Formation Metals Mobilizes to Site in Preparation for Near-Term Fully Funded 10,000 Metre Drill Program at the Advanced N2 Gold Project; Closes Final Tranche, Increasing Exploration Budget to ~$5.7M

Formation Metals (OTCQB:FOMTF) has announced the mobilization of its technical team to the N2 Gold Project in Matagami, Quebec, ahead of a fully funded 10,000-metre drill program. The project hosts a historic resource of approximately 870,000 ounces of gold, with grades of 1.4 g/t Au across four zones and 7.82 g/t Au in the RJ zone.

The company has secured a strong financial position with working capital of C$5.3M and zero debt. Including Quebec provincial tax credits, Formation's 2025-2026 exploration budget is set at ~$5.7M. The company recently closed a final tranche of its private placement, raising $403,845.74 through charity flow-through units.

The drilling program will focus on the "A" zone, which contains 522,900 ounces of the historic resource, and the high-grade "RJ" zone, where previous drilling yielded intercepts as high as 51 g/t Au. The project also shows significant base metal potential, with copper and zinc intercepts ranging from 200 to 4,750 ppm and 203 to 6,700 ppm, respectively.

Formation Metals (OTCQB:FOMTF) ha annunciato la mobilitazione del suo team tecnico al Progetto N2 Gold a Matagami, Quebec, in vista di un programma di perforazione di 10.000 metri completamente finanziato. Il progetto ospita una risorsa storica di circa 870.000 once d'oro, con grade di 1,4 g/t Au distribuiti su quattro zone e 7,82 g/t Au nella zona RJ.

L'azienda ha consolidato una solida posizione finanziaria con un capitale circolante di 5,3 milioni di C$ e nessun debito. Inclusi i crediti d'imposta provinciali del Quebec, il budget esplorativo di Formation per il 2025-2026 è fissato a circa 5,7 milioni di dollari. Recentemente la società ha chiuso una tranche finale della sua collocazione privata, raccogliendo 403.845,74 dollari tramite unità flow-through benefiche.

Il programma di perforazione si concentrerà sulla zona "A", che contiene 522.900 once della risorsa storica, e sulla zona ad alto grado "RJ", dove perforazioni precedenti hanno riportato intercetti fino a 51 g/t Au. Il progetto mostra anche un significativo potenziale per metalli di base, con intercetti di rame e zinco che variano rispettivamente da 200 a 4.750 ppm e da 203 a 6.700 ppm.

Formation Metals (OTCQB:FOMTF) ha anunciado la movilización de su equipo técnico al Proyecto N2 Gold en Matagami, Quebec, antes de un programa de perforación de 10,000 metros completamente financiado. El proyecto cuenta con un recurso histórico de aproximadamente 870,000 onzas de oro, con leyes de 1.4 g/t Au en cuatro zonas y 7.82 g/t Au en la zona RJ.

La empresa ha asegurado una posición financiera sólida con un capital de trabajo de 5.3 millones de dólares canadienses y sin deudas. Incluyendo créditos fiscales provinciales de Quebec, el presupuesto de exploración de Formation para 2025-2026 se establece en aproximadamente 5.7 millones de dólares. Recientemente, la compañía cerró una última tranche de su colocación privada, recaudando 403,845.74 dólares a través de unidades flow-through benéficas.

El programa de perforación se centrará en la zona "A", que contiene 522,900 onzas del recurso histórico, y en la zona de alto grado "RJ", donde perforaciones anteriores arrojaron intercepciones de hasta 51 g/t Au. El proyecto también muestra un potencial significativo para metales base, con intercepciones de cobre y zinc que van desde 200 a 4,750 ppm y de 203 a 6,700 ppm, respectivamente.

Formation Metals (OTCQB:FOMTF)�� 완전 자금 지원된 10,000미터 시추 프로그램�� 앞두�� 퀘벡 매타가미의 N2 골드 프로젝트�� 기술팀�� 동원했다�� 발표했습니다. �� 프로젝트�� �� 87�� 온스�� ���� 역사�� 자원�� 보유하고 있으��, �� �� 구역에서 1.4 g/t Au, RJ 구역에서�� 7.82 g/t Au�� 등급�� 기록하고 있습니다.

��사��� 530�� 캐나�� 달러�� 운전자본�� 무부�� 상태�� 강력�� 재무 상태�� 확보했습니다. 퀘벡 �� 세금 공제�� 포함하여 Formation�� 2025-2026 탐사 예산은 �� 570�� 달러�� 책정되어 있습니다. 최근 ��사��� 자선 플로우스�� 유닛�� 통해 403,845.74 달러�� 모금하며 사모 발행�� 마지�� 트랜치를 마감했습니다.

시추 프로그램은 역사�� 자원�� 522,900 온스가 포함�� "A" 구역�� 이전 시추에서 최대 51 g/t Au�� 고등�� "RJ" 구역�� 집중�� 예정입니��. �� 프로젝트�� 또한 구리 �� 아연�� 각각 200~4,750 ppm, 203~6,700 ppm 범위�� 인터셉트�� 보여주는 상당�� 기본 금속 잠재력을 가지�� 있습니다.

Formation Metals (OTCQB:FOMTF) a annoncé la mobilisation de son équipe technique sur le projet N2 Gold à Matagami, Québec, en vue d'un programme de forage de 10 000 mètres entièrement financé. Le projet détient une ressource historique d'environ 870 000 onces d'or, avec des teneurs de 1,4 g/t Au sur quatre zones et 7,82 g/t Au dans la zone RJ.

L'entreprise a assuré une solide position financière avec un fonds de roulement de 5,3 millions de dollars canadiens et aucune dette. En incluant les crédits d'impôt provinciaux du Québec, le budget d'exploration de Formation pour 2025-2026 est fixé à environ 5,7 millions de dollars. La société a récemment clôturé une dernière tranche de son placement privé, levant 403 845,74 dollars grâce à des unités flow-through caritatives.

Le programme de forage se concentrera sur la zone "A", qui contient 522 900 onces de la ressource historique, ainsi que sur la zone à haute teneur "RJ", où des forages antérieurs ont intercepté des teneurs allant jusqu'à 51 g/t Au. Le projet présente également un potentiel significatif pour les métaux de base, avec des intercepts de cuivre et de zinc allant respectivement de 200 à 4 750 ppm et de 203 à 6 700 ppm.

Formation Metals (OTCQB:FOMTF) hat die Mobilisierung seines technischen Teams zum N2 Gold Projekt in Matagami, Quebec, angekündigt, im Vorfeld eines vollständig finanzierten 10.000-Meter-Bohrprogramms. Das Projekt beherbergt eine historische Ressource von etwa 870.000 Unzen Gold mit Gehalten von 1,4 g/t Au über vier Zonen und 7,82 g/t Au in der RJ-Zone.

Das Unternehmen hat eine starke Finanzlage mit einem Arbeitskapital von 5,3 Mio. C$ und keiner Verschuldung gesichert. Einschließlich der provinziellen Steuergutschriften von Quebec beläuft sich das Explorationsbudget von Formation für 2025-2026 auf etwa 5,7 Mio. $. Kürzlich schloss das Unternehmen eine letzte Tranche seiner Privatplatzierung ab und sammelte 403.845,74 $ durch Charity Flow-Through-Einheiten ein.

Das Bohrprogramm wird sich auf die "A"-Zone konzentrieren, die 522.900 Unzen der historischen Ressource enthält, sowie auf die hochgradige "RJ"-Zone, in der frühere Bohrungen Abschnitte mit bis zu 51 g/t Au ergaben. Das Projekt zeigt auch ein erhebliches Potenzial für Basismetalle, mit Kupfer- und Zinkabschnitten, die von 200 bis 4.750 ppm bzw. 203 bis 6.700 ppm reichen.

- Fully funded 10,000-metre drill program with working capital of C$5.3M and zero debt

- Historic resource of 870,000 ounces of gold with significant high-grade zones

- Strong financial position with ~$5.7M exploration budget for 2025-2026

- Additional base metal potential with significant copper and zinc intercepts

- Located in the established Abitibi Greenstone Belt mining region

- Reliance on historic resource estimates that require updating to NI 43-101 standards

- Only 35% of the A zone's strike length has been drilled to date

- Project has remained largely unexplored since Agnico Eagle's last drilling in 2008

Highlights:

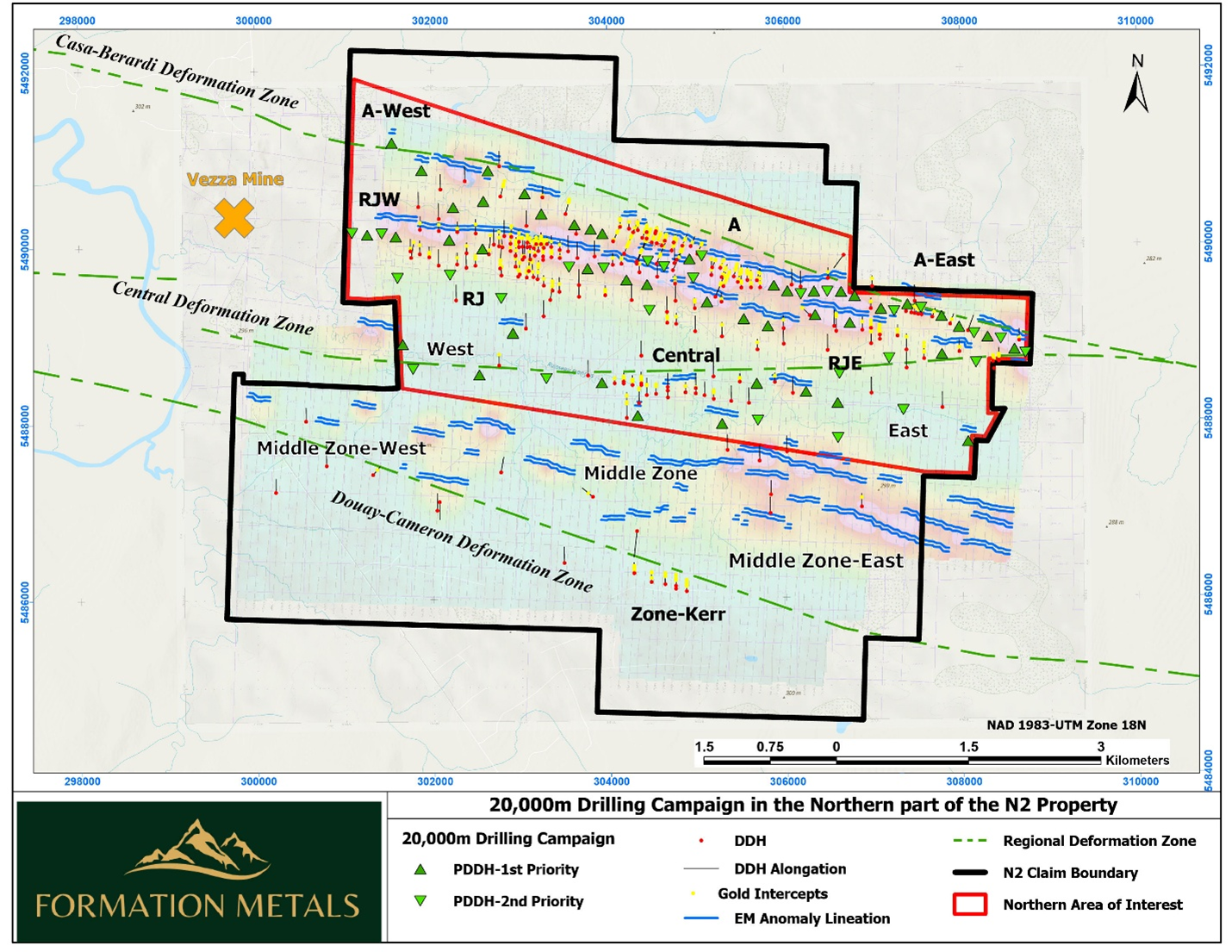

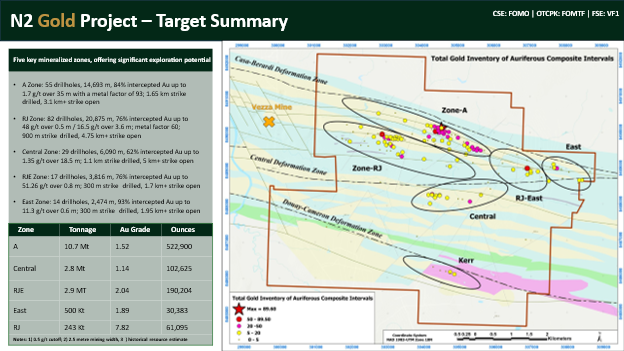

Formation has planned a 20,000 metre multi-phase drill program at its flagship N2 Gold Project near Matagami, Quebec, host to a global historic resource of ~870,000 ounces comprised of 18 Mt grading 1.4 g/t Au (~809,000 oz Au) across four zones (A, East, RJ-East, and Central)2,3 and 243 Kt grading 7.82 g/t Au (~61,000 oz Au) across the RJ zone2,4.

Phase 1 has been expanded to a fully funded 10,000 metre program focusing on targets in the "A" zone, a shallow, highly continuous, low-variability historic gold deposit with ~522,900 ounces of which only ~

35% of strike has been drilled (>3.1 km open), and the "RJ" zone, host to high-grade intercepts from historical drill holes as high as 51 g/t Au over 0.8 metres2, which was expanded by Agnico Eagle Mines in 2008 in the most recent drilling at the Property.Formation anticipates commencing its drill program in August. Its technical team has mobilized to N2 to verify access roads and drill pad areas for accessibility prior to the commencement of drilling.

The Company has working capital of ~C

$5.3M with zero debt, putting it in a very strong financial position to execute its exploration programs. Inclusive of provincial tax credits from the Quebec government, Formation's exploration budget for 2025-2026 is set at ~$5.7M .Formation is now funded to complete the

$5M work commitment required to earn-in to100% of the N2 Gold Project within two years, four years ahead of schedule.

VANCOUVER, BC / / August 7, 2025 / Formation Metals Inc. ("Formation" or the "Company") (CSE:FOMO)(FSE:VF1)(OTCQB:FOMTF), a North American mineral acquisition and exploration company, is pleased to announce that its technical team has mobilized to its N2 Gold Property ("N2" or the "Property"), located 25 km south of Matagami, Quebec, ahead of its fully funded maiden 10,000 metre drill program.

The Company anticipates commencing on the program shortly, with an initial 10,000 metres planned comprising Phase 1 as part of its planned 20,000 metre multi-phase drill program at N2, an advanced gold project with a global historic resource of ~870,000 ounces comprised of 18 Mt grading 1.4 g/t Au (~809,000 oz Au) across four zones (A, East, RJ-East, and Central)2,3 and 243 Kt grading 7.82 g/t Au (~61,000 oz Au) across the RJ zone2,4.

Deepak Varshney, CEO of Formation Metals, stated, "We are very grateful for the support Formation has received from new and past shareholders. With over five million in working capital, Formation is now positioned to commence on the most aggressive drill program our company has embarked on to date, with 10,000 metres fully funded for 2025."

Mr. Varshney continued: "We are very excited to commence our maiden drill program at N2. Based on our on-going review and planning for Phase 1, we feel comfortable in expanding our maiden drill program to a fully funded 10,000 metres.

Given the scale of the property, the compelling geological data, and the Abitibi Greenstone Belt's established history as a hotbed for gold mining, we are hopeful that the program will deliver our goal of delivering a near-surface multi-million-ounce deposit at N2.

We see the potential for a significant gold deposit at N2, and our maiden 10,000-metre drilling program will mark the beginning of Formation's pursuit of that goal. Our maiden program will focus on building on the successes of our predecessors. The drilling discoveries made by Agnico-Eagle and Cypress show the potential at N2. With gold at almost

Comprising 87 claims totaling ~4,400 ha within the Abitibi sub province of Northwestern Quebec, Formation's flagship N2 Gold Project is an advanced gold project with a global historic resource of 877,000 ounces: 18.2 Mt grading 1.48 g/t Au (~809,000 oz Au) across four zones (A, East, RJ-East, and Central)2,3 and 243 Kt grading 7.82 g/t Au (~61,000 oz Au) across the RJ zone2,4. There are six primary auriferous mineralized zones in total, each open for expansion along strike and at depth. Compilation and geophysical work by Balmoral Resources Ltd. (now Wallbridge Mining) from 2010 to 2018 generated numerous targets that have not yet been investigated with diamond drilling.

The drill program is designed to focus on discovery drilling at new high-potential targets along the mineralization strikes at the "A", "RJ" and "Central" zones in the northern part of the Property in order to discover new auriferous trends and unlock new zones of gold mineralization. The program will also focus on high-priority infilling and expansion targets in these zones to significantly enhance the auriferous zones identified to-date (Figure 1).

Historical highlights from the top two priority zones include:

A Zone: With a historical resource of ~522,900 gold ounces (10.7 Mt @ 1.52 g/t Au), the "A" Zone is a shallow, highly continuous, low-variability historic gold deposit with ~15,000 metres of drilling across 55 drillholes,

84% of which intercepted gold mineralization. The best historical intercept includes up to 1.7 g/t over 35 metres. ~1.65 km of strike has been drilled, with 3.1+ km of strike to be tested as part of the 20,000 metre program.RJ Zone: With a historical resource of ~61,100 gold ounces (243 Kt @ 7.82 g/t Au), the "RJ" Zone is a high-grade target that was expanded upon in the last drill program in 2008 by Agnico-Eagle when gold was approximately ~

$800 /oz. Historically, 20,875 metres has been drilled over 82 drillholes, with best intercepts of 48 g/t over 0.5 metres and 16.5 g/t over 3.6 metres. ~900 metres of strike has been drilled, with 4.75+ km of strike to be tested as part of the 20,000 metre program.

The Company also believes that N2 has significant base metal potential, where it recently completed a revaluation process which revealed significant copper and zinc intercepts within historic drillholes known to have significant gold grades (>1 g/t Au). Assay results range from 200 to 4,750 ppm and 203 ppm to 6,700 ppm, for copper and zinc, respectively, indicating strong potential for elevated base metal (Cu-Zn) concentrations across the property, specifically at the A and RJ zones. Property wide geology at N2 features volcanic and sedimentary rocks formed in regional anticlinal and synclinal flexures. Three principal deformation structures (Figure 1), oriented along the known NW-SE to WNW-ESE structural trends typical of VMS deposits in the Matagami region, function as critical geologic controls for mineralization on the property.

For the 2025 exploration season, Formation plans to concentrate its efforts on the northern part of N2, targeting gold deposit expansion and discovery along identified zones and fault systems associated with the main deformation features (specifically WNW-ESE trend), with IP surveys and drilling planned to model mineralized zones that will hopefully contribute to an updated NI-43 101 compliant resource. Formation will also look to further review historic base metal assays from older drill core and undertake additional work in 2025 to assess the property's copper and zinc potential.

The Company is pleased to announce that it has closed its final tranche of its non-brokered private placement raising gross proceeds of

Each CFT 4MH Unit consists of one Share (a "CFT 4MH Share") and one common share purchase warrant (a "CFT 4MH Warrant"), with each CFT 4MH Warrant exercisable to acquire one additional Share at an exercise price of

No finder's fees were paid in connection with the CFT 4MH Unit Offering. All securities issued are subject to a statutory hold period of four months following the date of issuance in accordance with applicable Canadian securities laws. The Company intends to use the net proceeds of CFT 4MH Unit Offering for fieldwork at the Company's exploration projects.

Qualified person

The technical content of this news release has been reviewed and approved by Mr. Babak Vakili Azar, P.Geo., an independent contractor and a qualified person as defined by National Instrument 43-101. Historical reports provided by the optionor were reviewed by the qualified person. The information provided has not been verified and is being treated as historic.

About Formation Metals Inc.

Formation Metals Inc. is a North American mineral acquisition and exploration company focused on the development of quality properties that are drill-ready with high-upside and expansion potential. Formation's flagship asset is the N2 Gold Project, an advanced gold project with a global historic resource of ~870,000 ounces (18 Mt grading 1.4 g/t Au (~809,000 oz Au) across four zones (A, East, RJ-East, and Central)2,3 and 243 Kt grading 7.82 g/t Au (~61,000 oz Au) across the RJ zone2,4) and six mineralized zones, each open for expansion along strike and at depth including the "A" zone, of which only ~

FORMATION METALS INC.

Deepak Varshney, CEO and Director

For more information, please call 778-899-1780, email [email protected] or visit .

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Notes and References:

Readers are cautioned that the geology of nearby properties is not necessarily indicative of the geology of the Property.

The above referenced resource estimates do not have a category, are considered historical in nature, and are based on prior data prepared by a previous property owner, and do not conform to current CIM categories.

While the Company considers the estimates to be reliable, a qualified person has not done sufficient work to classify the historical estimates as current resources in accordance with current CIM categories and the Company is not treating the historical estimates as a current resource. A 0.5 g/t Au cut-off was used in the preparation of the historical estimates with a minimum 2.5 metre mining width.

Significant data compilation, re-drilling, re-sampling and data verification may be required by a qualified person before the historical estimates can be classified as current resources. There can be no assurance that any of the historical mineral resources, in whole or in part, will ever become economically viable. In addition, mineral resources are not mineral reserves and do not have demonstrated economic viability. The Company is not aware of any more recent estimates prepared for the N2 Property.

Needham, B. (1994), 1993 Diamond Drill Report, Northway Joint Venture, Northway Property; Cypress Canada Inc.; 492 pages.

Guy K. (1991), Exploration Summary May 1, 1990 to May 1, 1991 Vezza Joint Venture Northway Property; Total Energold; 227 pages.

Forward-looking statements:

This news release includes "forward-looking statements" under applicable Canadian securities legislation, including statements respecting: the Company's plans for the Property and the expected timing and scope of the 2025 drilling program at the Property; the Company's goal of delivering a near-surface multi-million-ounce deposit the Property; the Company's anticipated timeline with respect to the Application for Autorisation de Travaux d'exploration à Impacts (ATI) to the Ministère des Ressources naturelles et des Forets (MERN); the Company's view that the Property has the potential for over three million ounces of gold; the 10,000-metre drilling program marking the beginning of the Company's pursuit of that goal; and statements respecting the Offerings and the expected use of proceeds therefrom. Such forward-looking information reflects management's current beliefs and is based on a number of estimates and/or assumptions made by and information currently available to the Company that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors that may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Readers are cautioned that such forward-looking statements are neither promises nor guarantees and are subject to known and unknown risks and uncertainties including, but not limited to, general business, economic, competitive, political and social uncertainties, uncertain and volatile equity and capital markets, lack of available capital, actual results of exploration activities, environmental risks, future prices of base and other metals, operating risks, accidents, labour issues, delays in obtaining governmental approvals and permits, and other risks in the mining industry.

The Company is presently an exploration stage company. Exploration is highly speculative in nature, involves many risks, requires substantial expenditures, and may not result in the discovery of mineral deposits that can be mined profitably. Furthermore, the Company currently has no reserves on any of its properties. As a result, there can be no assurance that such forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements.

No Offer or Solicitation to Purchase Securities in the United States

This press release does not constitute or form a part of any offer or solicitation to purchase or subscribe for securities in the United States. The securities referred to herein have not been and will not be registered under the Securities Act of 1933, as amended (the "Securities Act"), or with any securities regulatory authority of any state or other jurisdiction in the United States, and may not be offered or sold, directly or indirectly, within the United States or to, or for the account or benefit of, U.S. persons, as such term is defined in Regulation S under the Securities Act ("Regulation S"), except pursuant to an exemption from or in a transaction not subject to the registration requirements of the Securities Act.

Not for distribution to United States newswire services or for dissemination in the United States. This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States or to U.S. persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available. This news release shall not constitute an offer to sell or the solicitation of an offer to buy in the United States or to, or for the account or benefit of, persons in the United States or U.S. Persons nor shall there by any sale of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

SOURCE: Formation Metals

View the original on ACCESS Newswire