Latin Metals Expands Para Copper Project, Peru

Latin Metals (OTCQB: LMSQF) has expanded its Para Copper Project in southern Peru through a strategic acquisition of 300 hectares of additional mineral rights for US$20,000. The expansion brings the total project area to 2,200 hectares and secures coverage over key drill targets.

The company has integrated exploration data purchased from Vale Exploration Peru, which conducted extensive groundwork between 2013-2017, including geological mapping, geochemical sampling, and geophysical surveys. Multiple high-priority porphyry copper drill targets have been identified, and Latin Metals plans to initiate drill permitting while seeking a partner to fund and advance the project.

The Para Project is strategically located in Peru's Coastal Copper Belt, with access to infrastructure and port facilities. The company holds 100% ownership with no underlying royalties on the newly acquired land.

Latin Metals (OTCQB: LMSQF) ha ampliato il suo Para Copper Project nel sud del Perù tramite l'acquisizione strategica di 300 ettari di diritti minerari aggiuntivi per US$20.000. L'espansione porta l'area totale del progetto a 2.200 ettari e garantisce la copertura dei principali obiettivi di perforazione.

La società ha integrato i dati di esplorazione acquistati da Vale Exploration Peru, che ha svolto estesi lavori di campo tra il 2013 e il 2017, inclusi mappatura geologica, campionamenti geochimici e indagini geofisiche. Sono stati identificati più obiettivi di perforazione ad alta priorità per porfidi di rame e Latin Metals intende avviare le pratiche per i permessi di perforazione mentre cerca un partner per finanziare e sviluppare il progetto.

Il Progetto Para è situato strategicamente nel Coastal Copper Belt del Perù, con accesso a infrastrutture e strutture portuali. La società detiene il 100% della proprietà senza royalties sottostanti sui terreni appena acquisiti.

Latin Metals (OTCQB: LMSQF) ha ampliado su Proyecto Para Copper en el sur de Perú mediante la adquisición estratégica de 300 hectáreas adicionales de derechos mineros por US$20,000. La expansión eleva el área total del proyecto a 2,200 hectáreas y asegura cobertura sobre objetivos clave de perforación.

La compañía ha integrado datos de exploración comprados a Vale Exploration Peru, que realizó extensos trabajos de campo entre 2013 y 2017, incluyendo cartografía geológica, muestreo geoquímico y estudios geofísicos. Se han identificado múltiples objetivos prioritarios de perforación para pórfidos cupríferos, y Latin Metals planea iniciar los permisos de perforación mientras busca un socio que financie y haga avanzar el proyecto.

El Proyecto Para está ubicado estratégicamente en el Coastal Copper Belt del Perú, con acceso a infraestructura e instalaciones portuarias. La compañía posee el 100% sin regalías subyacentes sobre las tierras recientemente adquiridas.

Latin Metals (OTCQB: LMSQF)�� 페루 남부�� 파라(Para) 구리 프로젝트�� 전략적으�� 확대하여 추가 광업�� 300��������� 미화 20,000달러�� 취득했습니다. 이번 확장으로 프로젝트 총면적은 2,200�������가 되었으며 주요 시추 타깃을 확보했습니다.

��사��� Vale Exploration Peru로부�� 구매�� 탐사 데이터를 통합했으��, 해당 기관은 2013년부�� 2017년까지 지질도 작성, 지구화�� 샘플�� �� 지구물�� 조사 �� 광범위한 현장 조사�� 수행했습니다. 여러 개의 우선순위가 높은 포르피리(포형 ��) 구리 시추 타깃이 확인되었��, Latin Metals�� 시추 허가 절차�� 시작하는 동시�� 프로젝트�� 자금 조달 �� 진전�� 위한 파트너를 찾을 계획입니��.

파라 프로젝트�� 페루�� 해안 구리 지대(Coastal Copper Belt)�� 전략적으�� 위치�� 있으�� 인프�� �� 항만 시설�� 접근�� �� 있습니다. ��사��� 최근 취득�� 토지�� 대�� 기초적인 로열�� 없이 100% 소유권을 보유하고 있습니다.

Latin Metals (OTCQB: LMSQF) a élargi son Projet Para Copper dans le sud du Pérou par l'acquisition stratégique de 300 hectares supplémentaires de droits miniers pour US$20,000. Cette extension porte la superficie totale du projet à 2,200 hectares et assure la couverture des principaux cibles de forage.

La société a intégré des données d'exploration achetées à Vale Exploration Peru, qui a réalisé d'importants travaux de terrain entre 2013 et 2017, incluant cartographie géologique, échantillonnages géochimiques et levés géophysiques. Plusieurs cibles prioritaires de forage pour des porphyres cuprifères ont été identifiées, et Latin Metals prévoit d'entamer les démarches de permis de forage tout en recherchant un partenaire pour financer et faire avancer le projet.

Le Projet Para est situé de manière stratégique dans le Coastal Copper Belt du Pérou, avec accès aux infrastructures et aux installations portuaires. La société détient 100% de la propriété sans redevances sous-jacentes sur les terres récemment acquises.

Latin Metals (OTCQB: LMSQF) hat sein Para Copper Project im Süden Perus durch den strategischen Erwerb von 300 Hektar zusätzlicher Bergbaurechte für US$20.000 erweitert. Die Erweiterung bringt die Gesamtprojektfläche auf 2.200 Hektar und sichert die Abdeckung wichtiger Bohrziele.

Das Unternehmen hat Erkundungsdaten integriert, die von Vale Exploration Peru erworben wurden. Diese führte zwischen 2013 und 2017 umfangreiche Feldarbeiten durch, darunter geologische Kartierung, geochemische Probenahmen und geophysikalische Untersuchungen. Mehrere vorrangige Porphyr-Kupfer-Bohrziele wurden identifiziert, und Latin Metals plant, die Bohrgenehmigungen zu beantragen, während ein Partner zur Finanzierung und Weiterentwicklung des Projekts gesucht wird.

Das Para-Projekt liegt strategisch im Coastal Copper Belt Perus und verfügt über Zugang zu Infrastruktur und Hafenanlagen. Das Unternehmen hält 100% Eigentum an den neu erworbenen Flächen ohne zugrunde liegende Royalties.

- Strategic acquisition of 300 hectares completed for only US$20,000 with no royalty obligations

- Integration of Vale's comprehensive exploration data has defined clear porphyry-style drill targets

- Project location in Peru's Coastal Copper Belt provides excellent infrastructure access

- 100% ownership of consolidated 2,200-hectare land position

- Company requires an option partner to fund and advance the project

- No drilling has been conducted on the property despite previous drill permits

Defines Drill Targets

VANCOUVER, British Columbia, Aug. 13, 2025 (GLOBE NEWSWIRE) -- Latin Metals Inc. ("Latin Metals" or the "Company") - (TSXV: LMS) (���հ�ϵ�:��LMSQF) is pleased to announce that its

Key Takeaways:

- New Land Secured: Strategic acquisition of 300 hectares completes consolidation of

100% -owned Para Project - Drill Targets Defined: Multiple walk-up porphyry copper targets identified

- Next Step Permitting: Drill permit process will start; Latin Metals is seeking an option partner to fund and operate

- Tier-1 Location: Para is situated in Peru’s Coastal Copper Belt with access to infrastructure and port facilities

- Low-Cost Acquisition: New claim acquired for US

$20,000 with no royalty obligations

Exploration data collected by Latin Metals, combined with historic data purchased from Vale Exploration Peru S.A.C. ("Vale") (previous news release -02, dated February 10, 2025), a wholly owned subsidiary of Vale Canada Limited, has been instrumental in defining multiple high-priority drill targets across the Para Project (Figures 1, 2, and 3). Vale previously completed target definition and secured drill permits but never conducted drilling.

“Our exploration team initially identified the Para project in 2023 through analysis of regional geochemical data,�� stated Keith Henderson, President and CEO. “The integration of Vale’s comprehensive exploration data has allowed us to define clear porphyry-style drill targets. This new acquisition finalizes the consolidation of a high-quality,

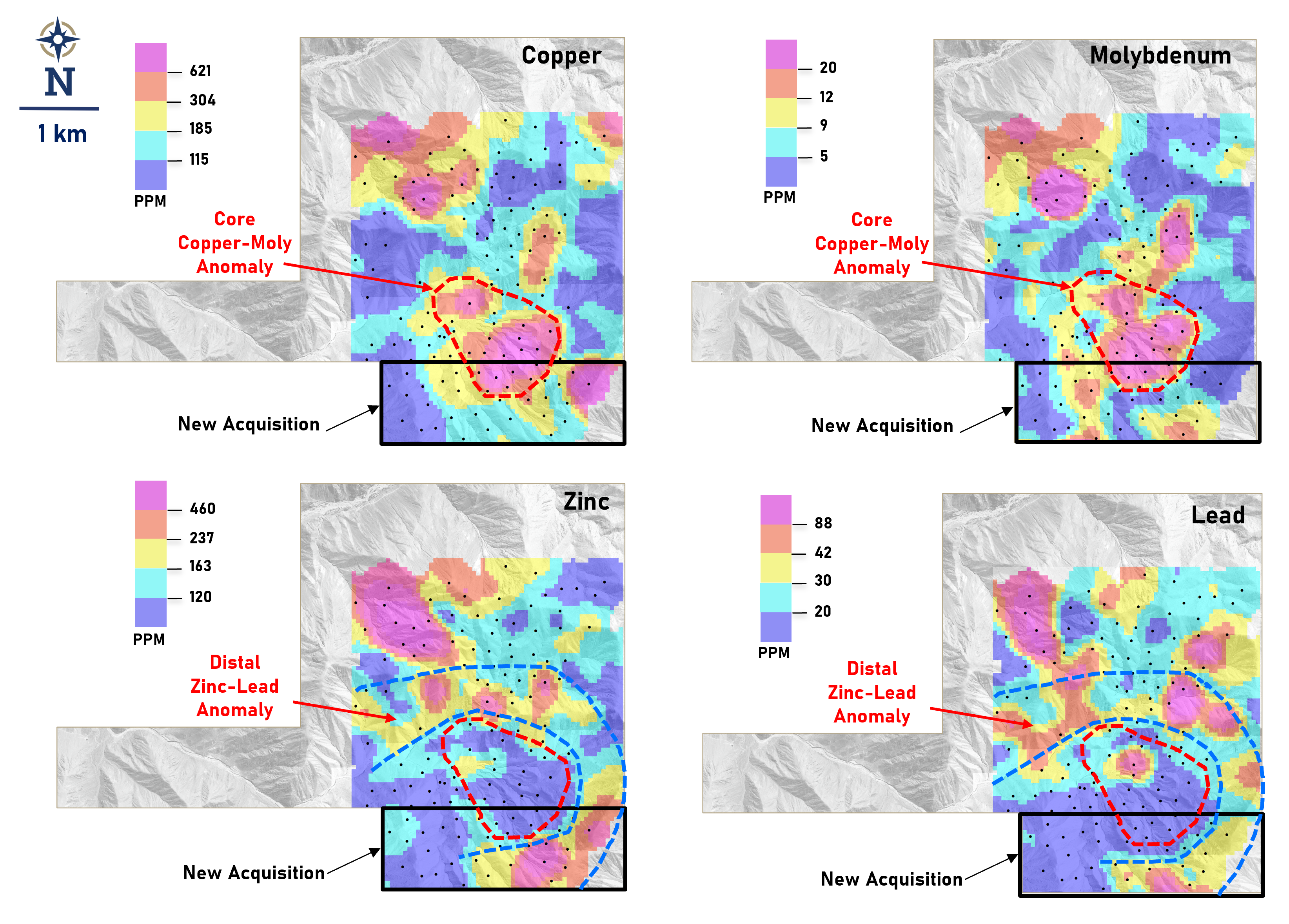

Figure 1: Results of Latin Metals�� geochemical talus sampling survey showing favorable chemical zonation interpreted as centering on a porphyry system. Proximal and coincident copper and molybdenum anomalies are interpreted to overlie a porphyry system, and coincident zinc and lead anomalies are distal, surrounding the core copper-molybdenum anomalies. This pattern is typical of porphyry systems. New property acquisition shown.

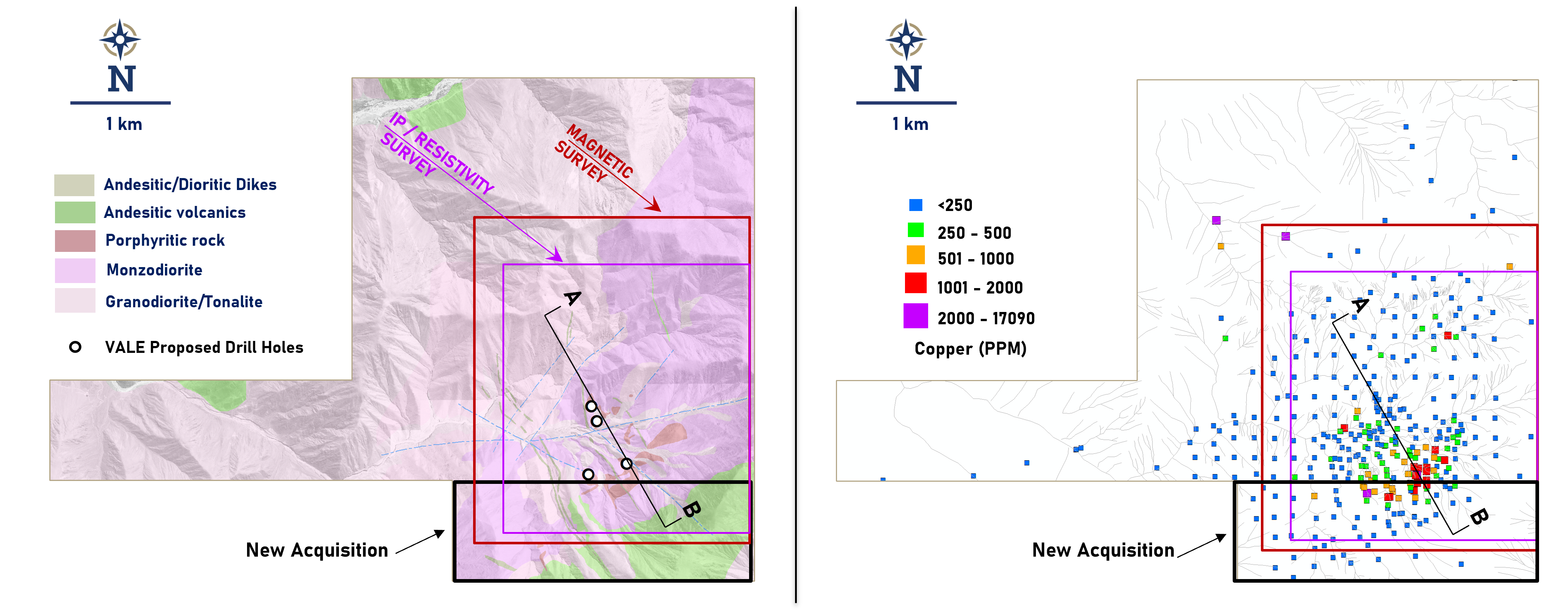

Figure 2: Left. Geological mapping completed by Vale together with outlines of Vale’s geophysical Induced Polarization and Magnetic surveys. Right. Map combining results of geochemical rock sampling completed by Latin Metals and Vale. The cross-section A-B references Figure 3. New property acquisition shown.

Acquisition Details

The newly acquired 300-hectare claim lies directly south of the current Para property (Figures 1 and 2). It was purchased for US

Project History

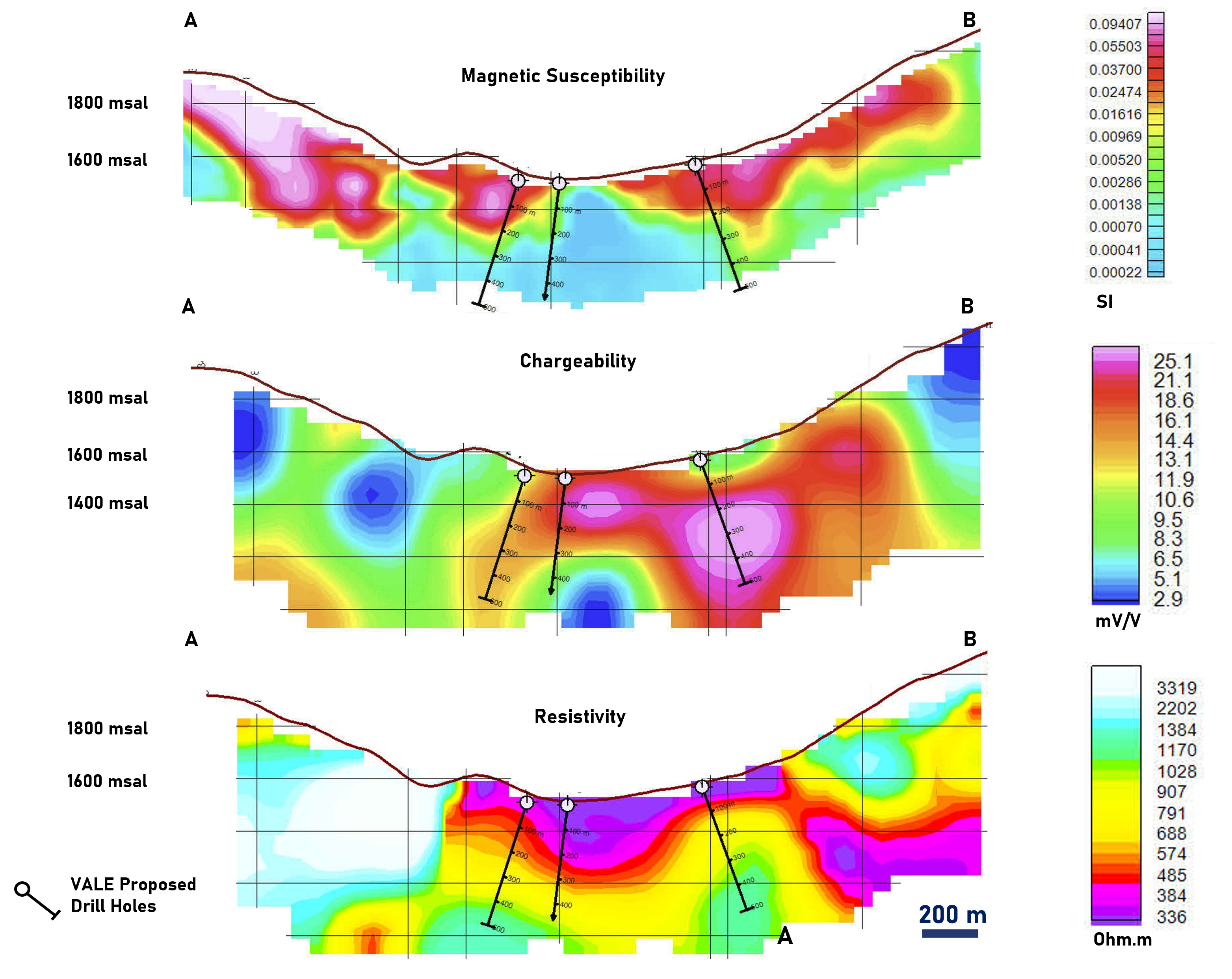

The Para Copper Project was previously explored by Vale Exploration Peru S.A.C. between 2013 and 2017. During this time, Vale conducted extensive groundwork, including geological mapping, collection of 282 geochemical rock samples, and completion of 18 line-kilometers of Induced Polarization (IP) geophysics, along with 44 line-kilometers of ground magnetic and radiometric surveys. Vale identified four priority drill targets totaling approximately 2,500 meters and secured a drill permit for the proposed program; however, no drilling was completed. Latin Metals acquired the project in 2023 and has since validated and expanded on Vale’s work through its own systematic geochemical sampling and interpretation, confirming the presence of multiple porphyry-style targets.

Figure 3: Cross section A-B. Drill holes shown were historically proposed and permitted by Vale but never drilled. Low magnetic susceptibility is interpreted as Phyllic alteration. High chargeability anomalies are interpreted to represent disseminated sulphide associated with a porphyry system. High resistivity is interpreted to result from silica within altered rocks. See Figure 2 for location of section.

Para Copper Project Background

The Para Copper Project is situated within Peru’s Coastal Copper Belt. This belt hosts several major deposits, and is known for its favorable geology, including porphyry copper systems. The region also offers exceptional infrastructure - with highway access, nearby power lines, and proximity to Pacific ports - making it highly attractive for exploration and potential mine development. Para now spans 2,200 hectares and is

QA/QC

The work program at Latin Metals' Para project was designed and supervised by Eduardo Leon, the Company's Vice President of Exploration, who oversees all aspects of operations, including quality control and quality assurance (QC/QA). A total of 208 talus samples were collected from 40 cm × 40 cm sampling areas, with a spacing of approximately 300��350 meters across the property. On-site personnel meticulously collected and tracked the samples, which were then securely sealed. The first batch of 56 samples was shipped to ALS Laboratory in Lima for multi-element analysis using inductively coupled plasma mass spectrometry (ICP-MS), adhering to industry standards. The second batch of 152 samples was analyzed on-site using an Olympus Vanta C pXRF device. The gridded talus data integrates results from both surveys.

Data purchased from Vale was collected by Vale and was not supervised by Latin Metals staff. The data includes typical and appropriate geochemical quality control data including blanks, duplicates and standards. Geophysical data was collected and interpreted by third party contractors retained by Vale and appropriate quality control was utilized.

Qualified Person

Eduardo Leon, QP, is the Company's qualified person as defined by NI 43-101 and has reviewed the scientific and technical information that forms the basis for portions of this news release. He has approved the disclosure herein. Mr. Leon is not independent of the Company, as he is an officer of the Company and holds securities of the Company.

About Latin Metals

Latin Metals Inc. is a copper, gold and silver exploration company operating in Peru and Argentina under a prospect generator model, minimizing risk and dilution while maximizing discovery potential. With 18 projects, the company secures option agreements with major mining companies to fund exploration. This approach provides early-stage exposure to high-value mineral assets.

Vale Data Purchase Agreement

Under the terms of a data purchase agreement, Vale delivered a comprehensive package of exploration data covering Latin Metals��

Stay Connected

Follow Latin Metals on , , , and to stay informed on our latest developments, exploration updates, and corporate news.

On Behalf of the Board of Directors of

LATIN METALS INC.

��Keith Henderson��

President & CEO

For further details on the Company, readers are referred to the Company's web site () and its Canadian regulatory filings on SEDAR+ at .

For further information, please contact:

Keith Henderson

Suite 890 - 999 West Hastings Street,

Vancouver, BC, V6C 2W2

E-mail:

Elyssia Patterson, VP Investor Relations

����������:��

Phone: 778-683-4324

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Note Regarding Forward-Looking Statements

This news release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian and U.S. securities legislation, including the United States Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, included herein including, without limitation, the anticipated content, commencement, timing and cost of exploration programs in respect of the Property and otherwise, anticipated exploration program results from exploration activities, and the Company's expectation that it will be able to enter into agreements to acquire interests in additional mineral properties, the discovery and delineation of mineral deposits/resources/reserves on the Properties, and the anticipated business plans and timing of future activities of the Company, are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Often, but not always, forward looking information can be identified by words such as "pro forma", "plans", "expects", "may", "should", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", "believes", "potential" or variations of such words including negative variations thereof, and phrases that refer to certain actions, events or results that may, could, would, might or will occur or be taken or achieved. In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation, market fundamentals will result in sustained precious and base metals demand and prices, the receipt of any necessary permits, licenses and regulatory approvals in connection with the future development of the Company’s Argentine projects in a timely manner, the availability of financing on suitable terms for the development, construction and continued operation of the Company projects, and the Company’s ability to comply with environmental, health and safety laws.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward-looking information. Such risks and other factors include, among others, operating and technical difficulties in connection with mineral exploration and development and mine development activities at the Properties, including the geological mapping, prospecting and sampling programs being proposed for the Properties (the "Programs"), actual results of exploration activities, including the Programs, estimation or realization of mineral reserves and mineral resources, the timing and amount of estimated future production, costs of production, capital expenditures, the costs and timing of the development of new deposits, the availability of a sufficient supply of water and other materials, requirements for additional capital, future prices of precious metals and copper, changes in general economic conditions, changes in the financial markets and in the demand and market price for commodities, possible variations in ore grade or recovery rates, possible failures of plants, equipment or processes to operate as anticipated, accidents, labour disputes and other risks of the mining industry, delays or the inability of the Company to obtain any necessary permits, consents or authorizations required, any current or future property acquisitions, financing or other planned activities, changes in laws, regulations and policies affecting mining operations, hedging practices, currency fluctuations, title disputes or claims limitations on insurance coverage and the timing and possible outcome of pending litigation, environmental issues and liabilities, risks related to joint venture operations, and risks related to the integration of acquisitions, as well as those factors discussed under the heading as well as those factors discussed under the heading “Risk Factors�� in the Company’s annual management’s discussion and analysis and other filings of the Company with the Canadian Securities Authorities, copies of which can be found under the Company’s profile on the SEDAR+ website at .

Readers are cautioned not to place undue reliance on forward looking statements. Except as otherwise required by law, the Company undertakes no obligation to update any of the forward-looking information in this news release or incorporated by reference herein.

Photos accompanying this announcement are available at