Cerrado Gold Announces Second Quarter 2025 Financial Results

Cerrado Gold (OTCQX:CRDOF) reported Q2 2025 financial results, producing 11,437 Gold Equivalent Ounces (GEO) at an All-In Sustaining Cost (AISC) of $1,779/oz. The company achieved Adjusted EBITDA of $7.4 million and maintains its full-year guidance of 55,000-60,000 GEO.

Key operational highlights include record heap leach production of 7,864 GEO, commencement of underground development at Paloma with three access portals, and repayment of ~$10M in debt during Q2. The company generated revenue of $29.6 million from selling 10,301 ounces of gold and 56,839 ounces of silver at an average realized gold price of $2,684/oz.

Cerrado expects production to increase and costs to decline in H2 2025 as higher-grade underground mining ramps up and heap leach volumes increase. The company is also advancing its 20,000-meter resource expansion exploration program at MDN and making progress at both Lagoa Salgada and Mont Sorcier projects.

Cerrado Gold (OTCQX:CRDOF) ha comunicato i risultati finanziari del secondo trimestre 2025, producendo 11.437 Gold Equivalent Ounces (GEO) a un All-In Sustaining Cost (AISC) di $1.779/oz. La società ha registrato un Adjusted EBITDA di $7,4 milioni e conferma la guidance per l'intero esercizio di 55.000-60.000 GEO.

I principali risultati operativi includono la produzione record da heap leach di 7.864 GEO, l'avvio dello sviluppo sotterraneo a Paloma con tre accessi e il rimborso di circa $10M di debito nel corso del secondo trimestre. La società ha realizzato ricavi per $29,6 milioni dalla vendita di 10.301 once d'oro e 56.839 once d'argento, con un prezzo medio realizzato dell'oro di $2.684/oz.

Cerrado prevede un aumento della produzione e una riduzione dei costi nella seconda metà del 2025, grazie all'incremento dell'estrazione sotterranea di minerale a più alto tenore e all'aumento dei volumi da heap leach. Prosegue inoltre il programma di esplorazione per l'espansione delle risorse di 20.000 metri a MDN e si registrano progressi sui progetti Lagoa Salgada e Mont Sorcier.

Cerrado Gold (OTCQX:CRDOF) informó sus resultados financieros del segundo trimestre de 2025, produciendo 11.437 Onzas Equivalentes de Oro (GEO) con un All-In Sustaining Cost (AISC) de $1.779/oz. La compañÃa alcanzó un EBITDA Ajustado de $7,4 millones y mantiene su guÃa para todo el año de 55.000-60.000 GEO.

Entre los aspectos operativos destacados figura la producción récord por heap leach de 7.864 GEO, el inicio del desarrollo subterráneo en Paloma con tres accesos y el pago de aproximadamente $10M de deuda durante el segundo trimestre. La compañÃa generó ingresos por $29,6 millones por la venta de 10.301 onzas de oro y 56.839 onzas de plata, con un precio medio realizado del oro de $2.684/oz.

Cerrado espera que la producción aumente y los costos disminuyan en la segunda mitad de 2025, a medida que se intensifique la minerÃa subterránea de ley más alta y aumenten los volúmenes de heap leach. También avanza su programa de exploración para la expansión de recursos de 20.000 metros en MDN y registra progresos en los proyectos Lagoa Salgada y Mont Sorcier.

Cerrado Gold (OTCQX:CRDOF)ì 2025ë � 2ë¶ê¸° ì¤ì ì� ë°ííë©° 11,437 골ë íì° ì¨ì¤(GEO)ë¥� AISC(ì´ì§ììê°) $1,779/ozë¡� ìì°íë¤ê³� ë°íìµëë�. íì¬ë� ì¡°ì EBITDA $740ë§�ì� 기ë¡íì¼ë©� ì°ê° ê°ì´ëì� 55,000â�60,000 GEOë¥� ì ì§íê³ ììµëë¤.

주ì ì´ì ì±ê³¼ë¡ë í� 리ì¹(Heap Leach) ì¬ì ìµê³ ìì°ë� 7,864 GEO, Palomaììì� ì§íê°ë°� ì°©ì(3ê°� ì§ì ë¡� íë³´), 2ë¶ê¸° ì¤� ì� $1,000ë§ì ë¶ì±� ìíì� í¬í¨ë©ëë�. íì¬ë� ê¸� 10,301ì¨ì¤ì ì 56,839ì¨ì¤ë¥� í매í� íê· ì¤í ê¸� ê°ê²� $2,684/ozë¡� ë§¤ì¶ $2,960ë§�ì� ì¬ë ¸ìµëë�.

Cerradoë� ê³ ë±ê¸� ì§í� ê´ì°ì� ê°ë� íëì í� ë¦¬ì¹ ë¬¼ë ì¦ê°ë¡� 2025ë � íë°ê¸°ì ìì° ì¦ê° ë°� ë¹ì© ê°ìë¥� 기ëíê³ ììµëë¤. ëí MDNììì� 2ë§� ë¯¸í° ìì íì¥ íì¬ íë¡ê·¸ë¨ì� ì§í ì¤ì´ë©� Lagoa Salgadaì Mont Sorcier íë¡ì í¸ììë� ì§ì ì� ìë¤ê³� ë°íìµëë�.

Cerrado Gold (OTCQX:CRDOF) a publié ses résultats du deuxième trimestre 2025, produisant 11 437 onces équivalent-or (GEO) à un All-In Sustaining Cost (AISC) de 1 779 $/oz. La société a enregistré un EBITDA ajusté de 7,4 M$ et maintient ses prévisions annuelles de 55 000â�60 000 GEO.

Parmi les faits marquants opérationnels figurent une production record en heap leach de 7 864 GEO, le lancement du développement souterrain à Paloma avec trois accès, et le remboursement dâenviron 10 M$ de dette au cours du T2. La société a généré 29,6 M$ de revenus en vendant 10 301 onces dâor et 56 839 onces dâargent, avec un prix moyen réalisé de lâor de 2 684 $/oz.

Cerrado anticipe une hausse de la production et une baisse des coûts au second semestre 2025, à mesure que la production souterraine de minerai à plus haute teneur sâintensifie et que les volumes de heap leach augmentent. La société poursuit également son programme dâexploration dâ�extension des ressources de 20 000 mètres à MDN et progresse sur les projets Lagoa Salgada et Mont Sorcier.

Cerrado Gold (OTCQX:CRDOF) meldete die Finanzergebnisse für das zweite Quartal 2025 und produzierte 11.437 Goldäquivalente Unzen (GEO) bei einem All-In Sustaining Cost (AISC) von $1.779/oz. Das Unternehmen erzielte ein bereinigtes EBITDA von $7,4 Mio. und bestätigt die Jahresprognose von 55.000â�60.000 GEO.

Zu den operativen Highlights zählen die Rekordproduktion aus Heap-Leach von 7.864 GEO, der Start der Untertageentwicklung in Paloma mit drei Zugangsstollen sowie die Rückzahlung von rund $10 Mio. Schulden im Q2. Das Unternehmen erwirtschaftete durch den Verkauf von 10.301 Unzen Gold und 56.839 Unzen Silber Einnahmen von $29,6 Mio. bei einem durchschnittlich realisierten Goldpreis von $2.684/oz.

Cerrado erwartet für die zweite Jahreshälfte 2025 eine steigende Produktion und sinkende Kosten, da der Abbau von höhergradigem Erz untertage hochgefahren und die Heap-Leach-Mengen erhöht werden. Zudem wird das 20.000-Meter-Explorationsprogramm zur Ressourcenerweiterung bei MDN vorangetrieben und es gibt Fortschritte bei den Projekten Lagoa Salgada und Mont Sorcier.

- Record heap leach production of 7,864 GEO in Q2 2025

- Adjusted EBITDA of $7.4 million for Q2 2025

- Repayment of ~$10M debt during Q2 2025

- Strong average realized gold price of $2,684/oz

- Expanded crushing circuit completed to support higher production rates

- Underground mining commenced with three access portals at Paloma

- Lower overall production of 11,437 GEO vs 16,255 GEO in Q2 2024

- Higher AISC of $1,779/oz compared to $1,178/oz in Q2 2024

- Revenue decreased to $29.6M from $34.7M in Q2 2024

- Lower gold sales of 10,301 ounces vs 15,484 ounces in Q2 2024

Transition extending life of mine production underway

Gold equivalent production of 11,437 Gold Equivalent Ounces ("GEO") at AISC of

$1,779 /oz during Q2 2025Adjusted EBITDA of

$7.4 million for Q2 2025Full year guidance of 55,000-60,000 GEO maintained: Production weighted to H2 as higher-grade underground mining and heap leach volumes increase

Repayment of ~US

$18m debt and payables at the MDN operations year to date- ~US$10m in Q2 202520,000 meter resource expansion exploration program at MDN underway

Significant investment and progress at both the Lagoa Salgada and Mont Sorcier projects

Positive Metallurgical results at Lagoa Salgada to be incorporated into Optimized Feasibility Study to be delivered by year end

Management to host conference call on Monday, 25th of August, 11AM EDT

TORONTO, ON / / August 21, 2025 / Cerrado Gold Inc. (TSXV:CERT)(OTCQX:CRDOF)(FRA:BAI0) ("Cerrado" or the "Company") announces its operational and financial results for the second quarter ("Q2/25") including its Minera Don Nicolas ("MDN") gold mine in Santa Cruz Province, Argentina, its Lagoa Salgada Polymetallic Project in Portugal and its Mont Sorcier High Purity DRI Iron Project in Quebec. Financial results now include the consolidated financial position of Ascendant Resources Inc. ("Ascendant") following the close of the acquisition effective May 16, 2025.

Production results for MDN were previously released on July 17, 2025. The Company's financial results are reported and available on SEDAR+ () and the Company's website ().

Q2/25 MDN Operating Highlights:

Q2/25 production of 11,437 GEO and AISC of

$1,779 /ozUnit costs expected to continue to decline as production increases in H2/2025

Q2/25 Adjusted EBITDA of

$7.4 million Record heap leach production of 7,864 GEO during the Quarter

Underground development at Paloma started with three access portals

CIL plant receiving initial contribution from underground development; production expected to ramp up over H2/2025

Operational results for the second quarter saw gold production increase compared to Q1 2025, but were lower than Q2/24 during which period the high grade Calandrias Norte pit was being mined. This was anticipated given the depletion of high-grade material from Calandrias Norte, following which, MDN became primarily a heap leach only operation pending the ramp up of new high-grade material from underground. The heap leach operation reached another production record of 7,864 GEO for the quarter. The recently expanded crushing circuit is enabling higher volumes of ore to be placed on the pad, with further increases expected following the planned addition of an agglomerator and additional conveyors in Q3 2025. With higher gold prices, the CIL plant continued to process lower-grade stockpiles through Q2/25. Going forward, lower grade material will be blended with new high-grade material from underground mining feed beginning in Q3/25 which will increase mill grades, boost production and lower unit operating costs further.

Mark Brennan, CEO and Chairman commented, "The results from the second quarter demonstrate a robust operation transitioning to deliver increased production in the second half of the year and beyond. The expanded and improved crushing capacity at the heap leach is delivering greater production and when combined with new, higher-grade ore expected from underground operations, unit costs are expected to decline significantly in the second half of the year, enhancing our financial performance."

He continued, "The strong cash flow generated from operations combined with our cash balance, has enabled us to pay down

Operating Results for the Quarter

Operational results for Q2 2025 showed a modest increase in production over the previous quarter, driven by modestly higher production from the heap leach operations. The heap leach performance remained steady over the quarter. However, recovery rates were impacted by a larger amount of primary ore placed on pad during the quarter due to mine sequencing. This primary material has lower recovery rates and longer retention times as compared to oxide material. Heap leach production is expected to improve in H2/25 as more oxide ore is mined, the addition of an agglomerator to reduce fines is implemented, and the ongoing upgrades to the crushing circuit are completed. In addition, early in the quarter the crushing circuit was offline for approximately 15 days as upgrades were put in place to support higher throughput rates moving forward. Production from stockpiled material via the CIL plant declined somewhat due to lower grades, however, underground operations at Paloma are expected to begin to contribute meaningfully to production in H2 2025 and beyond as development rates increase and more ore becomes available.

The second phase of the expansion of the heap leach crushing circuit is now complete, which will increase feed stability in order to deliver steady ore volumes to the pad. While supporting higher production rates, additional crushing facilities are also expected to reduce the feed size to the pad and result in increased recoveries. The final updates to the crusher circuit, including final installation of the agglomerator and additional conveyors, are set to be completed in Q3/25.

As previously announced, MDN commenced underground mining in June, opening up three portals for underground mining beneath the Paloma pit. Ore production is expected to ramp up over H2 and is set to make a material contribution to production rates as the year progresses. While initial production expectations are relatively modest given the current known underground resource, underground access is expected to provide a platform for major exploration activities at a lower cost than drilling from surface. Underground exploration aims to materially expand resources at MDN, leveraging the underground development for a potential expansion in production and/or mine life.

On the exploration front, the Company commenced an approximate 20,000 metre drill program at MDN late in the quarter and is set to drill numerous targets in the coming months with the aim to potentially define new resources to provide mill feed to the CIL plant. Drilling commenced with a single DDH rig north of the Paloma pit, where several new veins have been intersected. Results are pending and further drilling will be required to confirm new resources.

In the near term, the focus at MDN remains to ramp up production rates at its heap leach operation to approximately 4,000-4,500 GEO per month, grow underground production from the Paloma area in H2, and ramp up a new targeted exploration program across our 330k Ha property to increase resources and mine life.

The Company has reduced its debt position by approximately

Q1 Financial Performance

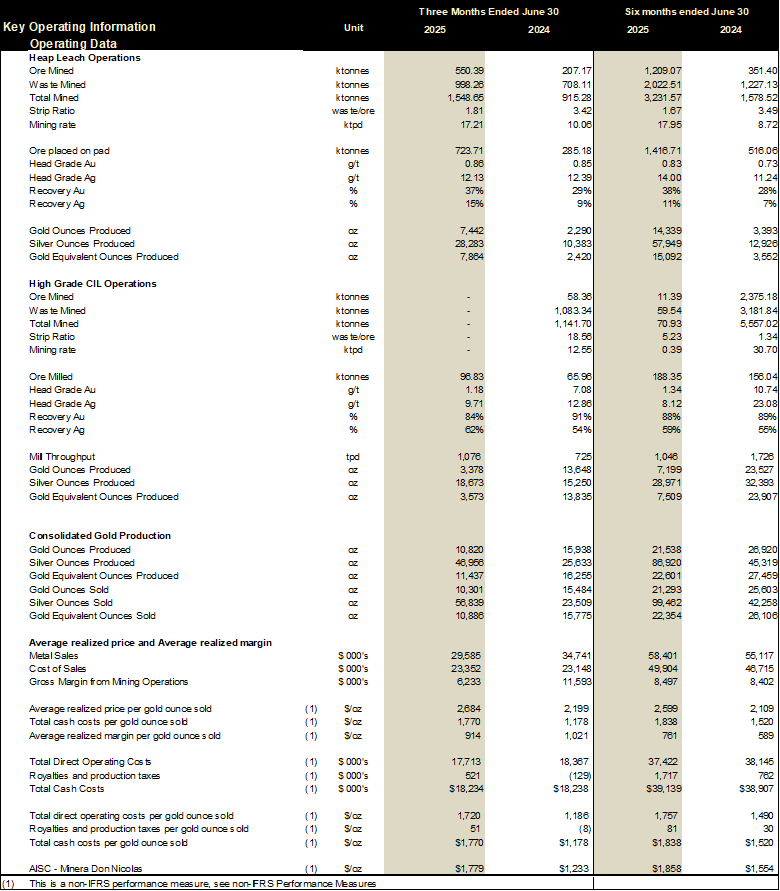

Table 1. Q1 2025 Operational and Financial Performance

The Company produced 11,437 gold equivalent ounces ("GEO") during the three months ended June 30, 2025, as compared to 16,255 GEO for the three months ended June 30, 2024. In the period ended June 30, 2025, heap leach production was significantly higher compared to the prior year due to

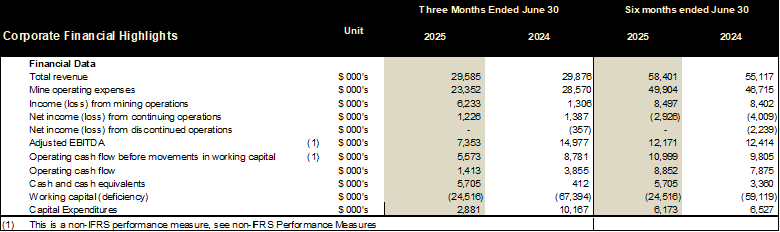

The Company generated revenue of

Cost of sales for the three months ended June 30, 2025, were

Total cash costs (including royalties) sold was

Net income from continued and discontinued operations for the three months ended June 30, 2025, was

The Company incurred general and administrative expenses of

Other loss of

Hedging Program

On April 26, 2025, the Company extended its limited hedging program with Ocean Partners UK Ltd. The hedge is constructed as a zero-cost collar with lower and upper boundaries of US

Outlook

Entering H2 2025 and beyond, Cerrado's MDN Heap Leach operations are benefiting from the recent improvements to its crushing infrastructure to grow and improve production rates. Higher gold prices have enabled the CIL plant to remain operational by processing lower grade stockpiles, and it is now set to benefit from the introduction of higher-grade ore from underground operations, which is expected to improve overall profitability and free cash flows.

The Company has maintained its 2025 annual production guidance to 55,000 - 60,000 GEO. AISC costs are expected decline in the second half of 2025 as production ramps up to deliver AISC of between

The 20,000-meter exploration program has begun and is focused on growing the known resources at MDN beyond those outlined in the most recent Mineral Resource Estimate ("MRE"). The focus remains on defining high grade-near surface targets that can readily be brought into the mine plan. The Company has developed an underground and a regional program to better understand the potential of known anomalies on the significant land package Cerrado holds at MDN. Drilling is now underway.

During Q2 2025 the Company closed the acquisition of all of the outstanding common shares of Ascendant Resources Inc. not already owned by the Company and thereby obtaining an effective

At the Lagoa Salgada project, work continued across key workstreams with the goal of reaching a construction decision by Q1 2026. Ongoing metallurgical testing has already delivered positive improvements and is expected to be completed imminently. Management considers the previously reported improvements to Capex and Opex at Lagoa to be very encouraging, and they will be integrated into the optimization program for the OFS. Significant positive results using Dense Media Separation on the Stockworks zone has warranted further analysis on mine and plant design. The expected result is a reduction in processing costs from this domain, but requires further detailed work to be undertaken before it can be incorporated into the OFS. Parallel workstreams to complete the OFS are currently ongoing and it is expected that the completion of the OFS will occur by year end.

The Company is also advancing the approval in the Environment Impact Assessment (EIA), after successfully receiving Article 16 approval from the Portuguese regulators. The Company expects to submit its revised EIA in October.

At the Mont Sorcier high grade and high purity DRI iron project operated by Cerrado's wholly owned subsidiary Voyager Metals Inc., work continued to advance the project with several workstreams related to permitting, social license and the initiation of the Feasibility Study which is targeted to be completed during Q1 2026. The high quality of the concentrate, grading over

Conference Call Details

Cerrado Management will host a conference call on August 25, 2025, at 11:00 AM EDT to discuss the Q2 Financial and Operational results. The presentation for the call can be found on the investor page on Cerrado Gold's website at cerradogold.com. Call details are as follows:

Pre-Registration for Conference Call

Participants can preregister for the conference by navigating to:

Participants will receive dial-in numbers to connect directly upon registration completion.

Those without internet access or unable to pre-register may dial in by calling:

PARTICIPANT DIAL IN (TOLL FREE): 1-833-752-3576

PARTICIPANT INTERNATIONAL DIAL IN: 1-647-846-8340

PARTICIPANT INTERNATIONAL DIAL IN: 1-647-846-8340

Review of Technical Information

The scientific and technical information in this press release has been reviewed and approved by Andrew Croal P.Eng, Chief Technical Officer for Cerrado Gold, who is a Qualified Person as defined in National Instrument 43-101.

About Cerrado

Cerrado Gold is a Toronto-based gold production, development, and exploration company. The Company is the

In Argentina, Cerrado is maximizing asset value at its Minera Don Nicolas operation through continued operational optimization and is growing production through its operations at the Las Calandrias heap leach project. An extensive campaign of exploration is ongoing to further unlock potential resources in our highly prospective land package in the heart of the Deseado Masiff.

In Portugal, Cerrado focused on the exploration and development of the highly prospective Lagoa Salgada VMS project located on the prolific Iberian Pyrite Belt in Portugal. The Lagoa Salgada project is a high-grade polymetallic project, demonstrating a typical mineralization endowment of zinc, copper, lead, tin, silver, and gold. Extensive exploration upside potential lies both near deposit and at prospective step-out targets across the large 7,209-hectare property concession. Located just 80km from Lisbon and surrounded by exceptional infrastructure, Lagoa Salgada offers a low-cost entry to a significant exploration and development opportunity, already showing its mineable scale and cashflow generation potential.

In Canada, Cerrado holds a

For more information about Cerrado please visit our website at: .

Mark Brennan

CEO and Chairman

Mike McAllister

Vice President, Investor Relations

Tel: +1-647-805-5662

[email protected]

Disclaimer

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This press release contains statements that constitute "forward-looking information" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements contained in this press release include, without limitation, statements regarding the business and operations of Cerrado, anticipated continued improvements in operating results and working capital position, future production and grade estimates, future cashflows, expectations regarding the CIL plant processing lower grade stockpiles, the potential for improvement at MDN's heap leach operation and higher grade ore being processed at MDN, expectations regarding improvements in operating costs at MDN including reduction in AISC, additional capacity being added at the heap leach operation, the potential of underground operation at MDN, the anticipated timing of completing the feasibility study at the Mont Sorcier project, the potential for a construction decision at Lagoa Salgada and the expected timing and likelihood of receiving approval of the environmental impact assessment at Lagoa Salgada. In making the forward- looking statements contained in this press release, Cerrado has made certain assumptions. Although Cerrado believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, Cerrado disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

SOURCE: Cerrado Gold Inc.

View the original on ACCESS Newswire