Plains to Acquire 55% Interest in EPIC Crude Holdings, LP

Plains All American Pipeline (Nasdaq: PAA) has announced a strategic acquisition of a 55% non-operated interest in EPIC Crude Holdings for approximately $1.57 billion, which includes about $600 million of debt. The transaction includes a potential $193 million earnout payment if pipeline capacity expansion reaches 900,000 barrels per day by 2027.

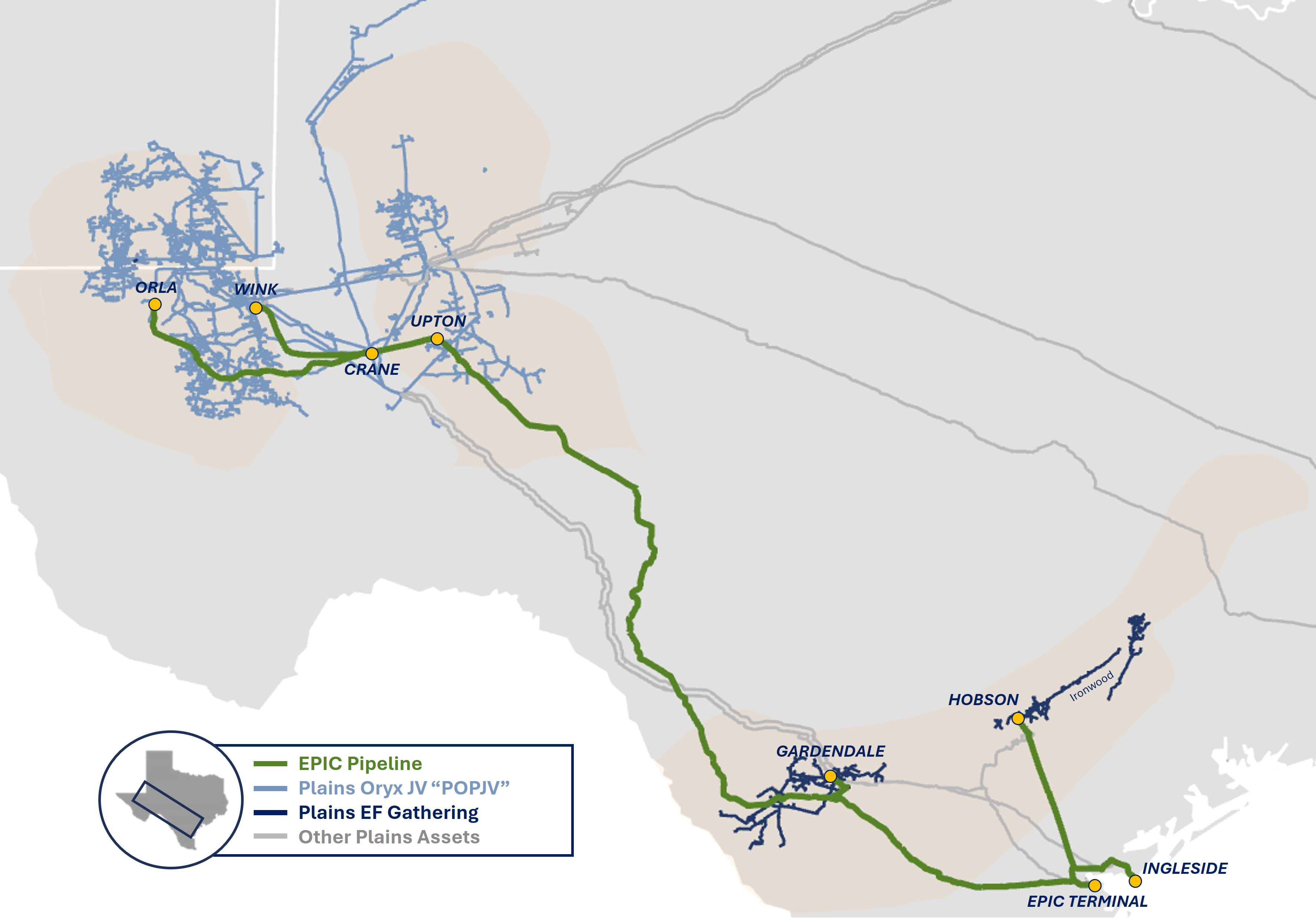

EPIC Crude Holdings owns and operates the EPIC Pipeline, which spans 800 miles connecting Permian and Eagle Ford basins to Corpus Christi, with a current capacity of 600,000 barrels per day. The system includes 7 million barrels of operational storage and over 200,000 barrels per day of export capacity.

The acquisition, expected to close by early 2026, will be immediately accretive to distributable cash flow and is projected to generate mid-teens unlevered returns. The remaining 45% stake is owned by an Ares Management Corporation portfolio company.

Plains All American Pipeline (Nasdaq: PAA) ha annunciato l'acquisizione strategica di una quota non operativa del 55% in EPIC Crude Holdings per circa $1,57 miliardi, comprensivi di circa $600 milioni di debito. L'operazione prevede un potenziale pagamento earnout di $193 milioni se la capacità del pipeline raggiungerà 900.000 barili al giorno entro il 2027.

EPIC Crude Holdings possiede e gestisce l'EPIC Pipeline, che si estende per 800 miglia collegando i bacini Permian ed Eagle Ford a Corpus Christi, con una capacità attuale di 600.000 barili al giorno. Il sistema include 7 milioni di barili di stoccaggio operativo e oltre 200.000 barili al giorno di capacità di esportazione.

L'acquisizione, prevista in chiusura entro i primi mesi del 2026, sarà immediatamente accretiva al cash flow distribuibile e dovrebbe generare rendimenti unlevered a metà dei due cifre. Il restante 45% è detenuto da una società del portafoglio di Ares Management Corporation.

Plains All American Pipeline (Nasdaq: PAA) ha anunciado la adquisición estratégica de una participación no operativa del 55% en EPIC Crude Holdings por aproximadamente $1.57 mil millones, que incluye alrededor de $600 millones de deuda. La transacción contempla un posible pago earnout de $193 millones si la capacidad del oleoducto alcanza 900.000 barriles por día para 2027.

EPIC Crude Holdings posee y opera el EPIC Pipeline, que recorre 800 millas conectando las cuencas Permian y Eagle Ford con Corpus Christi, con una capacidad actual de 600.000 barriles por día. El sistema incluye 7 millones de barriles de almacenamiento operativo y más de 200.000 barriles por día de capacidad de exportación.

La adquisición, que se espera cierre a principios de 2026, será inmediatamente acreedora al flujo de caja distribuible y se proyecta que genere rendimientos unlevered de mitad de dos dígitos. El 45% restante pertenece a una compañía del portafolio de Ares Management Corporation.

Plains All American Pipeline (Nasdaq: PAA)�� �� $15.7���(�� $6억의 부�� 포함)�� EPIC Crude Holdings�� 55% 비운영지���� 전략적으�� 인수한다�� 발표했습니다. 거래에는 2027년까지 파이프라�� 처리 능력�� 일일 90�� 배럴�� 도달�� 경우 $1.93억의 언아��(earnout) 지�� 가능성�� 포함되어 있습니다.

EPIC Crude Holdings�� 퍼미��(Permian) �� 이글포드(Eagle Ford) 분지와 코퍼�� 크리스티(Corpus Christi)�� 연결하는 800마일 길이�� EPIC 파이프라인을 소유·운영하고 있으�� 현재 처리 능력은 일일 60�� 배럴입니��. �� 시스템은 700�� 배럴�� 운용 저�� 능력�� 일일 20�� 배럴 이상�� 수출 용량�� 포함합니��.

�� 인수�� 2026�� 초까지 완료�� 것으�� 예상되며 배당가능현금흐��(distributable cash flow)�� 즉시 기여하고 레버리지�� 제외�� 수익��(unlevered)은 중간대�� �� 자릿수로 추정됩니��. 나머지 45% 지분은 Ares Management Corporation 포트폴리�� 회사가 보유하고 있습니다.

Plains All American Pipeline (Nasdaq: PAA) a annoncé l'acquisition stratégique d'une participation non opérée de 55 % dans EPIC Crude Holdings pour environ 1,57 milliard de dollars, incluant environ 600 millions de dollars de dette. L'opération comprend un éventuel paiement d'earnout de 193 millions de dollars si la capacité du pipeline atteint 900 000 barils par jour d'ici 2027.

EPIC Crude Holdings possède et exploite l'EPIC Pipeline, qui s'étend sur 800 miles reliant les bassins Permian et Eagle Ford à Corpus Christi, avec une capacité actuelle de 600 000 barils par jour. Le système comprend 7 millions de barils de stockage opérationnel et plus de 200 000 barils par jour de capacité d'exportation.

La transaction, dont la clôture est prévue début 2026, sera immédiatement accretive pour le flux de trésorerie distribuable et devrait générer des rendements unlevered de l'ordre de la mi-deux chiffres. Les 45 % restants sont détenus par une société du portefeuille d'Ares Management Corporation.

Plains All American Pipeline (Nasdaq: PAA) hat den strategischen Erwerb eines 55% nicht-operativen Anteils an EPIC Crude Holdings für rund $1,57 Milliarden bekanntgegeben, einschließlich etwa $600 Millionen Schulden. Die Transaktion sieht eine mögliche $193 Millionen Earnout-Zahlung vor, falls die Pipeline-Kapazität bis 2027 900.000 Barrel pro Tag erreicht.

EPIC Crude Holdings besitzt und betreibt die EPIC Pipeline, die sich über 800 Meilen erstreckt und die Permian- und Eagle-Ford-Becken mit Corpus Christi verbindet, mit einer aktuellen Kapazität von 600.000 Barrel pro Tag. Das System umfasst 7 Millionen Barrel Betriebs- und über 200.000 Barrel pro Tag �����ǰ��ٰ첹�貹������ä��.

Die Übernahme, die voraussichtlich bis Anfang 2026 abgeschlossen sein wird, wird sofort das distributable Cashflow steigern und dürfte unverschuldet mittlere zweistellige Renditen erzeugen. Die verbleibenden 45% gehören zu einer Portfoliogesellschaft von Ares Management Corporation.

- Immediately accretive to distributable cash flow with mid-teens unlevered returns expected

- System underpinned by long-term minimum volume commitments from high-quality customers

- Significant operational capacity with 600,000 barrels per day and expansion potential

- Strategic enhancement of Plains' Permian wellhead to water strategy

- Leverage ratio expected to remain within target range despite transaction size

- Potential for additional synergies through expanded scale and integration

- Large debt component of $600 million included in acquisition price

- Non-operated interest position limits operational control

- Transaction completion subject to regulatory approval and closing conditions

- Significant capital outlay of $1.57 billion with additional potential earnout of $193 million

Insights

Plains' $1.57B acquisition of EPIC Crude strengthens its Permian-to-Gulf Coast infrastructure position with immediate cash flow benefits.

Plains All American's $1.57 billion acquisition of a 55% stake in EPIC Crude Holdings represents a strategic enhancement of their midstream capabilities, particularly strengthening their Permian Basin to Gulf Coast connectivity. The EPIC Crude Oil Pipeline system includes 800 miles of long-haul pipelines with 600,000+ barrels per day capacity and 7 million barrels of storage, providing crucial takeaway capacity from the Permian and Eagle Ford basins to Corpus Christi export terminals.

This transaction solidifies Plains' "wellhead to water" strategy by creating a more comprehensive, integrated system linking their existing gathering assets directly to Gulf Coast export infrastructure. The deal structure includes existing minimum volume commitments from customers, providing revenue stability, while also incorporating a potential $193 million earnout if pipeline capacity expands to 900,000 barrels per day by 2027 - indicating confidence in future Permian production growth.

The acquisition multiple appears reasonable but will improve as synergies materialize through operational integration with Plains' existing assets. Management expects the transaction to be immediately accretive to distributable cash flow with mid-teens unlevered returns, suggesting the acquisition price represents approximately 7-8x EBITDA before synergies. Plains plans to finance the purchase using its balance sheet capacity while maintaining leverage within target ranges, demonstrating financial discipline. The strategic partnership with Ares Management (45% owner) creates alignment with an experienced operator while giving Plains significant influence without operational responsibility.

This vertical integration strengthens Plains' competitive position against peer midstream companies by offering producers more seamless transportation options from wellhead to export terminals, potentially commanding premium rates through enhanced service offerings.

Enhancing Wellhead to Water Strategy

HOUSTON, Sept. 02, 2025 (GLOBE NEWSWIRE) -- Plains All American Pipeline, L.P. (Nasdaq: ) and Plains GP Holdings (Nasdaq: ) (collectively, “Plains��) announced today that a wholly owned subsidiary has entered into a definitive agreement to acquire from subsidiaries of Diamondback Energy, Inc. and Kinetik Holdings Inc., a

The EPIC Pipeline provides long-haul crude oil takeaway from the Permian and Eagle Ford basins to the Gulf Coast market at Corpus Christi. EPIC Crude Holdings�� assets include:

- Approximately 800 miles of long-haul pipelines, including the EPIC Pipeline

- Operating capacity of over 600,000 barrels per day with low-cost expansion capabilities

- Approximately 7 million barrels of operational storage

- Over 200,000 barrels per day of export capacity

Transaction Highlights:

- Ability to provide customers with additional upstream connectivity and enhanced downstream market connectivity and optionality

- Enhances and expands Plains�� existing Permian wellhead to water strategy

- Synergy potential and Permian growth improves acquisition multiple over the next few years

- System underpinned by long-term minimum volume commitments from high-quality customers

- Expect pro forma leverage ratio to remain within target range (excluding NGL divestiture proceeds); strong balance sheet utilized to finance transaction with cash and debt

- Expected to be immediately accretive to distributable cash flow, supporting additional return of capital opportunities

“We are excited to work with the��EPIC Management team. This transaction strengthens our position as the premier crude oil midstream provider, complements our asset footprint and enhances our customer offering. The combination of our stake in EPIC Crude Holdings coupled with our existing integrated Permian and Eagle Ford assets enhances our commitment to offering a high level of connectivity and flexibility for our customers. By further linking our Permian and Eagle Ford gathering systems to Corpus Christi, we are enhancing market access and ensuring our customers have reliable, cost-effective routes to multiple demand centers,�� said Willie Chiang, Chairman, CEO and President.

“The combined assets will allow us to capture synergies through additional service offerings, and drive value via expanded scale and integration. Our financial flexibility enables us to finance the acquisition utilizing our balance sheet, while maintaining a pro-forma leverage ratio within our established leverage target range. Ultimately, our interest in EPIC Crude Holdings will not only benefit Plains and our partners but also our unit holders by creating further return of capital opportunities.��

The transaction is expected to be completed by early 2026, subject to customary closing conditions, including clearance under the Hart-Scott-Rodino Antitrust Improvements Act of 1976.

Forward-Looking Statements

Except for the historical information contained herein, the matters discussed in this release consist of forward-looking statements including, but not limited to, statements regarding the proposed acquisition of an interest in EPIC Crude Holdings and the terms, timing and anticipated operational, financial and strategic benefits thereof. There are a number of risks and uncertainties that could cause actual results or outcomes to differ materially from results or outcomes anticipated in the forward-looking statements. These risks and uncertainties include, among other things: changes in or disruptions to economic, market or business conditions; substantial declines in commodity prices or demand for crude oil; third-party constraints; legal constraints (including the impact of governmental regulations, orders or policies); unforeseen delays with respect to the receipt of regulatory approvals and completion of other closing conditions; and other factors and uncertainties inherent in transactions of the type discussed herein or in our business as discussed in PAA’s and PAGP’s filings with the Securities and Exchange Commission.

About Plains��

PAA is a publicly traded master limited partnership that owns and operates midstream energy infrastructure and provides logistics services for crude oil and natural gas liquids (NGL). PAA owns an extensive network of pipeline gathering and transportation systems, in addition to terminalling, storage, processing, fractionation and other infrastructure assets serving key producing basins, transportation corridors and major market hubs and export outlets in the United States and Canada. On average, PAA handles approximately eight million barrels per day of crude oil and NGL. ��

PAGP is a publicly traded entity that owns an indirect, non-economic controlling general partner interest in PAA and an indirect limited partner interest in PAA, one of the largest energy infrastructure and logistics companies in North America. ��

PAA and PAGP are headquartered in Houston, Texas. More information is available at .��

Investor Relations Contacts:��

Blake Fernandez

Michael Gladstein��

��

(866) 809-1291��

A photo accompanying this announcement is available at:��