Jaguar Mining Provides Update on BA Zone Exploration at the Pilar Mine, Reports High-Grade Gold Intercepts

Jaguar Mining (OTCQX:JAGGF) has reported significant high-grade gold intercepts from its exploration drilling at the BA zone within the Pilar mine in Brazil. The most notable result came from drill hole PPL1174, which intercepted 12.80 g/t Au over 25.00m true width, including 27.21 g/t Au over 7.00m.

The company completed 2,328 meters of additional drilling between Level 16 and Level 20, confirming the presence of high-grade gold mineralization extending at depth. The BA zone is expected to contribute approximately 50% of the mine's total production going forward, marking it as a key growth driver for Jaguar.

The geological structure reveals complex, overturned folds with consistent southeast-plunging axes, hosted within Banded Iron Formation layers. The mineralization remains open at depth and expands into adjacent un-tested upper levels, suggesting significant potential for resource growth.

Jaguar Mining (OTCQX:JAGGF) ha riportato importanti intersezioni di oro ad alta gradazione dai suoi sondaggi esplorativi nella zona BA all'interno della miniera Pilar in Brasile. Il risultato più significativo proviene dal foro di sondaggio PPL1174, che ha intercettato 12,80 g/t Au su 25,00 m di spessore reale, inclusi 27,21 g/t Au su 7,00 m.

L'azienda ha completato 2.328 metri di perforazioni aggiuntive tra il Livello 16 e il Livello 20, confermando la presenza di mineralizzazione aurifera ad alta gradazione che si estende in profondità . La zona BA dovrebbe contribuire a circa il 50% della produzione totale della miniera in futuro, rappresentando un fattore chiave di crescita per Jaguar.

La struttura geologica mostra pieghe complesse e rovesciate con assi costantemente inclinati verso sud-est, ospitate all'interno di strati di formazione di ferro a bande. La mineralizzazione rimane aperta in profondità e si espande verso i livelli superiori adiacenti non ancora testati, suggerendo un potenziale significativo per l'espansione delle risorse.

Jaguar Mining (OTCQX:JAGGF) ha reportado interceptaciones significativas de oro de alta ley en sus perforaciones exploratorias en la zona BA dentro de la mina Pilar en Brasil. El resultado más destacado provino del pozo de perforación PPL1174, que interceptó 12,80 g/t Au en 25,00 m de ancho verdadero, incluyendo 27,21 g/t Au en 7,00 m.

La compañÃa completó 2.328 metros adicionales de perforación entre el Nivel 16 y el Nivel 20, confirmando la presencia de mineralización de oro de alta ley que se extiende en profundidad. Se espera que la zona BA contribuya aproximadamente con el 50% de la producción total de la mina en adelante, marcándola como un motor clave de crecimiento para Jaguar.

La estructura geológica revela pliegues complejos e invertidos con ejes consistentemente inclinados hacia el sureste, alojados dentro de capas de Formación de Hierro Banded. La mineralización permanece abierta en profundidad y se expande hacia niveles superiores adyacentes no probados, lo que sugiere un potencial significativo para el crecimiento de recursos.

Jaguar Mining (OTCQX:JAGGF)ë� ë¸ë¼ì§� íë¼ë¥� ê´ì° ë� BA 구ììì íì¬ ìì¶ë¥� íµí´ ê³ íì� ê¸� ê´ë¬¼ì� ì¤ìí� ê°ì ê²°ê³¼ë¥� ë³´ê³ íìµëë¤. ê°ì� 주목í� ë§í ê²°ê³¼ë� ìì¶ê³� PPL1174ìì ëìì¼ë©°, ì¤í 25.00m 구ê°ìì 12.80 g/t Auë¥� í¬í¨í� 7.00m 구ê°ìì 27.21 g/t Auê° íì¸ëììµëë�.

íì¬ë� 16층과 20ì¸� ì¬ì´ìì ì¶ê° ìì¶ 2,328미í°ë¥� ìë£íì¬ ê³ íì� ê¸� ê´ë¬¼ì� ê¹ì´ê¹ì§ íì¥ëì´ ììì� íì¸íìµëë¤. BA 구ìì ìì¼ë¡� ê´ì° ì ì²´ ìì°ëì ì� 50%ë¥� ì°¨ì§í� ê²ì¼ë¡� ììëë©°, Jaguarì� 주ì ì±ì¥ ëë ¥ì¼ë¡ íê°ë©ëë�.

ì§ì§� 구조ë� ì¼ê´ëê² ë¨ë쪽ì¼ë¡� ê²½ì¬ì§� ì¶ì ê°ì§� ë³µì¡í� ìì í� ìµê³¡ì¼ë¡, ë ì² ê´ì¸µ ë´ì ìì¹í©ëë�. ê´ë¬¼íë ê¹ì´ ë°©í¥ì¼ë¡ ê°ë°©ëì´ ìì¼ë©� ì¸ì í� ìë¶ ë¯¸ìí� 구ìì¼ë¡ íì¥ëì´ ìì ì¦ê° ê°ë¥ì±ì� í½ëë�.

Jaguar Mining (OTCQX:JAGGF) a annoncé des interceptions significatives d'or à haute teneur lors de ses forages d'exploration dans la zone BA de la mine Pilar au Brésil. Le résultat le plus notable provient du trou de forage PPL1174, qui a intercepté 12,80 g/t Au sur 25,00 m de largeur vraie, incluant 27,21 g/t Au sur 7,00 m.

La société a réalisé 2 328 mètres de forage supplémentaires entre les niveaux 16 et 20, confirmant la présence d'une minéralisation aurifère à haute teneur s'étendant en profondeur. La zone BA devrait contribuer à environ 50 % de la production totale de la mine à l'avenir, en faisant un moteur clé de croissance pour Jaguar.

La structure géologique révèle des plis complexes inversés avec des axes inclinés de manière constante vers le sud-est, hébergés dans des couches de formation ferrugineuse rubanée. La minéralisation reste ouverte en profondeur et s'étend aux niveaux supérieurs adjacents non testés, suggérant un potentiel significatif de croissance des ressources.

Jaguar Mining (OTCQX:JAGGF) hat bedeutende hochgradige Goldabschnitte aus seinen Explorationsbohrungen in der BA-Zone innerhalb der Pilar-Mine in Brasilien gemeldet. Das bemerkenswerteste Ergebnis stammt aus dem Bohrloch PPL1174, das 12,80 g/t Au über eine wahre Mächtigkeit von 25,00 m durchteufte, einschlieÃlich 27,21 g/t Au über 7,00 m.

Das Unternehmen führte weitere 2.328 Meter Bohrungen zwischen Level 16 und Level 20 durch und bestätigte damit das Vorhandensein von hochgradiger Goldmineralisierung in der Tiefe. Die BA-Zone wird voraussichtlich etwa 50 % der Gesamtproduktion der Mine zukünftig beitragen und gilt als wichtiger Wachstumstreiber für Jaguar.

Die geologische Struktur zeigt komplexe, umgekehrte Falten mit konsistent nach Südost geneigten Achsen, eingebettet in Schichten der gebänderten Eisenformation. Die Mineralisierung bleibt in der Tiefe offen und dehnt sich in angrenzende, bislang ungetestete obere Bereiche aus, was auf ein erhebliches Potenzial für Ressourcenerweiterungen hindeutet.

- High-grade gold intercept of 12.80 g/t Au over 25m true width, representing 320.00 GT

- BA zone expected to deliver 50% of mine's total production

- Mineralization remains open at depth with consistent gold grades

- Strong geological predictability and structural continuity confirmed

- Additional exploration potential identified between levels 12 and 15

- None.

12.80 g/t Au over an estimated true width of 25.00m with 320.00 GT (including 27.21 g/t Au over an estimated true width of 7.00m) in hole PPL1174

TORONTO, ON / / August 5, 2025 / Jaguar Mining Inc. ("Jaguar" or the "Company") (TSX:JAG)(OTCQX:JAGGF) is pleased to provide an update on exploration drilling activities at the BA zone, located within its Pilar mine in Brazil. Recent diamond drilling results continue to confirm the presence of high-grade gold mineralization extending at depth.

Since the Company's previous BA zone update (see press release dated September 5, 2024), the Pilar mine has begun to see increased gold grades and additional production from this zone, a trend that is expected to continue.

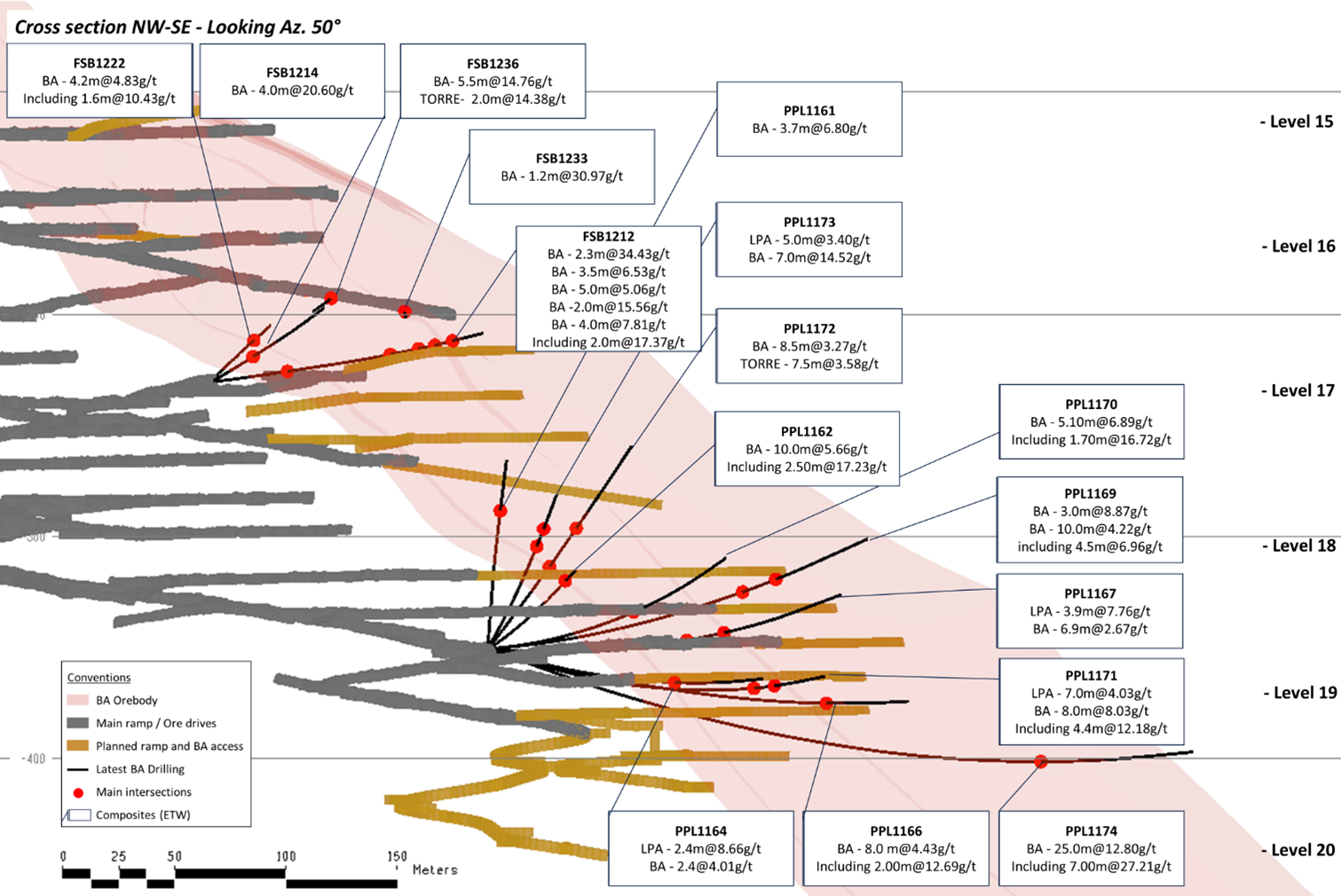

A total of 2,328 meters of additional drilling has been completed in the BA zone, targeting mineralization between Level 16 and Level 20. The most significant result to date was from drill hole PPL1174, which intersected 12.80 g/t Au over an estimated true width of 25.00m, representing 320.00 GT (Grade x Thickness). This intercept included 27.21 g/t Au over an estimated true width of 7.00m (refer to Figures 1, 2 and 3 for more details).

Highlights from diamond drilling completed since September 2024 include:

12.80 g/t Au over an estimated true width of 25.00m - hole FSB1174 - including 27.21 g/t Au over an estimated true width of 7.00m

34.43 g/t Au over an estimated true width of 2.30m - hole FSB1212

8.03 g/t Au over an estimated true width of 8.00m - hole FSB1171 - including 12.18 g/t Au over an estimated true width of 4.4m

14.52 g/t Au over an estimated true width of 7.00m - hole FSB1173

Armando Massucatto, Exploration Manager for Jaguar Mining, commented: "The exceptional intersections returned from the BA zone, notably by drill holes PPL1102 (see press release dated September 5, 2024) and PPL1174 (this release), underscore both the geological and structural coherence of the mineralization. These results affirm a pronounced down-plunge continuity, characteristic of prolific mineralized systems within the Iron Quadrangle, which are known to persist for several kilometers along plunge. Importantly, the mineralization remains open at depth and expands into adjacent un-tested upper levels, with gold grades maintained along extension. This supports a positive outlook for the ongoing growth of the Pilar mine's mineral resource base, highlighting exploration potential for the addition of further ounces."

Luis Albano Tondo, President and newly appointed CEO of Jaguar Mining, commented: "The ongoing work at the BA zone continues to exceed our expectations. Our latest drilling results confirm that the high-grade gold mineralization continues at depth and validate the continuity and predictability of this orebody across the levels we are actively developing. This comprehensive understanding of the deposit's geometry empowers us to systematically unlock a source of ore reserves in Pilar. We are now confidently forecasting the BA zone to deliver approximately

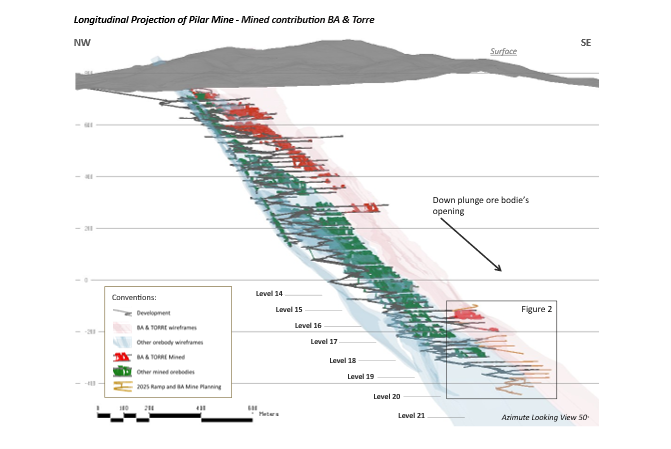

Figure 1 - Long Section showing the Pilar Mine underground layout and the position of the BA Zone relative to the other main orebodies. The location of the planned and ongoing BA Zone sub-level access development between level 15 and level 19 is highlighted at the bottom right corner of the figure.

Figure 2 - Long sectional view showing the location of access development to evaluate the BA Zone, along with key diamond drill mineralized intersections reported in this press release.

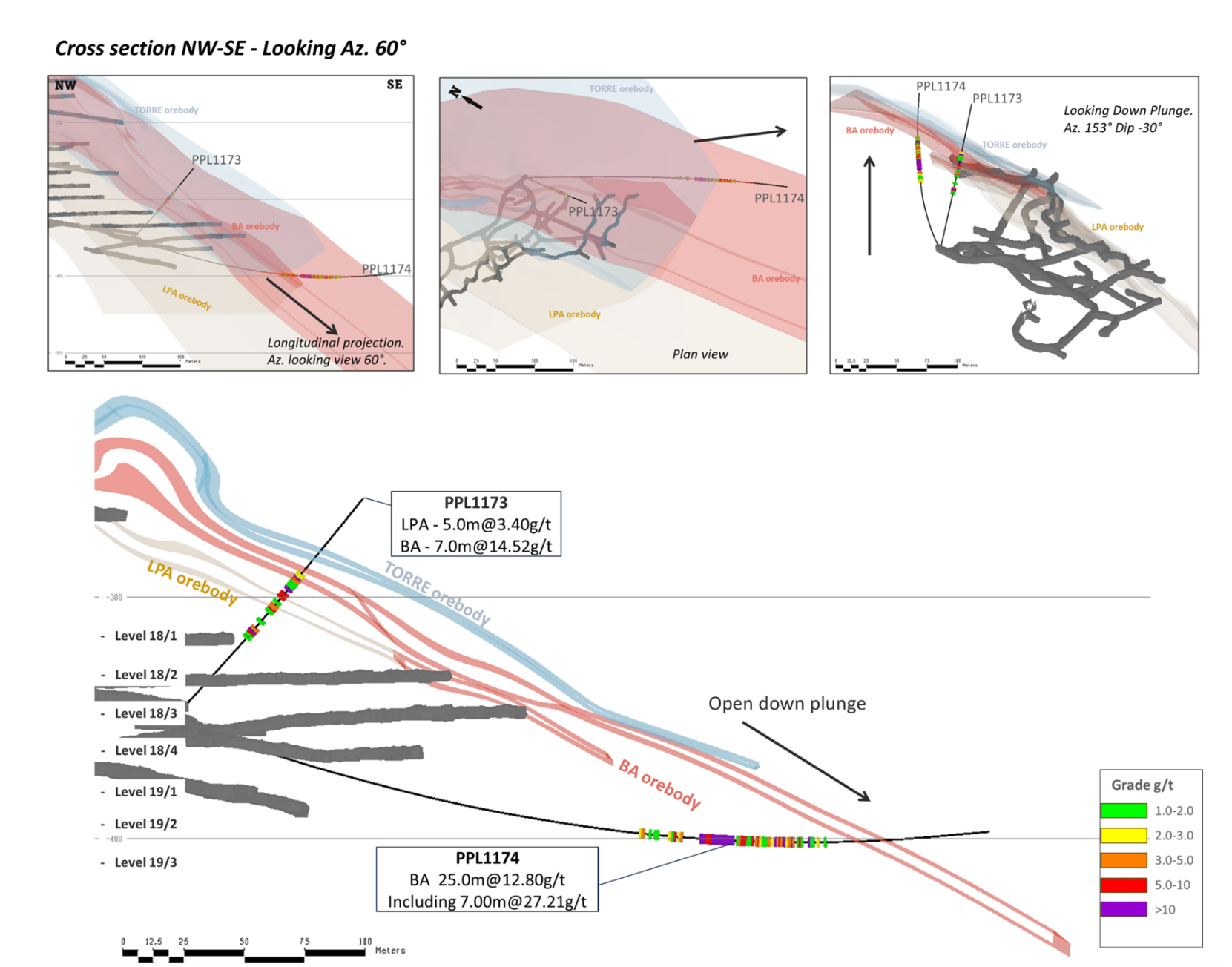

Figure 3 - Long sectional view highlighting the detail of drill holes PPL1173 and 1174, which confirm high grade continuity of the BA Zone over more than 250m.

Table 1 - Summary of significant diamond drilling intersections with grade x thickness (GT) > 20 between Level 16 and Level 20 targeting the BA Zone.

HOLE ID | From (m) | To (m) | Interval (m) | Est. True Width (m) | Grade (g/t Au) | GT (ETW) | Orebody |

PPL1161 | 67.90 | 72.20 | 4.30 | 3.70 | 6.80 | 25.16 | BA |

PPL1162 | 80.70 | 92.60 | 11.90 | 10.00 | 5.66 | 56.60 | BA |

Including | 89.80 | 92.60 | 2.80 | 2.50 | 17.23 | 43.08 | BA |

FSB1236 | 0.00 | 6.40 | 6.40 | 5.50 | 14.76 | 81.18 | BA |

FSB1236 | 11.40 | 13.75 | 2.35 | 2.00 | 14.38 | 28.76 | TORRE |

FSB1212 | 34.70 | 38.35 | 3.65 | 2.30 | 34.43 | 79.19 | BA |

FSB1212 | 82.05 | 87.85 | 5.80 | 3.50 | 6.53 | 22.86 | BA |

FSB1212 | 91.40 | 103.35 | 11.95 | 5.00 | 5.06 | 25.30 | BA |

FSB1212 | 108.05 | 110.65 | 2.60 | 2.00 | 15.56 | 31.12 | BA |

FSB1212 | 114.35 | 121.65 | 7.30 | 4.00 | 7.81 | 31.24 | BA |

Including | 117.25 | 119.84 | 2.59 | 2.00 | 17.37 | 34.74 | BA |

PPL1164 | 126.40 | 129.45 | 3.05 | 2.40 | 8.66 | 20.78 | LPA |

FSB1214 | 26.50 | 31.80 | 5.30 | 4.00 | 20.60 | 82.40 | BA |

FSB1222 | 40.45 | 45.55 | 5.10 | 4.20 | 4.83 | 20.29 | LPA |

Including | 42.45 | 44.45 | 2.00 | 1.60 | 10.43 | 16.69 | LPA |

PPL1167 | 106.70 | 112.40 | 5.70 | 3.90 | 7.76 | 30.26 | LPA |

PPL1167 | 119.40 | 129.40 | 10.00 | 6.90 | 2.67 | 18.42 | BA |

PPL1166 | 173.40 | 188.50 | 15.10 | 8.00 | 4.43 | 35.44 | BA |

Including | 173.40 | 177.15 | 3.75 | 2.00 | 12.69 | 25.38 | BA |

FSB1233 | 1.60 | 3.15 | 1.55 | 1.20 | 30.97 | 37.16 | BA |

PPL1169 | 120.35 | 124.30 | 3.95 | 3.00 | 8.87 | 26.61 | BA |

PPL1169 | 125.25 | 140.50 | 15.25 | 10.00 | 4.22 | 42.20 | BA |

Including | 129.35 | 135.70 | 6.35 | 4.50 | 6.96 | 31.32 | BA |

PPL1170 | 96.45 | 103.80 | 7.35 | 5.10 | 6.89 | 35.14 | BA |

Including | 96.45 | 98.75 | 2.30 | 1.70 | 16.72 | 28.42 | BA |

PPL1171 | 147.10 | 155.40 | 8.30 | 7.00 | 4.03 | 28.21 | LPA |

PPL1171 | 158.80 | 168.30 | 9.50 | 8.00 | 8.03 | 64.24 | BA |

Including | 158.80 | 164.65 | 5.85 | 4.40 | 12.18 | 53.59 | BA |

PPL1172 | 66.85 | 76.05 | 9.20 | 8.50 | 3.27 | 27.80 | BA |

PPL1172 | 82.75 | 91.00 | 8.25 | 7.50 | 3.58 | 26.85 | TORRE |

PPL1174 | 222.00 | 271.55 | 49.55 | 25.00 | 12.80 | 320.00 | BA |

Including | 222.00 | 236.30 | 14.30 | 7.00 | 27.21 | 190.47 | BA |

PPL1173 | 44.20 | 49.95 | 5.75 | 5.00 | 3.40 | 17.00 | LPA |

PPL1173 | 71.30 | 80.35 | 9.05 | 7.00 | 14.52 | 101.64 | BA |

Geological Context: Understanding the BA Zone's Mineralization

The geological structure of the BA orebody, as observed in our underground galleries, reveals a succession of complex, overturned folds. The axes of these folds consistently plunge to the southeast at medium to low angles, while their axial surfaces dip eastward at moderate to steep angles, aligning with the orientation of the Banded Iron Formation (BIF) bedding. Importantly, the high-grade gold mineralization is intrinsically hosted within these well-developed BIF layers.

Drill hole PPL1174 provides critical insights into this structural setting. The relationship between the rock bedding and the drill core orientation within this hole confirms that the BIF layers, which host the mineralization, maintain their folded nature even after undergoing subsequent refolding processes. This indicates a consistent structural environment at depth.

The primary gold-bearing zones are characterized by significant hydrothermal alteration, evidenced by the presence of minerals such as quartz and chlorite, alongside sulfide mineralization, predominantly pyrrhotite. The consistent presence of pyrrhotite and pyrite as the main sulfides filling the bedding, and within the vein edges, serves as a reliable indicator.

These collective geological features, including the consistent structural controls, the confirmation of folded ore zones at depth, and the characteristic mineral associations, significantly enhance our confidence in the down-plunge continuity of this high-potential ore zone. This structural and mineralogical predictability supports the long-term potential of the BA zone.

Between levels 1 and 6, the BA orebody was the primary contributor to production at the Pilar mine. Starting from Level 4, the structure progressively narrowed down-plunge making the BA orebody less economically viable, until Level 12.

More recently, between levels 15 and 19, exploration drilling campaigns have confirmed the renewed economic potential of the BA orebody at greater depths. This indicates that the interval between levels 12 and 15 still holds significant exploration potential. Drilling programs targeting this zone are either underway or in the planning phase, aiming to delineate additional resources at shallower levels and support the continuity of the BA orebody throughout the deposit.

Qualified Person

Scientific and technical information contained in this press release has been reviewed and approved by Armando José Massucatto, Geo, PhD, FAusIMM, Exploration Manager, who is also an employee of Jaguar Mining Inc. and is a "qualified person" as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101").

The Iron Quadrangle

The Iron Quadrangle has been an area of mineral exploration dating back to the 16th century. The discovery in 1699-1701 of gold contaminated with iron and platinum-group metals in the southeastern corner of the Iron Quadrangle gave rise to the name of the town Ouro Preto (Black Gold). The Iron Quadrangle contains world-class multi-million-ounce gold deposits such as Morro Velho, Cuiabá, and São Bento. Jaguar holds the second largest gold land position in the Iron Quadrangle with over 45,000 hectares.

About Jaguar Mining Inc.

Jaguar Mining Inc. is a Canadian-listed junior gold mining, development, and exploration company operating in Brazil with three gold mining complexes and a large land package with significant upside exploration potential from mineral claims. The Company's principal operating assets are located in the Iron Quadrangle, a prolific greenstone belt in the state of Minas Gerais and include the MTL complex (Turmalina mine and plant) and Caeté complex (Pilar and Roça Grande mines, and Caeté plant). The Roça Grande mine has been on temporary care and maintenance since April 2019. The Company also owns the Paciência complex (Santa Isabel mine and plant), which had been on care and maintenance since 2012 and is planned to restart in 2025. Additional information is available on the Company's website at .

For further information please contact:

Luis Albano Tondo

Chief Executive Officer

Jaguar Mining Inc.

[email protected]

+55 31-99959-6337

Marina de Freitas

Interim Chief Financial Officer

[email protected]

+55 31-98463-5344

Forward-Looking Statements

Certain statements in this news release constitute "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking statements and information are provided for the purpose of providing information about management's expectations and plans relating to the future. All of the forward-looking information made in this news release is qualified by the cautionary statements below and those made in our other filings with the securities regulators in Canada. Forward-looking information contained in forward-looking statements can be identified by the use of words such as "are expected," "is forecast," "forecasting", "is targeted," "approximately," "plans," "anticipates," "projects," "anticipates," "continue," "estimate," "believe" or variations of such words and phrases or statements that certain actions, events or results "may," "could," "would," "might," or "will" be taken, occur or be achieved. All statements, other than statements of historical fact, may be considered to be or include forward-looking information. This news release contains forward-looking information regarding, among other things, the nature, focus, timing and potential results or implications of the Company's exploration, drilling and prospecting activities, including the Company's diamond drilling at its Pilar mine, as described in this news release, as well as any other future exploration activities of the Company, management's expectations regarding the exploration potential of the Pilar Mine and future gold grades and production at the Pilar mine, including forecasts relating to production at the BA zone, any information and statements related to expected growth(including, without limitation, the potential for growth in regards to the Pilar mine's mineral resource base), sales, production statistics, ore grades, tonnes milled, recovery rates, cash operating costs, definition/delineation drilling, the timing and amount of estimated future production, costs of production, capital expenditures, costs and timing of the development of projects and new deposits, success of exploration, development and mining activities, currency fluctuations, capital requirements, project studies, mine life extensions, restarting suspended or disrupted operations, continuous improvement initiatives, and resolution of pending litigation. The Company has made numerous assumptions with respect to forward-looking information contained herein, including, among other things, assumptions about estimated timeline for the development of the Company's mineral properties; the supply and demand for, and the level and volatility of the price of, gold; the accuracy of reserve and resource estimates and the assumptions on which the reserve and resource estimates are based; the receipt of necessary permits; market competition; ongoing relations with employees and impacted communities; political and legal developments in any jurisdiction in which the Company operates being consistent with its current expectations including, without limitation, the impact of any potential power rationing, tailings facility regulation, exploration and mine operating licenses and permits being obtained and renewed and/or there being adverse amendments to mining or other laws in Brazil and any changes to general business and economic conditions. Forward-looking information involves a number of known and unknown risks and uncertainties, including among others: the risk of Jaguar not meeting the forecast plans regarding its operations and financial performance; uncertainties with respect to the price of gold, labour disruptions, mechanical failures, increase in costs, environmental compliance and change in environmental legislation and regulation, weather delays and increased costs or production delays due to natural disasters, power disruptions, procurement and delivery of parts and supplies to the operations; uncertainties inherent to capital markets in general (including the sometimes volatile valuation of securities and an uncertain ability to raise new capital) and other risks inherent to the gold exploration, development and production industry, which, if incorrect, may cause actual results to differ materially from those anticipated by the Company and described herein. In addition, there are risks and hazards associated with the business of gold exploration, development, mining and production, including environmental hazards, tailings dam failures, industrial accidents and workplace safety problems, unusual or unexpected geological formations, pressures, cave-ins, flooding, chemical spills, procurement fraud and gold bullion thefts and losses (and the risk of inadequate insurance, or the inability to obtain insurance, to cover these risks). Accordingly, readers should not place undue reliance on forward-looking information.

For additional information with respect to these and other factors and assumptions underlying the forward-looking information made in this news release, see the Company's most recent Annual Information Form and Management's Discussion and Analysis, as well as other public disclosure documents that can be accessed under the issuer profile of "Jaguar Mining Inc." on SEDAR+ at . The forward-looking information set forth herein reflects the Company's reasonable expectations as at the date of this news release and is subject to change after such date. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. The forward-looking information contained in this news release is expressly qualified by this cautionary statement.

SOURCE: Jaguar Mining, Inc.

View the original on ACCESS Newswire