McEwen Inc. and Canadian Gold Corp. Announce Letter of Intent

McEwen Inc. (NYSE: MUX) has entered into a binding letter of intent to acquire Canadian Gold Corp. (TSX-V:CGC) through a plan of arrangement. Under the proposed transaction, Canadian Gold shareholders will receive 0.0225 McEwen shares for each Canadian Gold share, representing a 26% premium to Canadian Gold's 30-day VWAP.

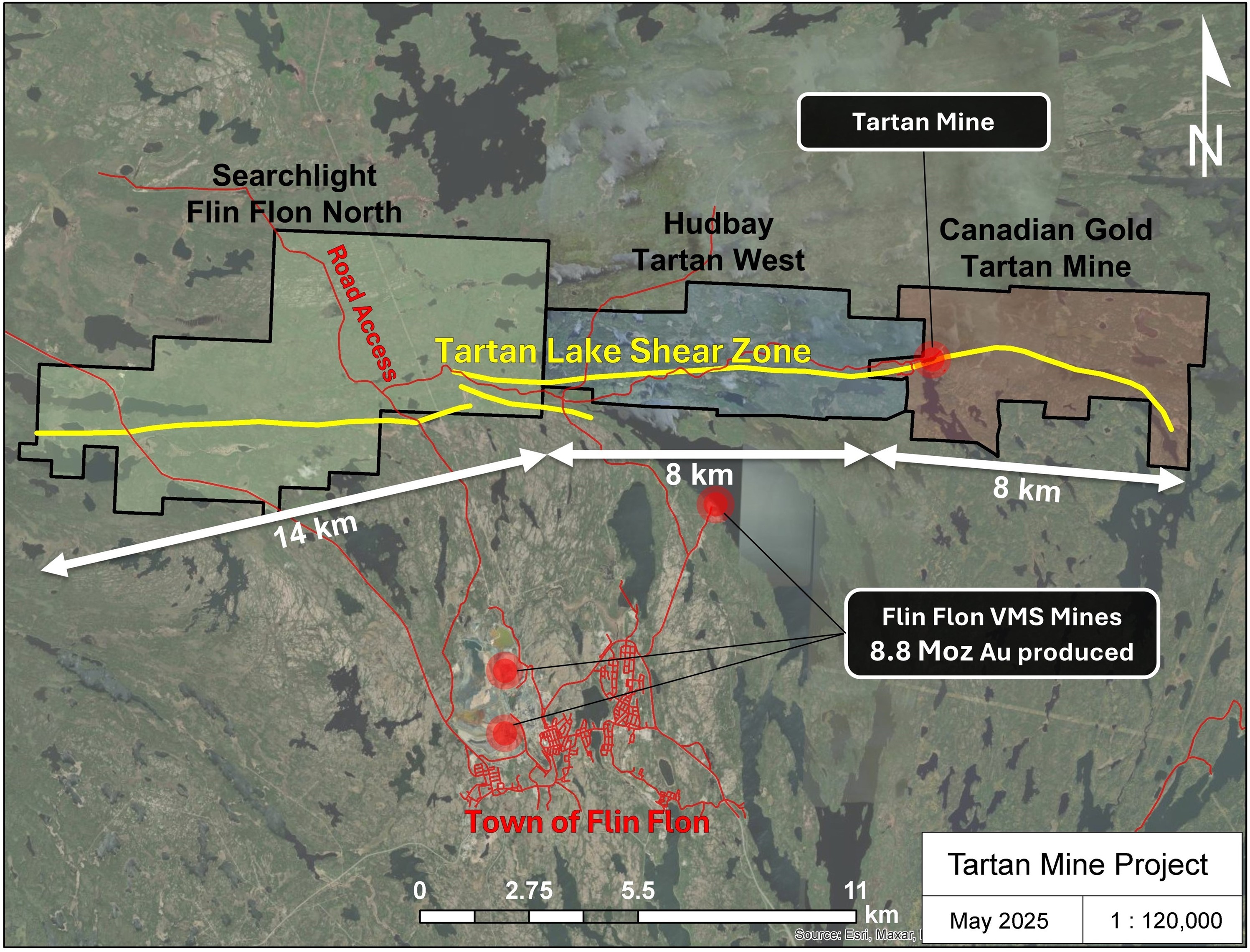

The deal's primary asset is Canadian Gold's Tartan Mine in Manitoba, a high-grade former gold producer with existing infrastructure. The mine previously produced 47,000 ounces of gold between 1987-1989. Post-transaction, Canadian Gold shareholders will own approximately 8.2% of the combined company.

The transaction requires 66��% approval from Canadian Gold shareholders and regulatory approvals. Closing is expected by the end of 2025, with potential production restart at Tartan Mine within 24-36 months.

McEwen Inc. (NYSE: MUX) ha firmato una lettera d'intenti vincolante per acquisire Canadian Gold Corp. (TSX-V: CGC) tramite un piano di riorganizzazione. Nell'ambito della transazione proposta, gli azionisti di Canadian Gold riceveranno 0,0225 azioni McEwen per ogni azione Canadian Gold, corrispondente a un premio del 26% rispetto al prezzo medio ponderato per il volume (VWAP) degli ultimi 30 giorni di Canadian Gold.

L'asset principale dell'accordo è la miniera Tartan in Manitoba di Canadian Gold, un'ex miniera d'oro ad alto tenore con infrastrutture esistenti. La miniera ha prodotto in passato 47.000 once d'oro tra il 1987 e il 1989. Dopo la transazione, gli azionisti di Canadian Gold deterranno circa l'8,2% della società combinata.

La transazione richiede l'approvazione del 66��% degli azionisti di Canadian Gold e le autorizzazioni regolamentari. La chiusura è prevista entro la fine del 2025, con un possibile riavvio della produzione nella miniera Tartan entro 24-36 mesi.

McEwen Inc. (NYSE: MUX) ha firmado una carta de intención vinculante para adquirir a Canadian Gold Corp. (TSX-V: CGC) mediante un plan de reorganización. Según la transacción propuesta, los accionistas de Canadian Gold recibirán 0,0225 acciones de McEwen por cada acción de Canadian Gold, lo que representa una prima del 26% sobre el VWAP de 30 días de Canadian Gold.

El principal activo del acuerdo es la mina Tartan en Manitoba de Canadian Gold, una antigua productora de oro de alta ley con infraestructura existente. La mina produjo anteriormente 47,000 onzas de oro entre 1987 y 1989. Tras la transacción, los accionistas de Canadian Gold poseerán aproximadamente el 8,2% de la empresa combinada.

La transacción requiere la aprobación del 66��% de los accionistas de Canadian Gold y las aprobaciones regulatorias. Se espera que el cierre se realice a finales de 2025, con un posible reinicio de la producción en la mina Tartan dentro de 24-36 meses.

McEwen Inc. (NYSE: MUX)��� Canadian Gold Corp. (TSX-V: CGC)�� 합병 계획�� 통해 인수하기 위한 구속�� 있�� 의향서를 체결했습니다. 제안�� 거래�� 따라 Canadian Gold�� 주주들은 Canadian Gold 주식 1주당 0.0225 McEwen 주식�� 받게 되며, 이�� Canadian Gold�� 30�� VWAP 대�� 26% 프리미엄�� 해당합니��.

이번 거래�� 주요 자산은 Manitoba�� 위치�� Canadian Gold�� Tartan 광산으로, 기존 인프라를 갖춘 고품�� �� 생산 광산입니��. �� 광산은 1987년부�� 1989�� 사이�� 47,000온스�� ���� 생산했습니다. 거래 완료 �� Canadian Gold 주주들은 합병 회사�� �� 8.2%�� 소유하게 됩니��.

거래��� Canadian Gold 주주들의 66��% 승인�� 규제 당국�� 승인�� 필요�� 합니��. 거래 마감은 2025�� 말까지 예상되며, Tartan 광산�� 생산 재개��� 24��36갵ӛ� 내에 가능할 것으�� 보입니다.

McEwen Inc. (NYSE : MUX) a signé une lettre d'intention contraignante pour acquérir Canadian Gold Corp. (TSX-V : CGC) via un plan d'arrangement. Dans le cadre de la transaction proposée, les actionnaires de Canadian Gold recevront 0,0225 actions McEwen pour chaque action Canadian Gold, représentant une prime de 26% par rapport au VWAP sur 30 jours de Canadian Gold.

L'actif principal de l'accord est la mine Tartan au Manitoba de Canadian Gold, une ancienne mine d'or à haute teneur avec des infrastructures existantes. La mine a produit 47 000 onces d'or entre 1987 et 1989. Après la transaction, les actionnaires de Canadian Gold détiendront environ 8,2% de la société combinée.

La transaction nécessite l'approbation à 66��% des actionnaires de Canadian Gold ainsi que les approbations réglementaires. La clôture est prévue d'ici la fin 2025, avec une possible reprise de la production à la mine Tartan dans les 24 à 36 mois.

McEwen Inc. (NYSE: MUX) hat eine verbindliche Absichtserklärung zum Erwerb von Canadian Gold Corp. (TSX-V: CGC) im Rahmen eines Umstrukturierungsplans unterzeichnet. Im Rahmen der vorgeschlagenen Transaktion erhalten die Aktionäre von Canadian Gold für jede Canadian Gold-Aktie 0,0225 McEwen-Aktien, was einer Prämie von 26% gegenüber dem 30-Tage-VWAP von Canadian Gold entspricht.

Das Hauptvermögen der Vereinbarung ist die Tartan-Mine in Manitoba von Canadian Gold, eine ehemalige Goldmine mit hohem Gehalt und vorhandener Infrastruktur. Die Mine produzierte zwischen 1987 und 1989 47.000 Unzen Gold. Nach der Transaktion werden die Aktionäre von Canadian Gold etwa 8,2% am kombinierten Unternehmen halten.

Die Transaktion erfordert die 66��% Zustimmung der Aktionäre von Canadian Gold sowie behördliche Genehmigungen. Der Abschluss wird bis Ende 2025 erwartet, mit einem möglichen Produktionsneustart in der Tartan-Mine innerhalb von 24-36 Monaten.

- Premium of 26% offered to Canadian Gold shareholders

- Acquisition adds high-grade former producing mine with existing infrastructure

- Potential to restart production at Tartan Mine within 24-36 months

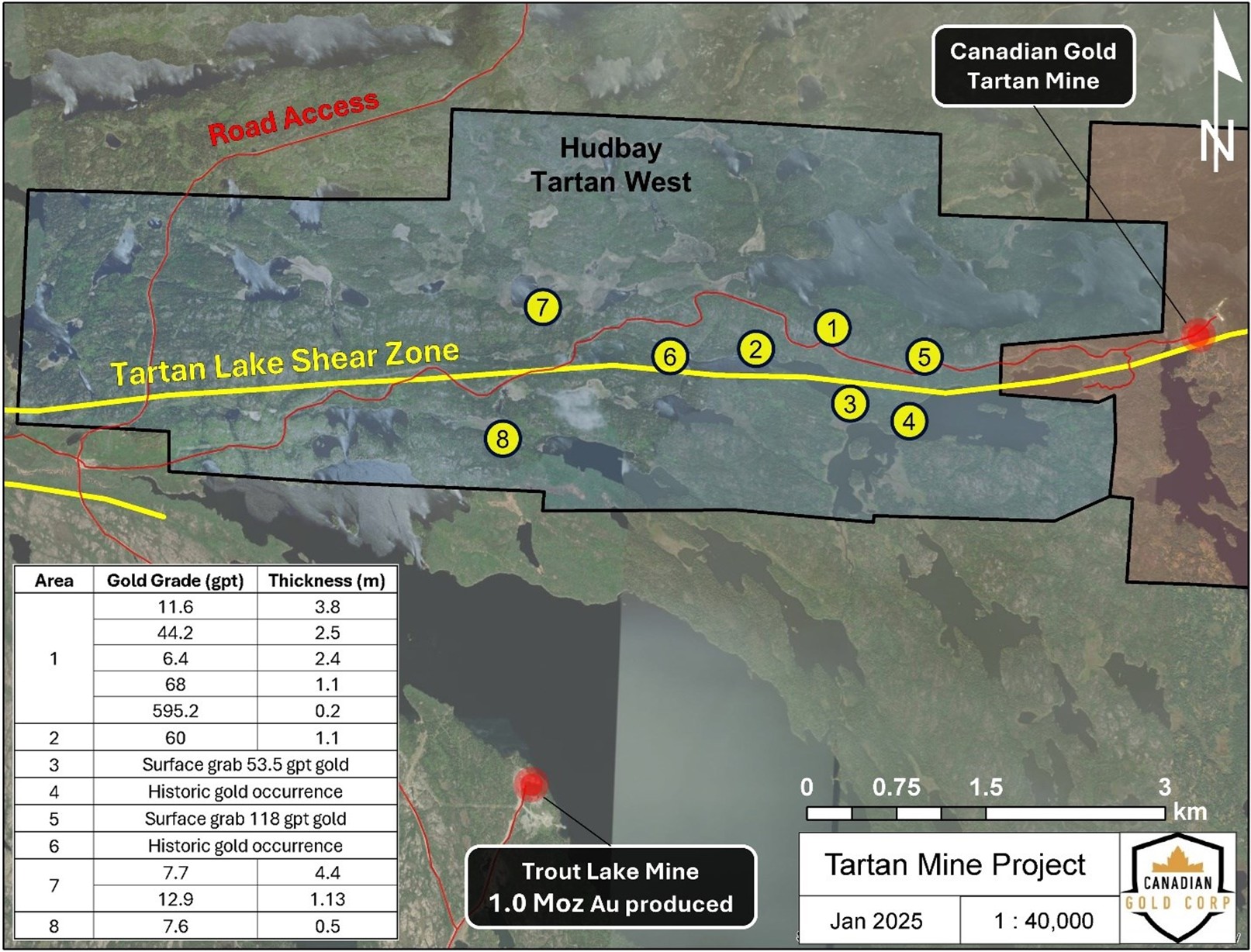

- Property strike length recently expanded from 8km to 29.5km

- Access to skilled workforce, low-cost renewable energy, and mining tax credits in Manitoba

- Dilution for existing McEwen shareholders as Canadian Gold shareholders will own 8.2% of combined company

- Break fee of C$2.2 million payable to McEwen in certain circumstances

- Rob McEwen's share acquisition limited to 1% without shareholder approval

Insights

McEwen's acquisition of Canadian Gold adds high-grade Tartan Mine to portfolio with 26% premium, strengthening development pipeline with near-term production potential.

McEwen Inc. has entered into a binding letter of intent to acquire Canadian Gold Corp. in an all-stock transaction that values Canadian Gold at a

The strategic rationale behind this acquisition is compelling. McEwen gains the Tartan Mine in Manitoba, a high-grade former producer with existing infrastructure that could potentially restart production within 24-36 months. The mine's location near Flin Flon provides access to a skilled workforce, eliminating the need for a mining camp. The acquisition also includes greenfield exploration properties in Hammond Reef and Malartic South adjacent to major Canadian gold operations.

From a development perspective, the Tartan Mine offers significant advantages. The asset features existing infrastructure including a ramp to 320 meters below surface, a former mill footprint, road access, and power connections. Canadian Gold recently expanded the property's strike length from 8 kilometers to 29.5 kilometers along a key regional shear zone, substantially increasing exploration potential. Manitoba's mining-friendly jurisdiction with low-cost renewable energy and attractive tax incentives further enhances the project's economics.

This transaction requires approval from

For Canadian Gold shareholders, the transaction provides immediate premium value plus access to McEwen's technical expertise and financial resources to advance the Tartan Mine toward production. For McEwen, the deal enhances its development pipeline with a high-grade Canadian asset that leverages the company's existing operational expertise from its Fox Complex.

TORONTO and FLIN FLON, Manitoba, July 28, 2025 (GLOBE NEWSWIRE) -- McEwen Inc. (��McEwen��) (NYSE: MUX) (TSX:MUX) and Canadian Gold Corp. (��Canadian Gold��) (TSX-V:CGC) are pleased to announce that they have entered into a binding letter of intent (the "LOI") on July 27, 2025 in respect of a proposed transaction (the "Proposed Transaction"), whereby McEwen would acquire all of the issued and outstanding securities of Canadian Gold by way of plan of arrangement. If the Proposed Transaction is completed, Canadian Gold would become a wholly-owned subsidiary of McEwen.

Canadian Gold's principal asset is its

The Proposed Transaction

Pursuant to the terms of the Proposed Transaction, each Canadian Gold common share (a ��Canadian Gold Share��) would entitle its holder to receive 0.0225 of a McEwen common share (a “McEwen Share��) (the "Exchange Ratio"). The Exchange Ratio represents an offer price of CDN

The LOI provides for the parties to enter into a definitive arrangement agreement (the "Arrangement Agreement") setting out the final terms and conditions of the Proposed Transaction. Upon the execution of the Arrangement Agreement, McEwen and Canadian Gold will issue a subsequent news release containing any additional terms of the Proposed Transaction.

Benefits of the Transaction for Canadian Gold Shareholders:

- Ability to fund development and construction of the Tartan Mine��with McEwen’s existing financial resources;��

- Access to McEwen’s technical team with a strong track record in gold exploration, underground mining and mine development;

- Exposure to McEwen’s diversified portfolio of commodities, producing operations, development projects and royalties; and

- An attractive premium of approximately

26% to the 30-day VWAP of the Canadian Gold Shares and the enhanced liquidity of McEwen Shares from dual stock exchanges listings within the US and Canada.

Benefits of the Transaction for McEwen Shareholders:

- Adds an increasingly rare, high-grade former producing mine in Canada with existing infrastructure. Situated close to Flin Flon, Manitoba (Fig. 1), the Tartan Mine benefits from access to a skilled mining workforce and does not require the construction of a mining camp.

- Proposed development of the Tartan Mine has many similarities to McEwen's Fox Complex (ramp access, mining method and proposed process plant design), leveraging McEwen’s internal skills;

- Enhances McEwen’s development and production pipeline with the potential to re-commence production at the Tartan Mine within 24 to 36 months; and

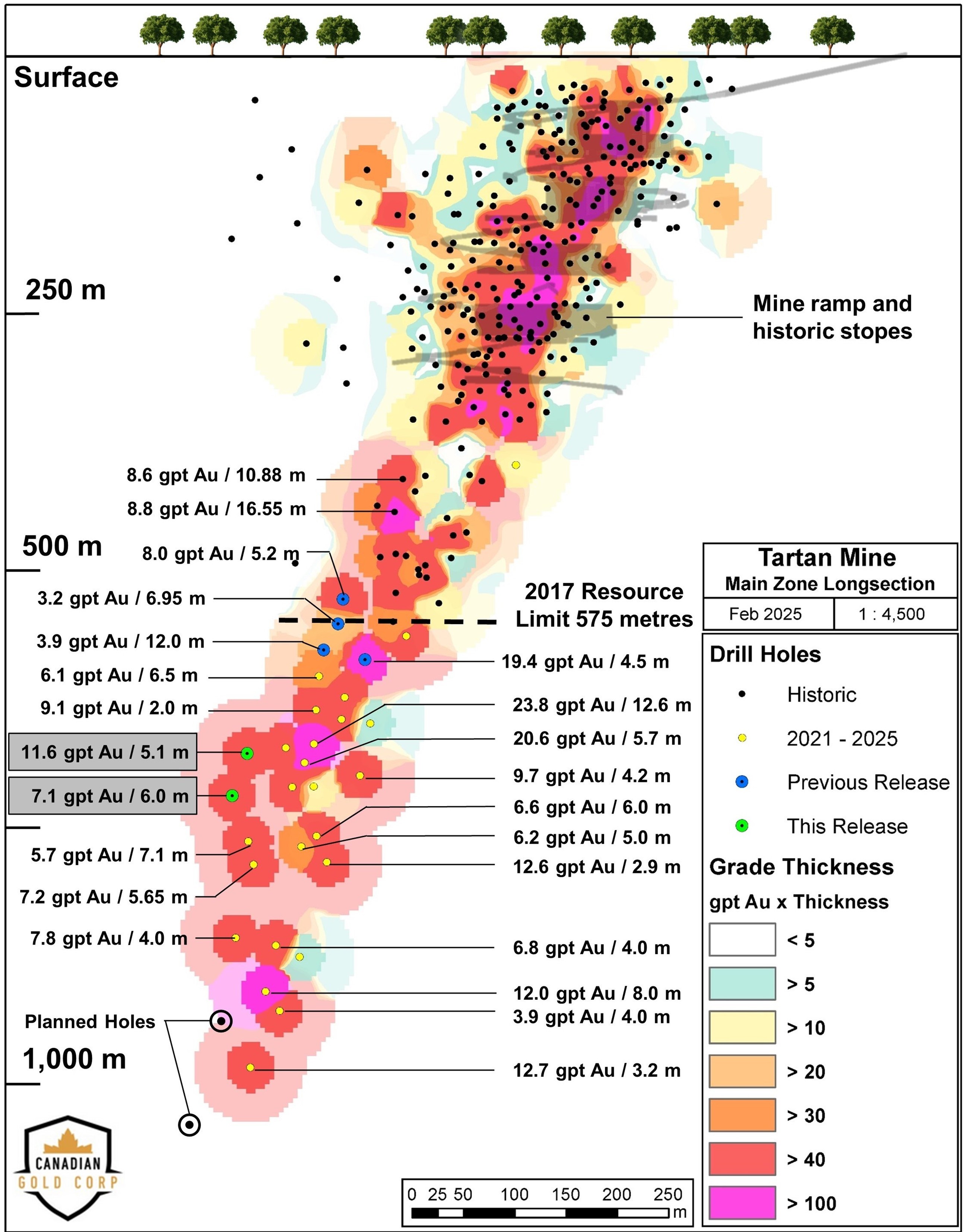

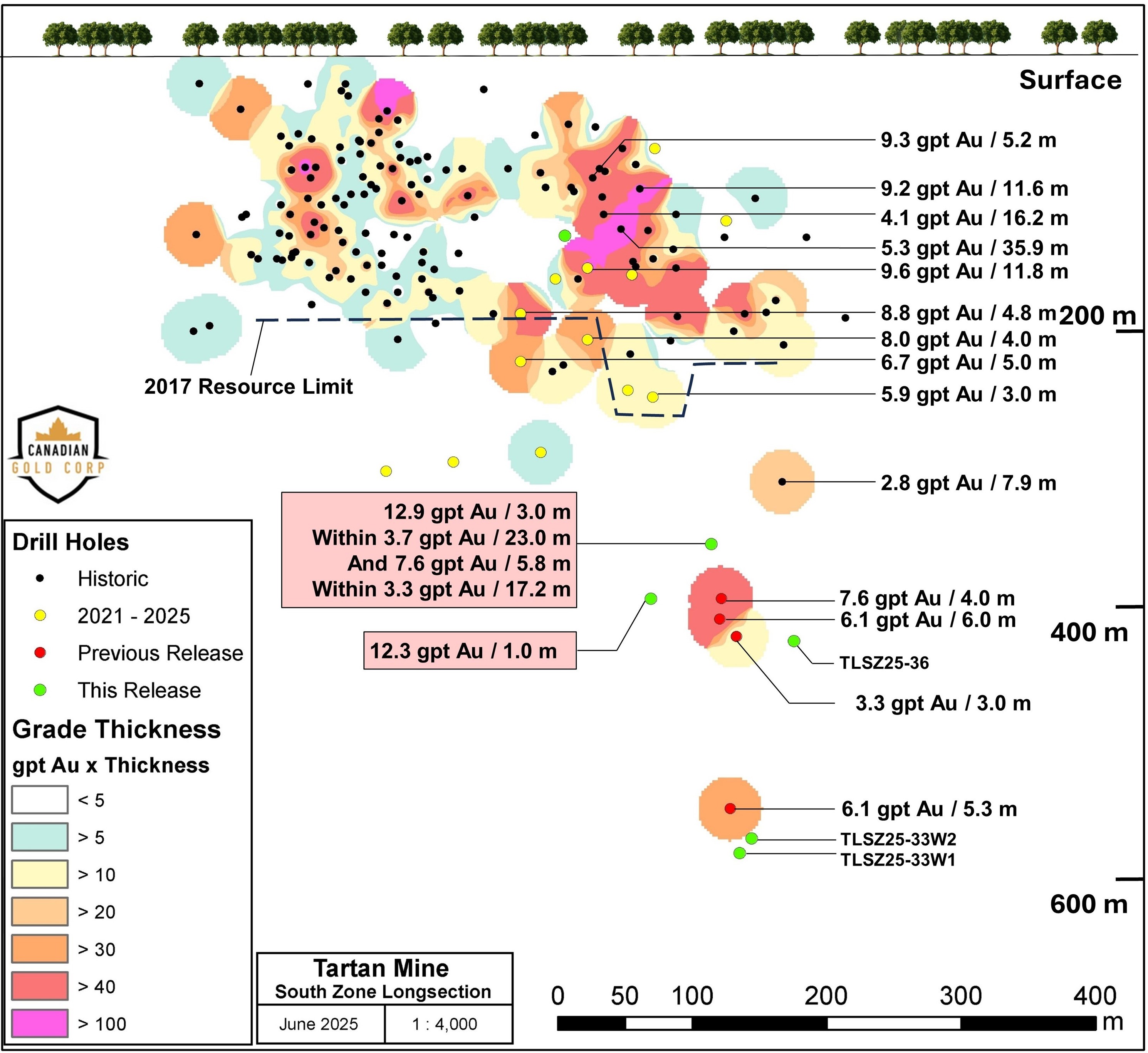

- Substantial exploration potential, which has been recently increased by Canadian Gold’s optioning of the adjoining Tartan West property (Fig. 2, 3 & 4).

"I am enthusiastic about the Tartan Mine for several reasons. First, it is a high-grade gold deposit with strong exploration potential in Canada. Second, the existing infrastructure, including the mine ramp, roads, and power, provides an opportunity to restart operations within a relatively short timeframe. Third, Manitoba stands out as one of the world's premier mining jurisdictions, offering a skilled workforce, low-cost renewable energy, and attractive mining tax credits. Additionally, the Tartan Mine shares many similarities with our Fox Complex, enabling us to leverage our internal expertise and resources to maximize its potential," said Rob McEwen, Chairman and Chief Owner of McEwen Inc.

“I’d like to thank Mr. McEwen, McEwen Inc. and all our shareholders for the support of Canadian Gold Corp. over the past several years. We believe that this acquisition by McEwen is a fantastic result for our shareholders as we will benefit from a broader portfolio of high-quality assets,�� said Peter Shippen, Chairman of Canadian Gold Corp.

Details of the Proposed Transaction

- The Proposed Transaction is expected to be completed by way of a court-approved plan of arrangement under the Business Corporations Act (British Columbia). Under the terms of the LOI, McEwen will acquire all of the issued and outstanding Canadian Gold Shares in exchange for McEwen Shares on the basis of the Exchange Ratio. Outstanding options and warrants to purchase Canadian Gold Shares would be exercisable prior to the closing of the Proposed Transaction (the "Closing"), in accordance with their respective terms. Any outstanding options and warrants not duly exercised prior to the Closing would be terminated without any additional compensation.

- In order to comply with NYSE rules, Mr. Rob McEwen will not be entitled to receive newly-issued shares of McEwen representing more than

1% of the currently issued and outstanding shares of McEwen without obtaining the prior approval of McEwen shareholders, which is expected to be voted on at the next annual meeting of McEwen shareholders. If such shareholder approval is not obtained, McEwen will pay for such excess shares in cash. - To be effective, the Proposed Transaction will require the approval of: (a) 66 ��% of the votes cast by shareholders of Canadian Gold; and, (b) a simple majority of the votes cast by minority Canadian Gold shareholders in accordance with Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101"), at a special meeting of Canadian Gold shareholders expected to take place by the end of 2025 (the "Canadian Gold Meeting"). In accordance with MI 61-101, the vote of the minority Canadian Gold shareholders will exclude, among others, the shares of Canadian Gold held by McEwen and Mr. Rob McEwen.

- The Arrangement Agreement will include provisions such as conditions to closing the Proposed Transaction, and representations and warranties and covenants customary for arrangement agreements. The LOI stipulates that the Arrangement Agreement will also include: (i) customary deal protection and non-solicitation provisions in favor of McEwen, including a break fee of��approximately C

$2.2 million ��payable to McEwen in certain circumstances; and (ii) provisions allowing Canadian Gold to consider and accept superior proposals, in compliance with its fiduciary duties.�� - Completion of the Proposed Transaction will be subject to customary closing conditions and receipt of necessary court and regulatory approvals, including approval of the TSX and the NYSE.

A copy of the LOI will be filed on McEwen's and Canadian Gold's SEDAR+ profiles at .

The Proposed Transaction was approved by the Board of Directors of both McEwen and Canadian Gold, based on the recommendation of their respective special committees comprised of independent and disinterested directors. These special committees reached their decisions after consulting with their independent legal and financial advisors.

Messrs. Rob McEwen and Ian Ball, recognizing their respective conflicts of interest as directors of McEwen and as shareholders/interested parties in Canadian Gold, abstained from voting on the approval of the Proposed Transaction by McEwen's Board of Directors. Similarly, Messrs. Alexander McEwen and Jim Downey acknowledged their conflicts of interest, as they were appointed to the Canadian Gold Board of Directors by Rob McEwen.

To ensure a thorough and impartial review of the Proposed Transaction, the special committees of both companies have engaged independent financial advisors. These advisors will prepare a formal valuation of the respective shares, as required by securities law, and provide an opinion that, subject to the assumptions, limitations, and qualifications outlined in the written opinion, the consideration to be exchanged is fair from a financial perspective.

Further details with respect to the Proposed Transaction will be included in the Arrangement Agreement and in an information circular to be mailed to Canadian Gold shareholders in connection with the Canadian Gold Meeting. Once available, a copy of the Arrangement Agreement will be filed on each of McEwen's and Canadian Gold's SEDAR+ profiles at and a copy of the information circular will be filed on Canadian Gold's SEDAR+ profile at .

Overview of Canadian Gold’s��Tartan Mine

The Tartan Mine is a former producing mine with significant infrastructure close to the town of Flin Flon, Manitoba. It has access to a skilled workforce, inexpensive renewable power and a supportive mining and taxation environment.

Tartan Mine produced 47,000 ounces of gold between 1987 and 1989. Recently, Canadian Gold announced two transactions that expanded the strike length of Tartan from 8 kilometers to 29.5 kilometers along a key regional shear zone. The expanded property has the benefit of leveraging the infrastructure at Tartan Mine that includes a ramp to 320 meters below surface, the footprint of the former 450 tpd mill, road access and power to the mine site.

About McEwen

McEwen provides its shareholders with exposure to gold, copper and silver in the Americas by way of its three mines located in the USA, Canada and Argentina and its large advanced-stage copper development project in Argentina. It also has a gold and silver mine on care and maintenance in Mexico. Its Los Azules copper project aims to become one of the world’s first regenerative copper mines and is committed to carbon neutrality by 2038.

Rob McEwen, Chairman and Chief Owner, has personally invested US

McEwen's shares are publicly traded on the New York Stock Exchange (NYSE) and the Toronto Stock Exchange (TSX) under the symbol "MUX".

McEwen Contact Info and Social Media

| WEB SITE | �� | SOCIAL MEDIA | �� | �� |

| �� | McEwen | Facebook: | ||

| �� | �� | LinkedIn: | ||

| CONTACT INFORMATION | �� | X: | ||

| 150 King Street West | �� | Instagram: | ||

| Suite 2800, PO Box 24 | �� | �� | �� | �� |

| Toronto, ON, Canada | �� | McEwen Copper | Facebook: | |

| M5H 1J9 | �� | LinkedIn: | ||

| �� | �� | X: | ||

| Relationship with Investors: | �� | Instagram: | ||

| (866)-441-0690 - Toll free line | �� | �� | �� | �� |

| (647)-258-0395 | �� | Rob McEwen | Facebook: | |

| Mihaela Iancu ext. 320 | �� | LinkedIn: | ||

| [email protected] | �� | X: |

About Canadian Gold

Canadian Gold Corp. is a Canadian-based mineral exploration and development company whose objective is to expand the high-grade gold resource at the past producing Tartan Mine, located in Flin Flon, Manitoba. The historic Tartan Mine currently has a 2017 Indicated mineral resource estimate of 240,000 oz gold (1,180,000 tonnes at 6.32 g/t gold) and an Inferred estimate of 37,000 oz gold (240,000 tonnes at 4.89 g/t gold). (Tartan Lake Project Technical Report, Manitoba, Canada, April 2017 authored by Mining Plus Canada Consulting Ltd.). The Company also holds a

For Further Information, Please Contact:

Michael Swistun, CFA����������������������������������������������������������������������������������

President & CEO

Canadian Gold Corp.

(204) 232-1373

[email protected]

Social Media Accounts:

:

:

:

:

Neither the NYSE, TSX or TSX-V have reviewed and do not accept responsibility for the adequacy or accuracy of the contents of this news release, which has been prepared by the management of McEwen and Canadian Gold.

Forward-Looking Statements

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

In this news release, forward-looking statements relate to, among other things, statements regarding: the Proposed Transaction; the Arrangement Agreement; the receipt of necessary shareholder, court and regulatory approvals for the Proposed Transaction; the anticipated timeline for completing the Proposed Transaction; the terms and conditions pursuant to which the Proposed Transaction will be completed, if at all; the anticipated benefits of the Proposed Transaction including, but not limited to McEwen having an

In respect of the forward-looking statements concerning the Proposed Transaction, including the entering into of the Arrangement Agreement, and the anticipated timing for completion of the Proposed Transaction including, but not limited to the expectation of McEwen having a

Risks and uncertainties that may cause such differences include but are not limited to: the risk that the Proposed Transaction may not be completed on a timely basis, if at all; the conditions to the consummation of the Proposed Transaction may not be satisfied; the risk that the Proposed Transaction may involve unexpected costs, liabilities or delays; the possibility that legal proceedings may be instituted against the McEwen, Canadian Gold and/or others relating to the Proposed Transaction and the outcome of such proceedings; the possible occurrence of an event, change or other circumstance that could result in termination of the Proposed Transaction; risks relating to the failure to obtain necessary shareholder and court approval; other risks inherent in the mining industry. Failure to obtain the requisite approvals, or the failure of the parties to otherwise satisfy the conditions to or complete the Proposed Transaction, may result in the Proposed Transaction not being completed on the proposed terms, or at all. In addition, if the Proposed Transaction is not completed, the announcement of the Proposed Transaction and the dedication of substantial resources of McEwen and Canadian Gold to the completion of the Proposed Transaction could have a material adverse impact on each of McEwen's and Canadian Gold's share price, its current business relationships and on the current and future operations, financial condition, and prospects of each McEwen and Canadian Gold.

McEwen and Canadian Gold expressly disclaim any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise except as otherwise required by applicable securities legislation.

Qualified Person

The scientific and technical information disclosed in this news release was reviewed and approved by Wesley��Whymark, P. Geo., Consulting Geologist for McEwen and Canadian Gold, and a Qualified Person as defined under National Instrument 43-101.

Historical Exploration References Tartan West

(1)��Spooner, A.J., 1987. Tout Lake Joint Venture Diamond Drilling. Manitoba Mineral Assessment Report 71523. NTS REF. No. 63K-13SW

(2)��Spooner, A.J., 1988. Tout Lake Joint Venture Diamond Drilling. Manitoba Mineral Assessment Report 81737. NTS REF. No. 63K-13SW

(3)��Spooner, A.J., 1989. Tout Lake Joint Venture Diamond Drilling. Manitoba Mineral Assessment Report 72046. NTS REF. No. 63K-13SW

(4)��Historical scanned paper maps on Company database

Figure 1. Tartan Mine location in relation to Flin Flon

Figure 2. Tartan Mine - Main Zone Longitudinal Section (from Canadian Gold’s Feb 18, 2025 press release)

Figure 3. Tartan Mine - South Zone Longitudinal Section (from Canadian Gold’s June 10, 2025 press release)

Figure 4. Location of highlight historic gold occurrences on the Tartan West Property

Figures��accompanying this announcement are available at:��