Inspire Veterinary Partners Reports Second Quarter 2025 Financial Results

Inspire Veterinary Partners (NASDAQ:IVP), a U.S. pet healthcare services provider, reported Q2 2025 financial results showing mixed performance. The company achieved total revenue of $4.3 million, representing a 20% sequential increase from Q1 2025 but a 2% year-over-year decrease. Notably, comparable clinic revenues grew 5.7% year-over-year, while net losses improved by 10% to $3.0 million.

The quarter was marked by strategic expansion, including the acquisition of a Florida animal hospital expected to add $1.8 million in revenue and a pending New Jersey acquisition potentially adding $2.0 million. The company also secured up to $10 million in financing through a convertible preferred stock transaction and implemented an AI platform in partnership with Covetrus.

Inspire Veterinary Partners (NASDAQ:IVP), fornitore statunitense di servizi per la salute degli animali, ha pubblicato i risultati finanziari del secondo trimestre 2025 mostrando performance contrastanti. L'azienda ha realizzato ricavi totali di $4.3 million, pari a un aumento sequenziale del 20% rispetto al Q1 2025 ma a una diminuzione del 2% su base annua. I ricavi comparabili delle cliniche sono cresciuti del 5.7% anno su anno, mentre le perdite nette si sono ridotte del 10% a $3.0 million.

Il trimestre è stato caratterizzato da un'espansione strategica, con l'acquisizione di un ospedale veterinario in Florida che dovrebbe aggiungere $1.8 million di ricavi e una potenziale acquisizione nel New Jersey che potrebbe apportarne $2.0 million. L'azienda ha inoltre assicurato fino a $10 million di finanziamento tramite una transazione di azioni privilegiate convertibili e ha implementato una piattaforma di intelligenza artificiale in collaborazione con Covetrus.

Inspire Veterinary Partners (NASDAQ:IVP), proveedor estadounidense de servicios de salud para mascotas, publicó los resultados financieros del segundo trimestre de 2025 con un desempeño mixto. La compañÃa alcanzó ingresos totales de $4.3 million, un aumento secuencial del 20% respecto al 1T 2025 pero una caÃda interanual del 2%. Los ingresos comparables de las clÃnicas crecieron un 5.7% interanual, mientras que las pérdidas netas mejoraron un 10% hasta $3.0 million.

El trimestre estuvo marcado por la expansión estratégica, incluida la adquisición de un hospital animal en Florida que se espera aporte $1.8 million en ingresos y una adquisición pendiente en Nueva Jersey que podrÃa añadir $2.0 million. La compañÃa también aseguró hasta $10 million en financiamiento mediante una transacción de acciones preferentes convertibles e implementó una plataforma de IA en asociación con Covetrus.

Inspire Veterinary Partners (NASDAQ:IVP), 미êµì� ë°ë ¤ë물 ìë£ ìë¹ì� ì ê³µì ì²´ê° 2025ë � 2ë¶ê¸° ì¤ì ì� ë°ííìµëë¤. ì¤ì ì ìê°ë ¸ìµëë¤. íì¬ë� ì´ë§¤ì¶� $4.3 millionì� 기ë¡íì¼ë©� ì´ë 2025ë � 1ë¶ê¸° ëë¹� ì°ìì ì¼ë¡� 20% ì¦ê°íì¼ë� ì ë ë기 ëë¹ë¡ë� 2% ê°ìíìµëë¤. ë¹êµ ê°ë¥í í´ë¦¬ë� 매ì¶ì ì ë ëë¹� 5.7% ì¦ê°íê³ , ììì¤ì 10% ê°ì ëì´ $3.0 millionì´ììµëë�.

ì´ë² ë¶ê¸°ë� ì ëµì � íì¥ì� ëëë¬ì¡ìµëë�. íë¡ë¦¬ë¤ ìì¬ ë물ë³ì ì¸ìë¡� ì� $1.8 millionì� 매ì¶ì� ì¶ê°ë� ê²ì¼ë¡� ììëë©°, ë´ì ì§ìì ì§í ì¤ì¸ ì¸ìë� ì¶ê°ë¡� $2.0 millionì� ê°ì ¸ì¬ ì� ììµëë¤. íì¬ë� ì íì°ì ì£� ê±°ëë¥� íµí´ ìµë $10 millionì� ìê¸ì� íë³´íê³ , Covetrusì íë ¥í� AI íë«í¼ì ëì íìµëë¤.

Inspire Veterinary Partners (NASDAQ:IVP), prestataire américain de services de santé animale, a publié ses résultats du deuxième trimestre 2025 affichant des performances contrastées. La société a réalisé un chiffre d'affaires total de $4.3 million, soit une hausse séquentielle de 20% par rapport au T1 2025 mais une baisse de 2% en glissement annuel. Les revenus comparables des cliniques ont augmenté de 5.7% en glissement annuel, tandis que les pertes nettes se sont améliorées de 10% à $3.0 million.

Le trimestre a été marqué par une expansion stratégique, comprenant l'acquisition d'un hôpital animalier en Floride qui devrait générer $1.8 million de revenus et une acquisition en attente dans le New Jersey susceptible d'ajouter $2.0 million. La société a également obtenu jusqu'à $10 million de financement via une opération d'actions privilégiées convertibles et a déployé une plateforme d'IA en partenariat avec Covetrus.

Inspire Veterinary Partners (NASDAQ:IVP), ein US-Anbieter von Tiergesundheitsdiensten, veröffentlichte die Finanzergebnisse für das 2. Quartal 2025 mit gemischten Ergebnissen. Das Unternehmen erzielte Gesamtumsatz von $4.3 million, ein sequenzieller Anstieg um 20% gegenüber Q1 2025, jedoch ein Rückgang von 2% im Jahresvergleich. Die vergleichbaren Klinikumsätze wuchsen um 5.7% im Jahresvergleich, während der Nettoverlust sich um 10% auf $3.0 million verringerte.

Das Quartal war von strategischer Expansion geprägt, darunter die Ãbernahme eines Tierhospitals in Florida, das voraussichtlich $1.8 million an Umsatz hinzufügen wird, sowie eine geplante Ãbernahme in New Jersey, die potenziell $2.0 million bringen könnte. Das Unternehmen sicherte sich auÃerdem bis zu $10 million an Finanzierung durch eine Transaktion mit wandelbaren Vorzugsaktien und implementierte in Zusammenarbeit mit Covetrus eine KI-Plattform.

- None.

- Total revenue decreased 2% year-over-year to $4.3M

- Product revenue declined 7% to $1.1M

- Operating expenses increased 5% year-over-year

- Low cash position of $0.2M as of June 30, 2025

- Service revenue decreased 1% to $3.2M

Insights

IVP shows mixed Q2 results with improving comparable clinic growth and reduced losses despite overall revenue decline; strategic acquisitions and financing position company for potential turnaround.

Inspire Veterinary Partners' Q2 2025 results present a mixed but improving financial picture. While total revenue decreased by

The standout metric is the

On the profitability front, despite a

The company's expansion strategy is accelerating with the completed acquisition of a Florida animal hospital expected to contribute

From a liquidity perspective, the

The implementation of an employee incentive program and AI integration with Covetrus demonstrates management's focus on operational improvements and technology adoption to enhance service delivery and staff retention in the competitive veterinary market. CEO Kimball Carr's characterization of Q2 as a "turning point" appears supported by the sequential revenue growth and strategic initiatives, though the company remains unprofitable with substantial quarterly losses.

Comparable clinic revenues increase

Net losses decrease

VIRGINIA BEACH, VA / / August 14, 2025 / Inspire Veterinary Partners, Inc. (Nasdaq:IVP) ("Inspire" or the "Company"), an owner and provider of pet health care services throughout the U.S., today reported financial results for the second quarter ended June 30, 2025.

Second Quarter 2025 Financial Highlights Compared to Prior Periods

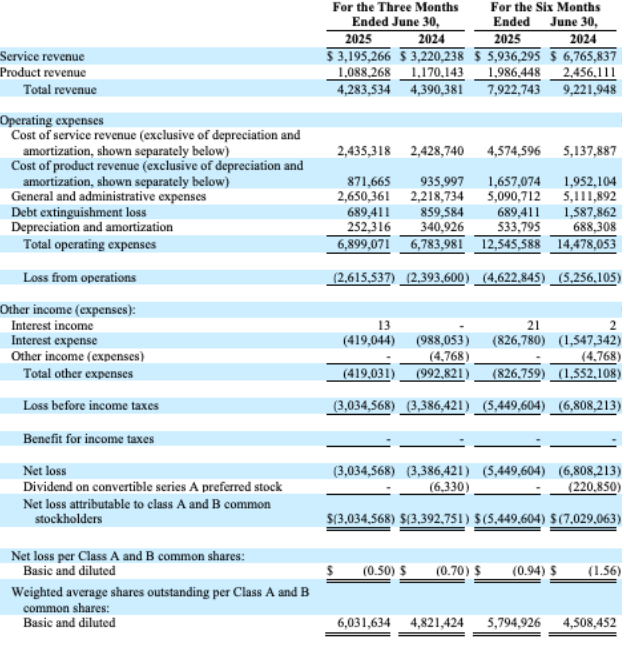

Total revenue of approximately

$4.3 million , a sequential increase of20% from Q1 2025 and a decrease of2% from the prior year period. The decrease in revenue is attributed to the exclusion of the Hawaii clinic (KVC) from 2025 resultsServices revenue of approximately

$3.2 million , a sequential increase of17% from Q1 2025 and a decrease of1% from the prior year periodProduct revenue of

$1.1 million , a sequential increase of21% from Q1 2025 and a decrease of7% from the prior year periodComparable clinic revenues increased

5.7% from the prior year periodTotal operating expenses of

$6.2 million , an increase of5% from the prior year periodNet loss of

$3.0 million , a decrease of$0.4 million from the prior year periodEntered an exclusive, non-binding Letter of Intent to acquire

100% ownership interest in one animal hospital located in New Jersey. Once completed, the acquisition could potentially add up to approximately$2.0 million in (unaudited) revenueEntered into a securities purchase agreement for the issuance and sale of securities for up to

$10M under a new convertible preferred stock transaction. The consideration, consisting of a combination of cash and transferred securities, was valued at$1.00 per shareAnnounced the launch of a company-wide incentive and recognition program, which provides vital new engagement tools and offers new avenues to wealth for all employees across their clinic network

Integrated a new artificial intelligence (AI) platform in partnership with leading software provider Covetrus into the Company's medical software. The Company believes this is the only AI platform being offered among publicly traded veterinary clinic networks

Acquired

100% ownership interest in one animal hospital located in central Florida (DeBary). The acquisition is expected to add up to approximately$1.8 million in (unaudited) revenue, and brings the Company's Florida holdings up to 5 clinicsFor the second quarter of 2025, total revenue was approximately

$4.3 million , a decrease of2% from the prior year period but an increase of20% from Q1 2025. Comparable clinic revenues increased5.7% from the prior year period.

Second Quarter 2025 Operational Highlights

Entered an exclusive, non-binding Letter of Intent to acquire

100% ownership interest in one animal hospital located in New Jersey. Once completed, the acquisition could potentially add up to approximately$2.0 million in (unaudited) revenueEntered into a securities purchase agreement for the issuance and sale of securities for up to

$10M under a new convertible preferred stock transaction. The consideration, consisting of a combination of cash and transferred securities, was valued at$1.00 per shareAnnounced the launch of a company-wide incentive and recognition program, which provides vital new engagement tools and offers new avenues to wealth for all employees across their clinic network

Integrated a new artificial intelligence (AI) platform in partnership with leading software provider Covetrus into the Company's medical software. The Company believes this is the only AI platform being offered among publicly traded veterinary clinic networks

Acquired

100% ownership interest in one animal hospital located in central Florida (DeBary). The acquisition is expected to add up to approximately$1.8 million in (unaudited) revenue, and brings the Company's Florida holdings up to 5 clinics

Executive Commentary

"During the second quarter of 2025, we started to see the rewards of our new initiatives, processes, and hard work over the past 18 months with sequential revenue growth of

Second Quarter 2025 Financial Overview

All comparisons are made relative to the same period in 2024 unless otherwise stated.

For the second quarter of 2025, total revenue was approximately

$4.3 million , a decrease of2% from the prior year period but an increase of20% from Q1 2025. Comparable clinic revenues increased5.7% from the prior year period.

Service revenue for the second quarter of 2025 decreased

$25,000 or1% , to$3.2 million . The decrease in service revenue is mainly attributed to the exclusion of KVC from 2025 results and reduced practitioner capacity. These decreases were partially offset by the acquisition of the DeBary animal clinic during Q2 2025.

Product revenue for the second quarter 2025 decreased

$82,000 , or7% , to$1.1 million . The overall decrease was a result of customers purchasing less products per visit and the exclusion of KVC from 2025 results partially offset by the acquisition of the DeBary animal clinic during Q2 2025.

Total operating expenses increased

$285,000 or5% . The increase is primarily due to increased costs of consulting agreements relating to customer outreach and public company costs.

Net loss for the first quarter of 2025 decreased

$352,000 , or10% , to$3.0 million . The decline in net loss is primarily attributable to the reduction of interest expense and the exclusion of the operating expenses associated with KVC.

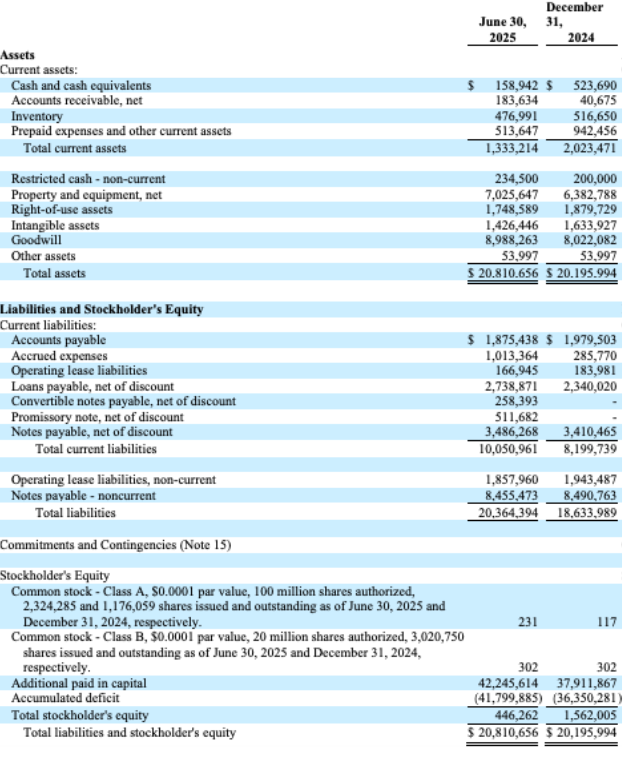

Balance Sheet

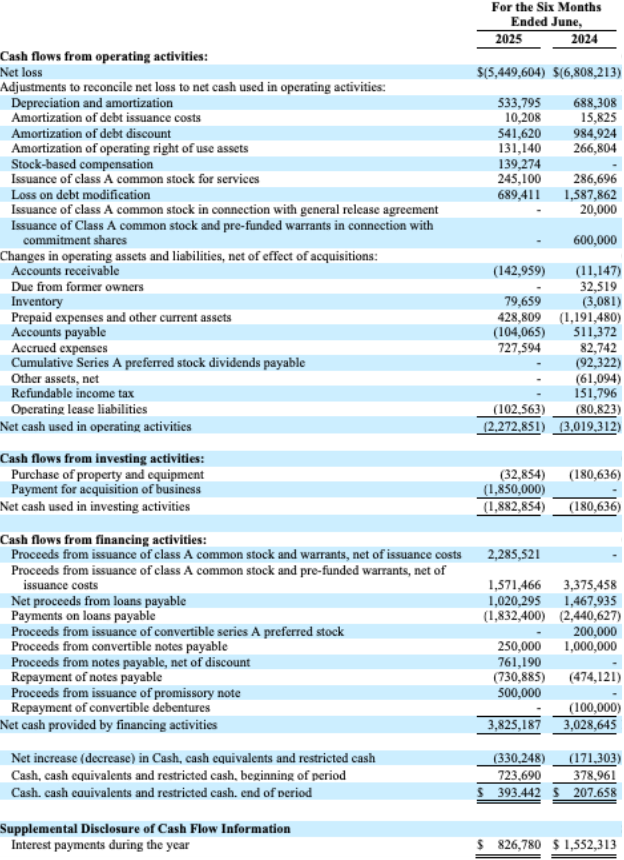

As of June 30, 2025, the Company had cash and cash equivalents of approximately

About Inspire Veterinary Partners, Inc.

Inspire Veterinary Partners is an owner and provider of pet health care services throughout the US. As the Company expands, it expects to acquire additional veterinary hospitals, including general practice, mixed animal facilities, and critical and emergency care.

For more information, please visit: .

Connect with Inspire Veterinary Partners, Inc.

Forward-Looking Statements

This press release includes certain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding management's expectations of future financial and operational performance and expected growth and business outlook. These forward-looking statements include, but are not limited to, plans, objectives, expectations and intentions and other statements contained in this press release that are not historical facts and statements identified by words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," "estimates" or words of similar meaning. These forward-looking statements reflect our current views about our plans, intentions, expectations, strategies and prospects, which are based on the information currently available to us and on assumptions we have made. Although we believe that our plans, intentions, expectations, strategies and prospects as reflected in or suggested by those forward-looking statements are reasonable, we can give no assurance that the plans, intentions, expectations or strategies will be attained or achieved. Furthermore, actual results may differ materially from those described in the forward-looking statements and will be affected by a variety of risks and factors that are beyond our control including, without limitation, risks associated with our limited operating history and history of losses; our ability to continue operating as a going concern; our ability to raise additional capital; our ability to complete additional acquisitions; our ability to recruit and retain skilled veterinarians; our ability to retain existing customers and add new customers; the continued growth of the market in which we operate; our ability to manage our growth effectively over the long-term to maintain our high level of service; the price volatility of our Class A common stock; our ability to continue to have our Class A common stock listed on the Nasdaq Stock Market; the impact of geopolitical conflicts, inflation, and macroeconomic instability on our business, the broader economy, and our ability to forecast our future financial performance; and other risks set forth under the caption "Risk Factors" in our SEC filings. We assume no obligation to update any forward-looking statements contained in this document as a result of new information, future events or otherwise.

Investors

CoreIR

516-386-0430

General Inquiries

Morgan Wood

[email protected]

Inspire Veterinary Partners, Inc. and Subsidiaries

Consolidated Balance Sheet

Inspire Veterinary Partners, Inc. and Subsidiaries

Consolidated Statements of Operation

Inspire Veterinary Partners, Inc. and Subsidiaries

Consolidated Statements of Cash Flows

SOURCE: INSPIRE VETERINARY PARTNERS, INC.

View the original on ACCESS Newswire