencias positivas con un incremento del 3.2% en unidades vendidas y un aumento del 1.5% en el número de compras por cesta. Los precios promedio de los 500 artÃculos principales subieron un 2.9% en comparación con julio de 2024. La red procesó 2.1 mil millones de dólares en ventas (+18% interanual) a lo largo de 145 millones de transacciones durante julio de 2025.

Se observó un crecimiento notable en las categorÃas de bebidas, cócteles preparados, nicotina oral moderna y nutrición para el rendimiento, mientras que algunas categorÃas de snacks enfrentaron presiones.

NRSInsightsµç� IDT Corporation (NYSE: IDT)ì� ìíì¬ë¡ì� 2025ë � 7ì� ì매 ì¤ì ì� ê°ì¸ë¥� ë³´ìë¤ê³ ë³´ê³ íìµëë¤. ì� 32,100ê°ì ë 립 ì매ì ì²´ì� ê±¸ì³ 37,200ê°ì íì± POS ë¨ë§ê¸�ë¡� 구ì±ë� íì¬ ë¤í¸ìí¬µç� ì ë ë기 ëë¹� ëì¼ ë§¤ì¥ ë§¤ì¶ì� 5.8% ì¦ê°íì¬ 1ë � ì´ì ë§ì ê°ì� ëì ì±ì¥ë¥ ì 기ë¡íìµëë¤.

주ì ì±ê³¼ ì§íµç í매 ë¨ìê° ì ë ëë¹� 3.2% ì¦ê°Çêê³ ì¥ë°êµ¬ë ìê° 1.5% ì¦ê°íµç ê¸ì ì ì¸ ì¶ì¸ë¥� ë³´ììµëë�. ìì 500ê°� í목ì� íê· ê°ê²©ì 2024ë � 7ì� ëë¹� 2.9% ìì¹íìµëë¤. ë¤í¸ìí¬µç� 2025ë � 7ì� ëì 1ì� 4,500ë§� ê±´ì ê±°ëë¥� íµí´ 21ì� ë¬ë¬ì� 매ì¶(ì ë ëë¹� 18% ì¦ê°)ì� ì²ë¦¬íìµëë¤.

ìë£, ì¤ë¹ë ì¹µí ì�, íë êµ¬ê° ëì½í�, í¼í¬ë¨¼ì¤ ìì ì¹´í ê³ ë¦¬ìì ëì ëµç ì±ì¥ì� ììì¼ë©°, ì¼ë¶ ì¤ëµ ì¹´í ê³ ë¦¬µç� ìë°ì� ë°ììµëë�.

NRSInsights, une filiale de IDT Corporation (NYSE : IDT), a annoncé de solides performances commerciales pour juillet 2025. Le réseau de l'entreprise, composé de 37 200 terminaux de point de vente actifs répartis dans environ 32 100 détaillants indépendants, a enregistré une augmentation de 5,8 % des ventes comparables d'une année sur l'autre, marquant le taux de croissance le plus élevé depuis plus d'un an.

Les indicateurs clés de performance ont montré des tendances positives avec une hausse de 3,2 % des unités vendues et une augmentation de 1,5 % des paniers moyens. Les prix moyens des 500 articles les plus vendus ont augmenté de 2,9 % par rapport à juillet 2024. Le réseau a traité 2,1 milliards de dollars de ventes (+18 % en glissement annuel) lors de 145 millions de transactions en juillet 2025.

Une croissance notable a été observée dans les catégories boissons, cocktails préparés, nicotine orale moderne et nutrition sportive, tandis que certaines catégories de snacks ont subi des pressions.

NRSInsights, eine Tochtergesellschaft der IDT Corporation (NYSE: IDT), meldete starke Einzelhandelskennzahlen für Juli 2025. Das Netzwerk des Unternehmens, bestehend aus 37.200 aktiven POS-Terminals bei etwa 32.100 unabhängigen Einzelhändlern, verzeichnete ein 5,8%iges Wachstum bei den vergleichbaren Umsätzen im Jahresvergleich und erreichte damit die höchste Wachstumsrate seit über einem Jahr.

Wichtige Leistungskennzahlen zeigten positive Trends mit einem 3,2%igen Anstieg der verkauften Einheiten und einem 1,5%igen Anstieg der durchschnittlichen Warenkörbe. Die Durchschnittspreise der Top 500 Artikel stiegen im Vergleich zu Juli 2024 um 2,9%. Das Netzwerk verarbeitete im Juli 2025 2,1 Milliarden US-Dollar Umsatz (+18% im Jahresvergleich) bei 145 Millionen Transaktionen.

Bemerkenswertes Wachstum wurde in den Kategorien Getränke, fertige Cocktails, moderne orale Nikotinprodukte und Leistungsnahrung verzeichnet, während einige Snackkategorien unter Druck standen.

- Same-store sales grew 5.8% YoY, highest increase in over a year

- Total network sales reached $2.1B, up 18% YoY

- Network expansion to 37,200 active terminals nationwide

- Strong performance in beverage categories and prepared cocktails

- Average prices increased 2.9% YoY, indicating inflationary pressure

- Some snack categories remained under pressure

- Month-over-month units sold decreased 1.5%

- Baskets decreased 0.4% compared to previous month

Insights

NRS shows exceptional 5.8% same-store sales growth in July, outperforming previous months despite inflation pressures.

The July 2025 data from NRSInsights reveals remarkable momentum in the independent retail sector. The

Breaking down the components, we see unit sales rose

The beverage category emerges as a key growth driver, with energy drinks, soft drinks, and sparkling waters all performing well. The strength in prepared cocktails, modern oral nicotine products, and performance nutrition shakes points to evolving consumer preferences that savvy independent retailers are successfully capitalizing on.

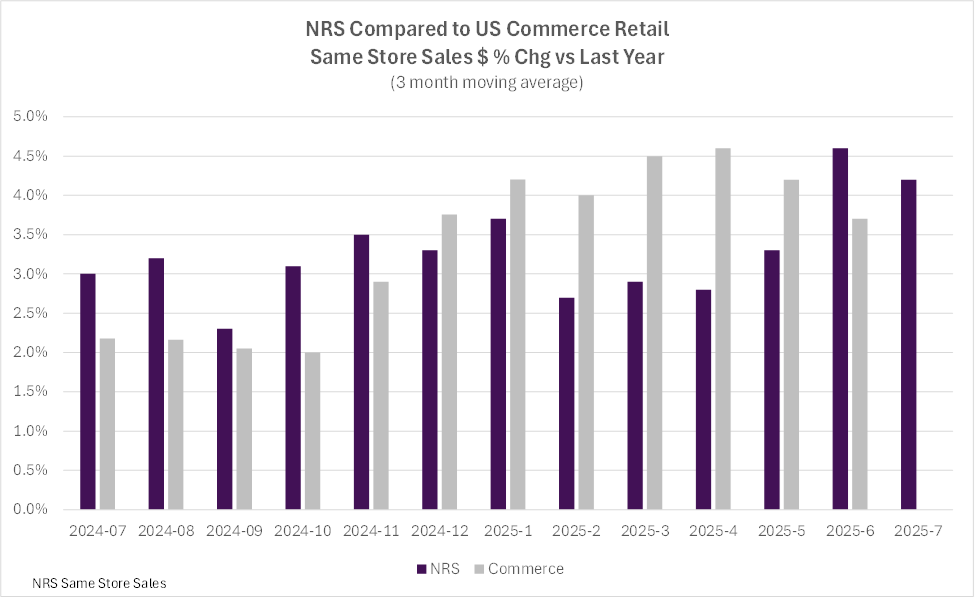

Most telling is how NRS network data compares to broader retail trends. Over the past year, NRS has tracked closely with U.S. Commerce Department figures, but in June, NRS's three-month average actually exceeded the national benchmark by

The expanding terminal network (37,200 active terminals processing

July same-store sales increased

NEWARK, N.J., Aug. 07, 2025 (GLOBE NEWSWIRE) -- , a provider of sales data and analytics drawn from retail transactions processed through the (NRS) point-of-sale (POS) platform, today announced comparative retail same-store sales results for July 2025.

As of July 31, 2025, the NRS retail network comprised approximately 37,200 active terminals nationwide, scanning purchases at approximately 32,100 independent retailers including convenience stores, bodegas, liquor stores, grocers, and tobacco and sundries sellers, predominantly serving urban consumers.

July Highlights*

(*Same-store sales, unit sales, transactions, and average price data refer to July 2025 and are compared to July 2024 unless otherwise noted. All comparisons are provided on a âper calendar dayâ� basis to remove from consideration variability in the number of days per month or three-month period.)

- SALES

- Same-store sales increased

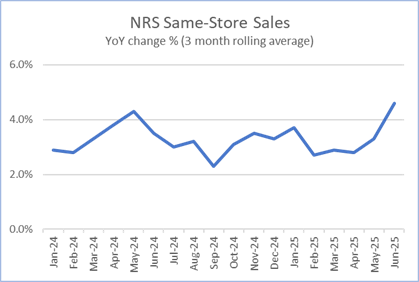

5.8% year-over-year. In the previous month (June 2025), same-store sales increased3.5% year-over-year. - Same-store sales increased

0.3% compared to the previous month (June 2025). Same-store sales in June 2025 were unchanged compared to the previous month (May 2025). - For the three months ended July 31, 2025, same-store sales increased

4.2% compared to the corresponding three months a year ago.

- UNITS SOLD

- Units sold increased

3.2% year-over-year. In the previous month (June 2025), units sold increased3.0% year-over-year. - Units sold decreased

1.5% compared to the previous month (June 2025). Units sold in June 2025 increased0.7% compared to the previous month (May 2025).

- Units sold increased

- BASKETS (TRANSACTIONS) PER STORE

- Baskets increased

1.5% year-over-year. In the previous month (June 2025), baskets were unchanged year-over-year. - Baskets decreased

0.4% compared to the previous month (June 2025). Baskets in June 2025 increased0.6% compared to the previous month (May 2025).

- Baskets increased

- AVERAGE PRICES

- A dollar-weighted average of prices for the top 500 items purchased increased

2.9% year-over-year, a higher rate of increase than the2.7% year-over-year increase recorded in June 2025.

- A dollar-weighted average of prices for the top 500 items purchased increased

Retail Trade Comparative Data

The table below provides historical comparative data with the U.S. Commerce Departmentâs Advance Monthly Retail Trade same-store sales data excluding food service:

Over the past twelve months, the , excluding food services, outpaced the NRS networkâs three-month moving average same-store sales by

The NRSInsights data in the chart above have not been adjusted to reflect inflation, demographic distributions, seasonal buying patterns, item substitution, days per month, or other factors that may facilitate comparisons to other periods, to other same-store retail sales data, or to the U.S. Commerce Departmentâs retail data.

Commentary from Brandon Thurber (VP, Data Sales & Client Success at NRS)

"Independent retailers performed extremely well in July. Sales increased by

âBeverage performance helped drive the expansion. Energy drinks, soft drinks, and both sparkling and seltzer waters all delivered solid gains. Sports drinks were stable year-over-year and up month-over-month.

âShifts in consumer behavior spurred continued growth in prepared cocktails, modern oral nicotine, and performance and nutrition shakes, while certain snack categories remained under pressure.â�

NRSInsights Reports

The NRSInsights monthly Same-Store Retail Sales Reports are intended to provide timely topline data reflective of sales at NRSâ� network of independent, predominantly urban, retail stores.

Same-store data comparisons of July 2025 with July 2024 are derived from approximately 226 million transactions processed through the approximately 23,000 stores on the NRS network that scanned transactions in both months. Same-store data comparisons of July 2025 with June 2025 are derived from approximately 278 million transactions processed through approximately 31,000 stores.

Same-store data comparisons for the three months ended July 31, 2025 with the year-ago three months are derived from approximately 649 million scanned transactions processed through those stores that scanned transactions in both three-month periods.

NRS POS Platform

The NRS platform predominantly serves small-format, independent, retail stores nationwide including convenience stores, bodegas, liquor stores, grocers, and tobacco and sundries sellers. These independent retailers operate in all 50 states as well as the District of Columbia, and in 205 of the 210 designated market areas (DMAs) in the United States. During July 2025, NRSâ� POS terminals processed

About National Retail Solutions (NRS):

operates the largest point-of-sale (POS) terminal-based platform and digital payment processing service for independent retailers nationwide. Retailers utilize NRS offerings to process transactions and effectively manage their businesses. Consumer packaged goods (CPG) suppliers, brokers, analytics firms, and advertisers access the terminalâs digital display network to reach these retailersâ� predominantly urban, multi-cultural shopper base, and to harness transaction data-based learnings to identify growth opportunities and measure execution and returns on marketing investment. NRS is a subsidiary of ).

All statements above that are not purely about historical facts, including, but not limited to, those in which we use the words âbelieve,â� âanticipate,â� âexpect,â� âplan,â� âintend,â� âestimate,â� âtargetâ� and similar expressions, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. While these forward-looking statements represent our current judgment of what may happen in the future, actual results may differ materially from the results expressed or implied by these statements due to numerous important factors. Our filings with the SEC provide detailed information on such statements and risks, and should be consulted along with this release. To the extent permitted under applicable law, IDT assumes no obligation to update any forward-looking statements.

NRSInsights Contact:

Brandon Thurber

VP, Data Sales & Client Success at NRS

National Retail Solutions

IDT Corporation Contact:

Bill Ulrey

# # #